The GBP/USD currency pair was growing on Wednesday evening as well as the EUR/USD pair. As we have already said, the market reaction to the results of the Fed meeting was not logical. Powell's "hawkish" rhetoric and strong monetary policy decisions were supposed to provoke the growth of the US currency. But today it is already clear that there is not much difference in how the market would react on Wednesday evening. Because the dollar rose significantly on Thursday when the Bank of England summed up the results of the meeting. They were also "hawkish", as the British regulator raised the key rate for the fourth time in a row. It is now 1% and is equal to the Fed rate. Nevertheless, when the results were announced, the pound sterling fell as if knocked down, which is also absolutely illogical. As a result, we have two illogical market reactions to two important events, and they leveled each other.

Meanwhile, the British pound has updated its 2-year lows. The pair showed a strong drop over the past two weeks, failed to even properly adjust, and the results of the meetings of the two central banks did not become the impetus for the bulls, which could lead to the formation of a new upward trend. Or at least to a strong correction. The British pound, despite 4 rate hikes by the Bank of England, remains very weak against the dollar. And, as in the case of the euro currency, we are already wondering if the pound has fallen too low? Yes, most factors are now playing against it, but at the same time, there are not as many of them as negative factors for the euro currency. Nevertheless, both European currencies are falling like stones thrown into the abyss. There is a feeling that the market has just got used to selling the pound in recent weeks, so now it is doing it for no reason.

Andrew Bailey's rhetoric was far from the concept of "optimistic."

As already mentioned, the Bank of England raised the rate by 0.25%. Now it is 1%, which is the maximum value for the last 12 years. It should also be noted that all nine members of the monetary committee voted for an increase in the rate, while some voted for an increase of 0.5% at once. From our point of view, this is a strong "hawkish" signal, which indicates that the May increase is not the last in 2022. However, this news did not become a "ticket up" for the British pound. Half an hour later, BA Chairman Andrew Bailey's speech began, which was, of course, very pessimistic, but we cannot conclude that the pound fell precisely because of Bailey's rhetoric. Because the fall of the British currency began exactly at the moment of the announcement of the decisions taken by the monetary committee. And Bailey's performance started later.

The head of the Bank of England said that the prospects for global economic growth have deteriorated very much due to the military conflict in Ukraine. According to him, monetary policy should go "on the razor's edge" to restrain price growth as much as possible and at the same time not reduce business activity due to falling real incomes. He noted that inflation in the UK is much higher than the target level, but indirectly made it clear that it is unlikely to be able to return to the target of 2% in the coming months. Bailey said that he understands all the difficulties of British residents due to the fall in real incomes, but the situation in the world remains very unstable and tense. Inflation risks remain high. Thus, Mr. Bailey made it clear that inflation will remain high. BA has already raised the rate four times, but the consumer price index continues to grow. However, it continues to grow in the United States, and for some reason, only the pound sterling is falling. The problems associated with inflation are now almost identical in the European Union, the United States, and the United Kingdom. And they depend not only on the actions of central banks but on the global market situation, geopolitical tensions in Eastern Europe, and the situation with the pandemic in China.

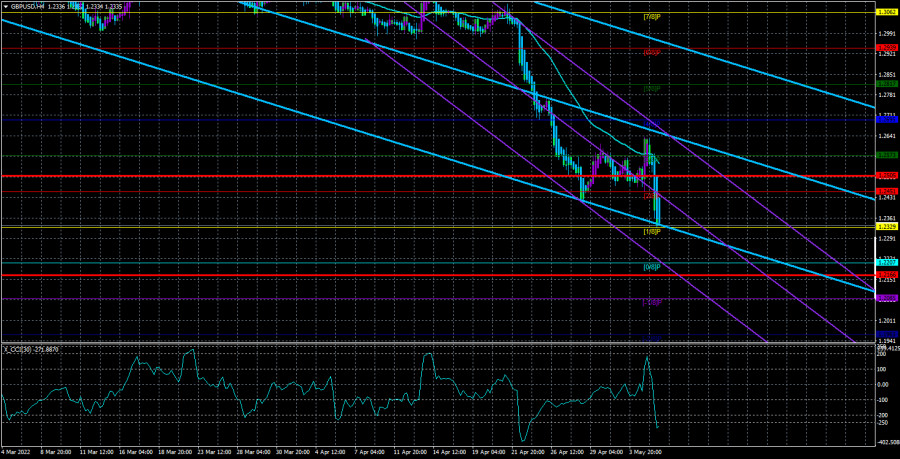

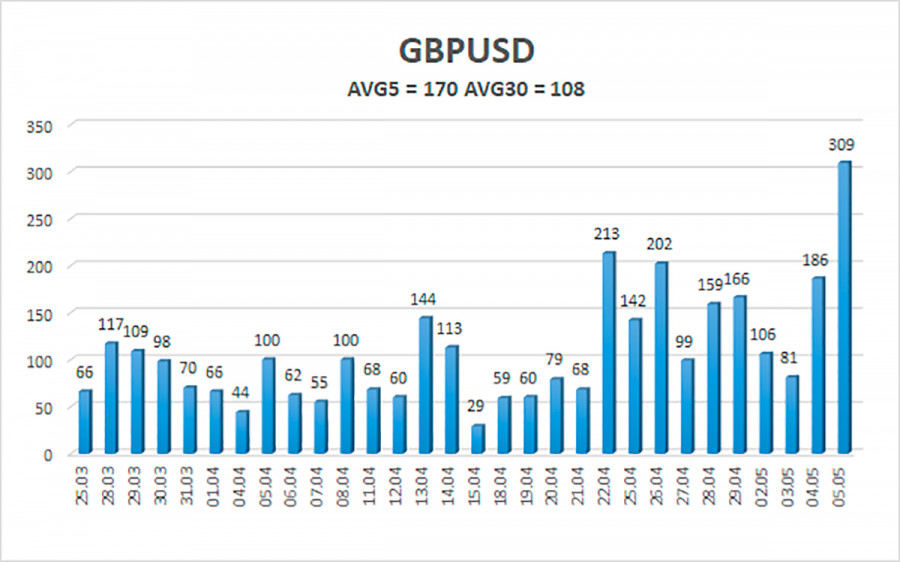

The average volatility of the GBP/USD pair over the last 5 trading days is 170 points. For the pound/dollar pair, this value is "very high". On Friday, May 6, thus, we expect movement inside the channel, limited by the levels of 1.2166 and 1.2505. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.2329

S2 – 1.2207

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2573

R3 – 1.2695

Trading recommendations:

The GBP/USD pair failed to adjust on the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1,2207 and 1,2166 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2695.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.