The dollar has been trading in the red zone for two weeks in a row. It ended May with gains. However, its prospects for summer are vague. Which currencies are worth buying except the dollar?

On May 31, the dollar tried to rebound above 102.00. However, it is unclear whether it will manage to rise significantly as at the start of the year. Earlier, expectations of aggressive tightening of US monetary policy were the main catalyst for buying the dollar. Moreover, traders counted on this event. Currently, the quotes include the next rate hike of 50 basis points and the Fed may suspend tightening its monetary policy. Therefore, traders are cautious about buying the dollar.

Despite today's recovery, the dollar index is under pressure. A further decline is possible in the near term. The currency market does not focus on the dollar. Bears are expected to target the level of 101.16, then they break through 100.80.

Commodity currencies have good prospects for growth, taking into account soaring prices for grain and other basic products. The Canadian, New Zealand, and Australian dollars are in question.

Oil prices have been rising for the ninth straight session. On Tuesday, Brent crude oil continued to hit new highs, reaching 119.00. Australia is known to be a major exporter of liquefied natural gas, hard coal, iron ore and agricultural products.

Economists have recently indicated the possibility of rising inflationary pressures in this country. Therefore, the Reserve Bank of Australia can start more aggressive tightening of its monetary policy. Inflation may exceed 7% in the third quarter. This fact will force the regulator to raise the interest rate to 2.75% by the beginning of 2023. A slowdown in economic activity is unlikely to change the situation as there is a global tendency to reduce inflation. In this case, the Reserve Bank of Australia may raise the interest rate by 50 basis points several times. It is definitely a positive sign for the Australian dollar.

This week, the economic calendar in the US and Australia is extremely varied as a number of important publications will be released. The major focus will be on the US labor market monthly data. They will probably cause the greatest volatility. Economists expect the employment rate to rise by 320,000 and the unemployment rate to drop from 7% to 6.9%.

In case there will be no negative news from Australia and the US dollar's downtrend continues, the AUD/USD pair can reach the levels of 0.7240 and 0.7270 by the end of the week.

Support levels are located at 0.7165, 0.7128, 0.7085, 0.7064, 0.7000 and 0.6970. Resistance levels are at 0.7200, 0.7240, 0.7270, 0.7310, 0.7400, 0.7440, 0.7510.

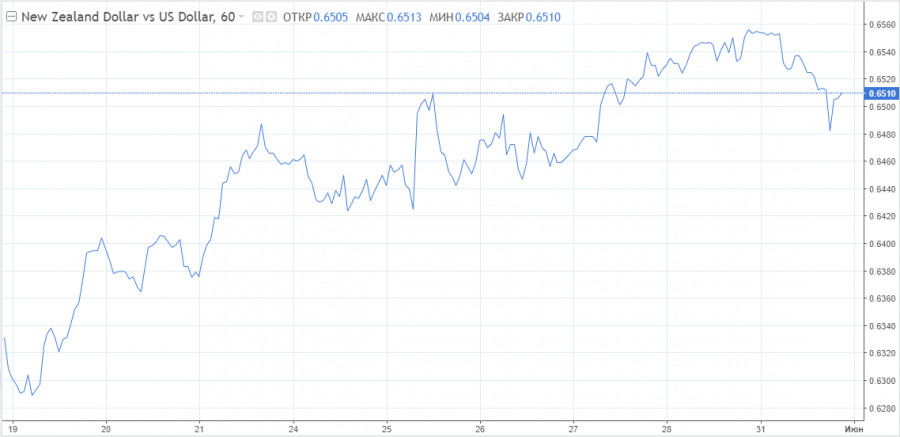

The New Zealand dollar has less favorable prospects despite the hawkish stance of the country's regulator. The day before, the Reserve Bank of New Zealand signaled a rate hike above the key level. Meanwhile, the kiwi is highly sensitive to the global activity and the situation in China. Taking into account these negative aspects, the New Zealand dollar together with the US dollar risk to test the recent lows, according to the Canadian Imperial Bank of Commerce.

The central bank of New Zealand's very hawkish stance will be the reason for falling domestic activity. This fact will put pressure on economic growth. Moreover, expected slowdown in China's and global activity increase the bearish sentiment in the NZD/USD pair.

CIBC analysts recommend selling the pair from 0.6530 with a target of 0.6220 and placing a stop order to limit the possible loss at 0.6625.

On Monday, the Canadian dollar showed the best performance during the American trading session. The USD/CAD pair hit the recent lows. Moreover, it has reached the level of 1.2660 for the first time since April 22. A combination of several factors was favorable for the pair, mainly improved market sentiment, rising oil and a weaker dollar during the Memorial Day celebrations in the US.

Today, traders are analyzing Canada's GDP release, which undermined the loonie's position. In March, the economy grew by 0.7% month-on-month. This figure is higher than economists' average forecast of 0.5%. However, it is lower compared to February's reading of 0.9%.

GDP growth in the first quarter was 3.1% in annual terms. This figure is considerably below economists' average forecast of 5.4% and below the quarterly growth rate of 6.6% in the fourth quarter of 2021.

Market players will try to figure out whether such figures will favor the Bank of Canada's plan to raise the rate by another 50 basis points to 1.50% on Wednesday.

Scotiabank experts highlight the key levels to focus on concerning the USD/CAD pair.

Intraday support is located at 1.2655, 1.2660 and resistance is at 1.2690. However, analysts note that the resistance is likely to increase to the area of 1.2715, the low of early May.

A drop below the level of 1.2650 would target the pair at 1.2550 and give it a chance to fall to the April low at 1.2405.