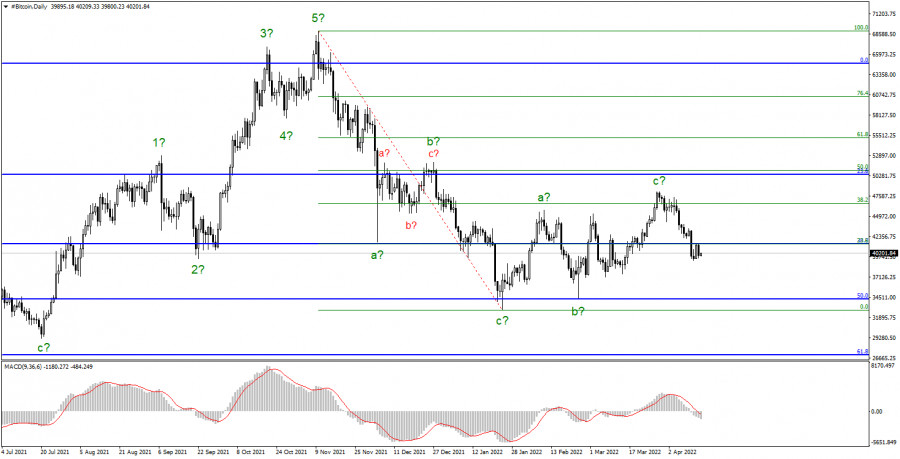

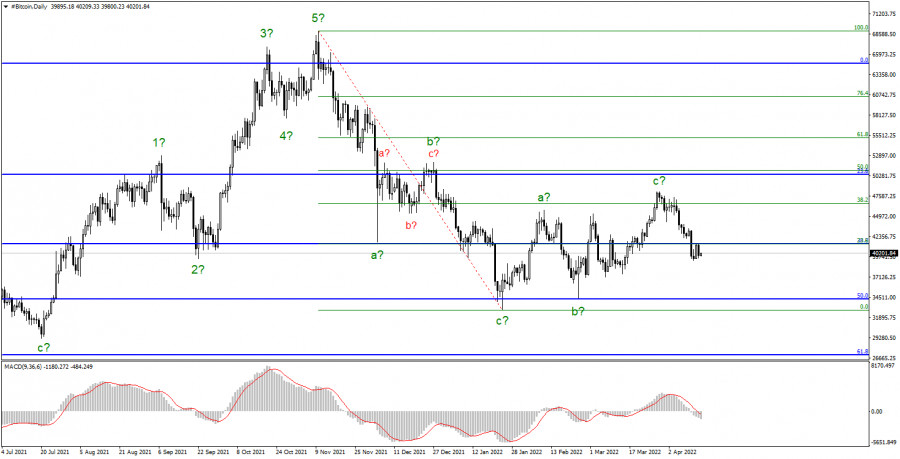

Bitcoin has managed to grow in price by almost $ 2,000 over the past 24 hours. However, the current wave marking does not give an unambiguous answer to the question of which section of the trend is currently being built. Let me remind you that the upward section of the trend, which originates on January 24, may turn out to be a three-wave and in this case has already been completed. Or it may turn out to be a five-wave, then in the coming weeks, the increase in bitcoin quotes should resume with targets located near the estimated mark of $ 50,364, which equates to 23.6% Fibonacci. I think that the chances of building an a-b-c-d-e structure are still a little more. About 60 by 40. However, at this time, the news background for the cryptocurrency market is very weak. There is no news of this magnitude that could suggest how the market mood will change in the near future. The Fed should raise the rate by 0.5% in May, and in June - raise the rate by 0.5% and reduce its balance sheet by $ 95 billion. In my opinion, this means that the stock and cryptocurrency markets may be under pressure. I think that in the next year or two we will observe the flow of capital from stocks and cryptocurrencies into bonds and deposits. However, some analysts say that the flow will be observed from the stock market to bitcoin.

Bitcoin is still predicted to have a great future

One of the ardent fans of bitcoin, the president of the Celsius Network, Alex Mashinsky, said that the cryptocurrency could grow in price to $ 100,000 this year. He believes that due to the actions of the Fed to tighten monetary policy, investors will flee from the stock market. Mashinsky does not currently see a correlation between the stock and the cryptocurrency market, which "may speak of bitcoin as a safe-haven." Mashinsky believes that all assets that are somehow connected with the dollar are now very much inflated due to QE programs. In his opinion, investors will not transfer capital from the "bloated" stock market to the no less "bloated" real estate market, bond market, or any other. Inflation is observed everywhere. Another thing is bitcoin, Mashinsky believes, it is not connected with the US dollar, and its emission is limited. The Fed cannot influence him in any way either with rates or with "games with liquidity".

Elon Musk moves cryptocurrencies

Just the other day, the head of Tesla, Elon Musk, voiced his opinion. He wrote on Twitter that he continues to hold bitcoins, Ethereum, and dogecoin due to fears of high inflation and the rising cost of raw materials due to the isolation of Russia. Musk advised everyone to buy "physical" or "scarce" assets, as well as shares of companies that make "good products." That is, Musk voiced an opinion directly opposite to what Mashinsky said. In my opinion, this once again proves the fact that even billionaires, investors, and analysts of large banks and agencies have different opinions on the cryptocurrency market. Therefore, one cannot blindly believe any one of them.

The construction of the downward section of the trend has been completed, it has taken a three-wave form. An unsuccessful attempt to break through the $ 34,238 mark, which corresponds to 50.0% on the senior Fibonacci grid, allowed bitcoin to start building a new upward section, which is also corrective. The only question is, what kind will it take: three-wave or five-wave? In the first case, the decline in quotations has already begun within the first wave of a new downward trend segment with targets located around $ 34,238. The targets of the entire descending set of waves are located much lower. In the second case, the instrument can already start building a wave e with targets of about $ 50,364 from the current price marks. I don't expect the current trend segment to take on an impulsive look. Accordingly, I do not expect a BTC quote above $ 50,364. In the perspective of the next two or three months, I expect a strong drop in demand for the first cryptocurrency and its decline is much lower than the low of the previous downward trend segment, located at around $ 32,840.