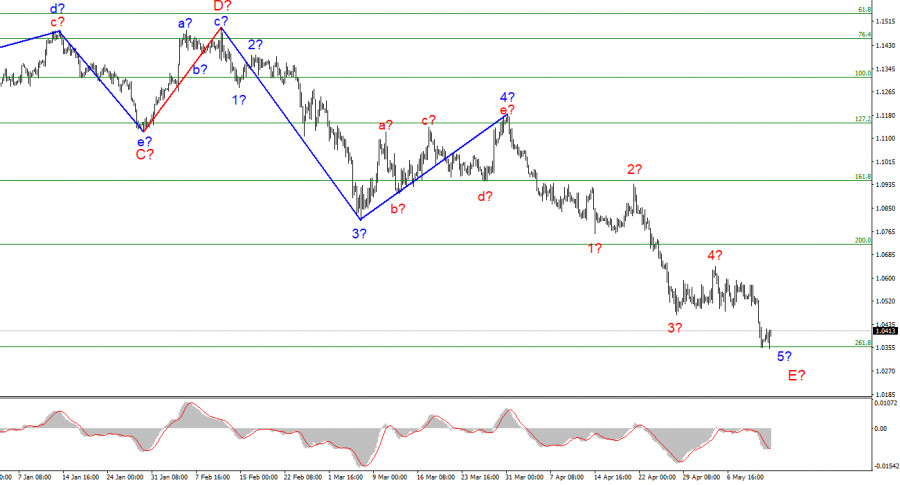

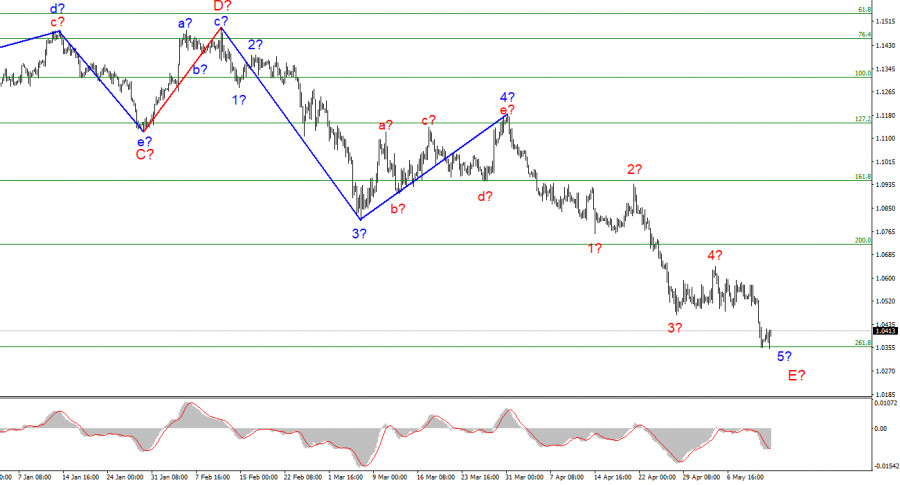

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument continues the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may end at any moment, since the internal structure of this wave is already five-wave. And an unsuccessful attempt to break through the 1.0355 mark indicates that the market is not ready for new sales. If the attempt to break 1.0355 turns out to be successful after all, then the instrument will further complicate its wave structure and continue to decline with targets located near the zero figure. So far, the wave marking looks like in a textbook, and even its complication (lengthening in the fifth wave or the wave E) will not lead to its scraping. There are no alternative wave markings now. I continue to expect the downward trend to end, but a pronounced bearish market sentiment may lead to an even stronger decline in the instrument.

The 1.0355 level is a lifeline for the euro.

The euro/dollar instrument rose by 30 basis points on Friday. This increase definitely cannot be considered the beginning of a new upward wave. At the moment, only an unsuccessful attempt to break through the 1.0355 mark, which corresponds to 261.8% Fibonacci, is the hope for the instrument that a new fall will not happen. The internal wave marking of wave 5-E looks very convincing. Therefore, the European currency needs to stay above 1.0355 next week. The news background in the next five working days will be very weak. In the European Union, reports on GDP, and inflation will be released and Christine Lagarde will speak once. However, the GDP report will be released in the second estimate and is unlikely to differ much from the first, which was +0.2%. The inflation report will also be released in the second assessment and its value is unlikely to differ much from 7.5%. I don't expect any surprises and strong data from Europe.

Perhaps the geopolitical news will have an impact on the market mood. The situation is heating up in the Baltic region, where Finland and Sweden may apply for NATO membership as early as Monday. It is now known that Turkey opposes this, as it believes that there are representatives of "terrorist organizations" in these countries' Parliaments. However, it may turn out the same as with Hungary, which opposes the introduction of an oil embargo as part of the sixth package of sanctions against Russia. After a few weeks of negotiations - and the issue will be resolved. NATO Secretary-General Jens Stoltenberg has already stated that the applications of Sweden and Finland will be considered quickly and there is no reason for them to be rejected. Russia, in turn, has already refused to supply electricity to Finland and announced that it will strengthen the border with this country. There have also been repeated hints of a military conflict with Finland if it joins NATO. The situation is also heating up around Poland, as it provides the strongest support to Ukraine. In the State Duma of the Russian Federation, words about the "denazification" of Poland have already been heard at the official level. At the same time, Moscow changed its position on Ukraine's accession to the EU. Now the Kremlin is against it. The situation continues to deteriorate and become more complicated.

General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0000 mark, which corresponds to 323.6% Fibonacci. But first, you need to wait for confirmation that the descending wave will continue its construction - a successful attempt to break the 1.0355 mark.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which turns out to be as long as wave C. The European currency may still decline for some time.