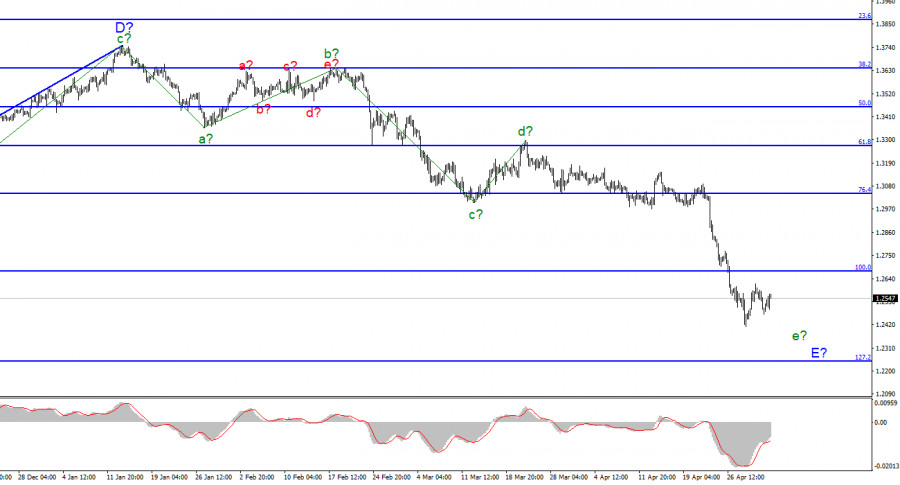

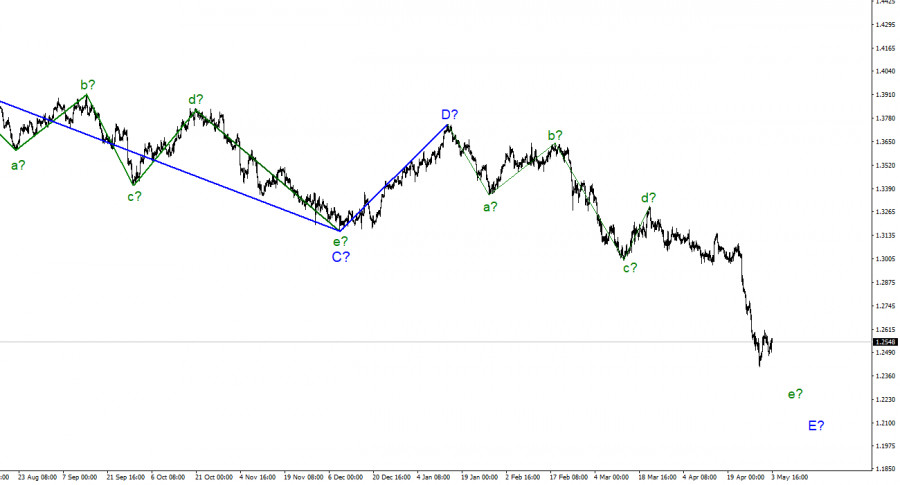

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend continues its construction within the framework of wave E-E, and its internal wave marking looks quite difficult - correction waves are practically not viewed in it, so it is very difficult to determine which internal wave is being built at this time. Presumably, wave 4-e-E. If this is true, then we get almost the same wave markings for the British and the Europeans. The current wave is the last wave of the current downward trend segment. The entire site is either nearing completion of its construction, or it will have to take a much more complex and extended form. Everything will depend on the news background, which is now clearly divided into geopolitical and economic. The military conflict between Ukraine and Russia, according to many military analysts, may persist not just for months, but for years. The consequences for the European and British economies will be serious. From an economic point of view, the meetings of the Bank of England and the Fed will be held this week, which can greatly affect the mood of the market.

The meetings of the Fed and the Bank of England will determine the future of the British

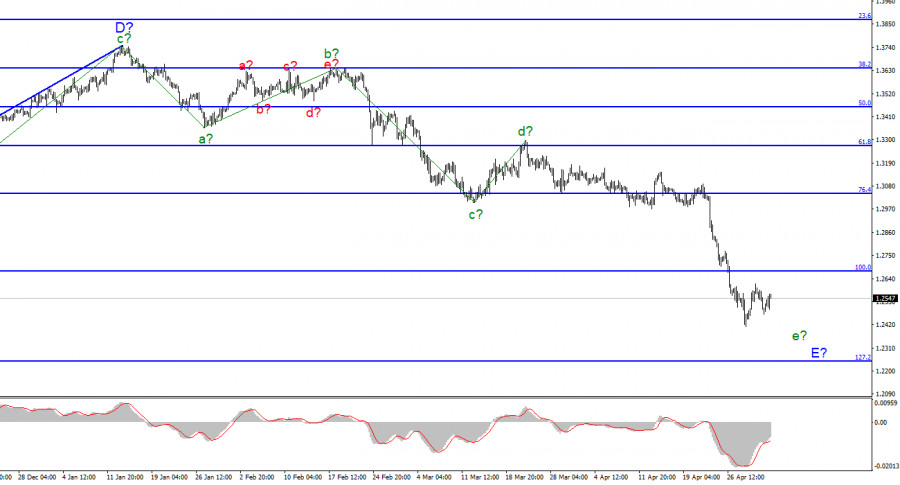

The exchange rate of the pound/dollar instrument increased by 60 basis points on May 3. I assume that an internal correction wave is being built now, after which the decline in quotes will continue. To do this, the results of the Fed meeting, which will be held tomorrow, should be "hawkish". For them to be recognized as "hawkish", the Fed should not retreat from its plans, which it has actively voiced in recent months. The rate should be raised by 50 basis points tomorrow, and a quantitative tightening program should be announced, under which the regulator will sell bonds worth 95 billion rubles every month. If these two decisions are made and announced, then the demand for the US currency may begin to grow again, which will give us the necessary result that will fully correspond to the current wave markup. If not, then the Briton can finish another day with an increase, and on Thursday the results of the Bank of England will be known. Given that no matter how hard the British central bank tried, it failed to stop the fall of the pound by raising the interest rate, there are serious reasons to assume that demand for the British will not increase.

There was no important news in Britain today. In the USA, too. Thus, I believe that the market is now purposefully building a corrective wave, after which it will start new sales. So far, everything looks very harmonious and logical. Separately, I would like to note the speech at the press conference by Jerome Powell, which will take place late tomorrow evening, after the meeting. It is very important what Powell will say about inflation since the issue of inflation is now the most important for many central banks. At the moment, there are no signs of its slowing down either in the UK, the US, or the European Union. But the Fed cannot announce an even stronger and faster rate hike. In the next two months, the rate may rise by 1% at once, which will be the fastest tightening of monetary policy since 2000.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2246 mark, which corresponds to 127.2% Fibonacci, according to the MACD signals "down". However, I don't see a pound below this mark yet. From my point of view, the construction of a downward section of the trend is nearing its completion and the mark of 1.2246 looks very good for the trend to end right around it.

At the higher scale, wave D looks complete, but the entire downward trend section does not. Therefore, I still expect a continuation of the decline of the instrument with targets located around the 22nd figure. Wave E takes on a five-wave appearance but still doesn't look fully equipped. However, it already takes a little time to complete the complete set.