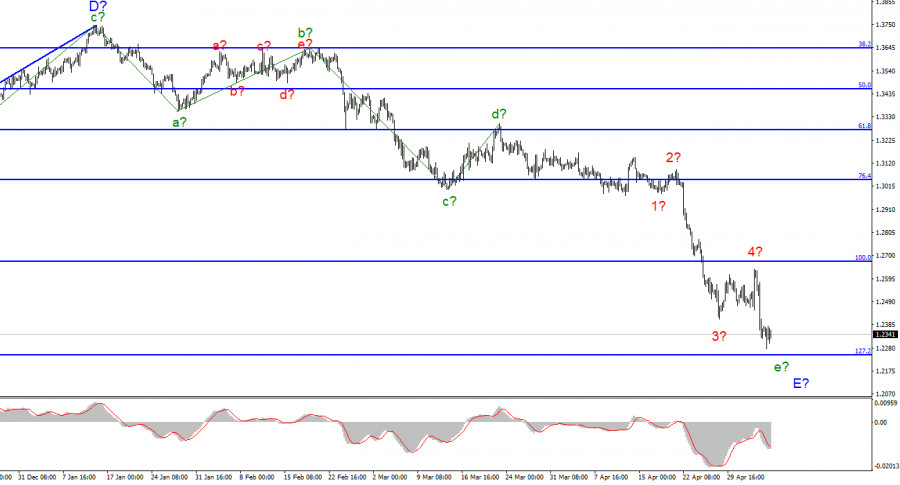

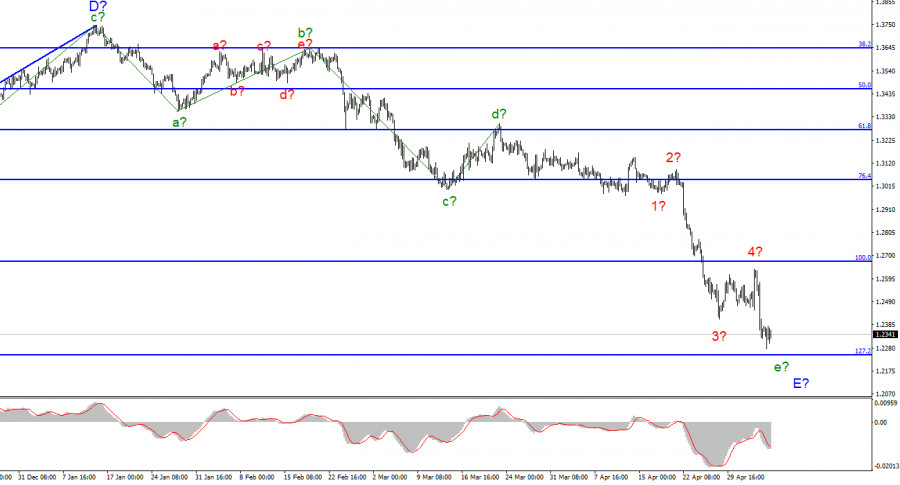

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend continues its construction within the framework of the wave e-E, and its internal wave marking looks quite complicated. Nevertheless, I have identified five waves inside this wave and, if my markup is correct, then wave 5, the last internal wave, is being built at this time. Thus, we get almost identical wave markings for the British and the European, each of which indicates the possible imminent completion of the downward trend section. Or it will have to take a much more complex and extended form than a weak news background or a complex geopolitical one can contribute to. The meetings of the Bank of England and the Fed resulted in a new decline in demand for the British dollar, although their results cannot be considered "positive only for the dollar." If the current wave marking does not become more complicated, then the decline in the British dollar may end within the next week.

The pound experienced shock instead of joy and euphoria.

The exchange rate of the pound/dollar instrument decreased by 10 basis points on May 6, but what difference does it make how much it lost on Friday if it ended Thursday with a result of -280 points? The pound has experienced another difficult week for itself, although the current wave marking suggests the imminent completion of his fall. I would like to note that the market practically ignored the results of the Bank of England meeting. To be more precise, the market reaction was not quite appropriate. After all, the British regulator raised the interest rate for the fourth time in a row, but the demand for the pound at the same time fell very much. From my point of view, such a reaction cannot be considered correct and indirectly indicates that the market is now trying to complete the downward trend section without violations in the wave marking and without complicating it. If this is true, then the construction will be completed in the near future, after which the pound may already rise quite a lot, as if playing back all the news that was ignored during its decline.

Separately, I want to note that geopolitics is gradually weakening its influence on the pound and the euro. There have been no important events at the front in recent weeks, nevertheless, the Ukrainian-Russian conflict persists and is likely to be very protracted. Kyiv and Moscow show no signs of wanting to end the conflict. I mean, there are no real signs, since both sides would like to stop everything. This conflict is not beneficial for both of them and destroys their economy. Both sides are suffering huge financial losses. In addition, Ukraine is losing infrastructure, which will have to be rebuilt for many years, and the Russian Federation has already been isolated from most of the world and it will also take years to restore economic ties. However, Kyiv's position is as follows: the resumption of peace talks will be possible only if the Russian Federation withdraws its troops from the borders of Ukraine. Moscow's position is the opposite. Compromise is not possible at this time.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2246 mark, which corresponds to 127.2% Fibonacci, according to the MACD signals "down". I don't see a pound below this mark yet. From my point of view, the construction of a downward section of the trend is nearing its completion and the mark of 1.2246 looks very good for the trend to end right around it. However, a successful attempt to break through this mark - and it will be possible to stay in sales.

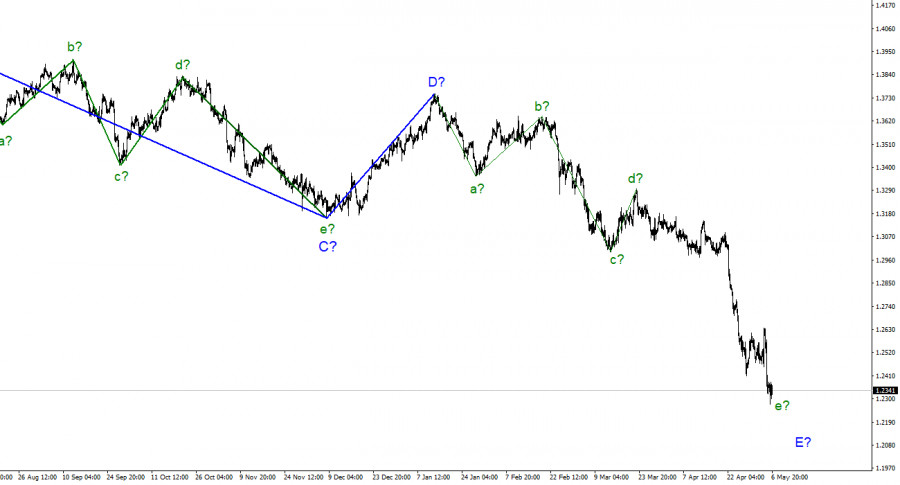

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, I still expect a continuation of the decline of the instrument with targets located around the 22nd figure. Wave E takes on a five-wave appearance but still doesn't look fully equipped. However, it already takes a little time to complete the complete set.