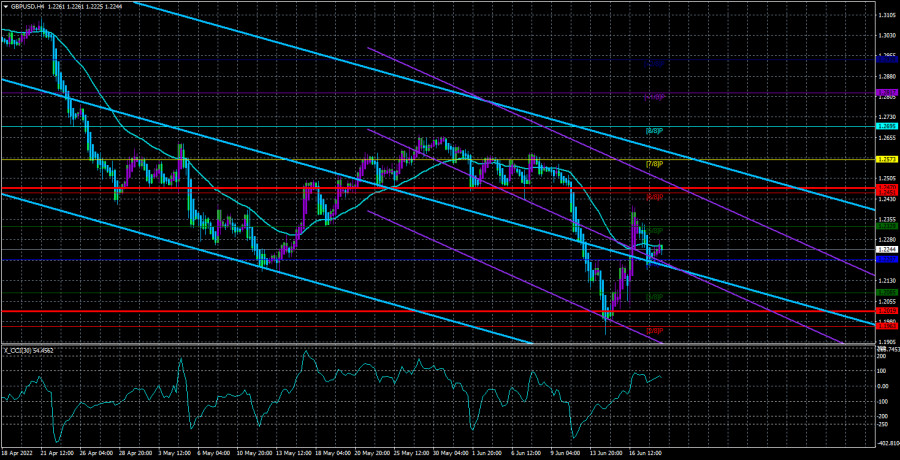

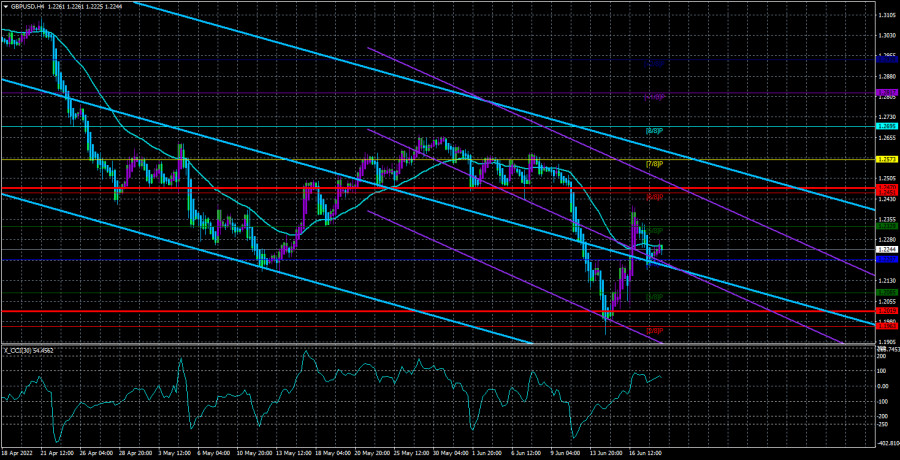

The GBP/USD currency pair was also trading very calmly on Monday. The price first dropped below the moving average line, then tried to start a new round of upward movement, but in general, the day passed without "incidents". Thus, the first conclusion is that the euro and the pound continue to show almost identical movements, which greatly simplifies the analysis process. Further, although the pound showed solid growth last week, even such growth does not mean practically anything. Yes, the pound rolled back from its 2-year lows thanks to the illogical reaction of the market to the Fed meeting and thanks to the increase in the key rate of the Bank of England. But then what? The Bank of England has raised the rate for the fifth time in a row over the past five meetings, and the British currency has been falling in the medium term and continues to do so. This is exactly what we talked about in the next article on the euro/dollar. One important event can provoke a serious movement in the market, but it is not able to break the current trend in most cases. Thus, the pound sterling may be adjusted upwards for another week or two, but even before its last local maximum (1.2658), it will be very difficult to get it. You need to go as many as 400 points before it. Therefore, the second conclusion is that the global downward trend remains relevant, and the pound remains a high chance of falling. Topics with the "Northern Ireland protocol", and scandals related to Boris Johnson, have now receded into the background. The UK does not impose new significant sanctions against the Russian Federation, because it has already imposed all possible sanctions. Consequently, there should be no new shocks to its economy in the near future. If not for inflation.

British inflation may rise again by the end of May.

Perhaps the most important event of the week for the pound will not even be Jerome Powell's speech to Congress, but the publication of the inflation report for May. Recall that exactly a year ago, inflation in the UK was 2%, and for sure the British authorities and economists remember that time with a smile on their lips. Of course, at that time, the "coronavirus" pandemic was still raging all over the world, which disappeared by a strange coincidence as soon as the military conflict in Ukraine began. However, let's return to inflation. If you look at the chart for the last 12 months, you can see with the naked eye that inflation is not just growing, it is accelerating. If we translate this term into ordinary language and prices in stores, now prices in Britain are not just rising, they are accelerating at the rate of their growth. For example, in January, inflation was 5.5%, in February – 6.2%, in March – at 7%, and in April – at 9%. According to experts' forecasts, by the end of May, the CPI may grow to 9.1-9.2%. According to the forecasts of the Bank of England, the maximum inflation may reach 11% in 2022. According to our forecasts, it will exceed 11% in 2022. That is, once again we focus the attention of traders: the Bank of England has raised rates five times and is still waiting for further acceleration of inflation.

We believe that this is the most eloquent forecast for the next few months. If inflation continues to rise, as almost everyone believes, it will mean that the British regulator simply has no other way but to continue raising the rate. However, on the other hand, BA has already raised the rate several times, but the pound sterling was able to demonstrate growth only for a short period. Thus, formally, the pound has grounds for tangible growth, but in fact, we do not believe that this is possible at this time. At the same time, we remind you that you should trade strictly according to the trend. If the pair is above the moving average, this is already a reason to buy, not sell.

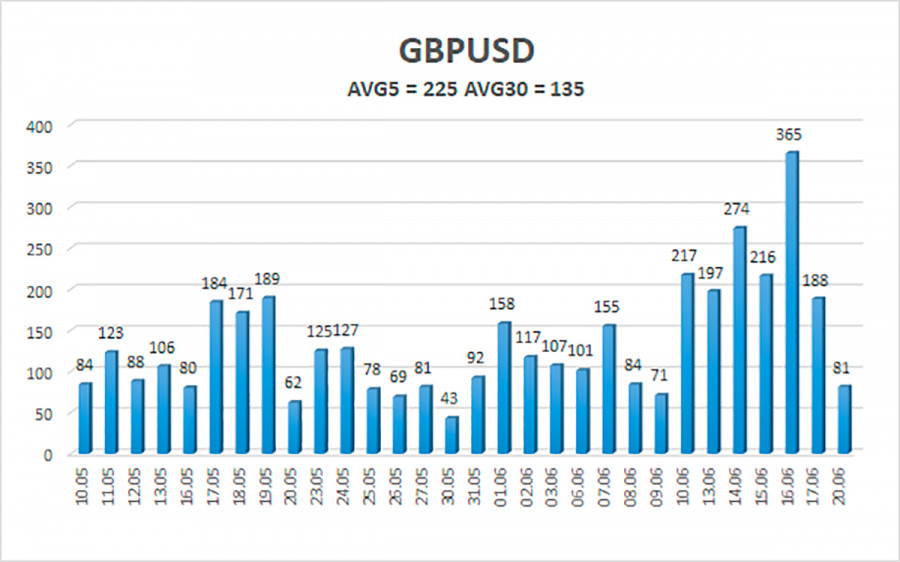

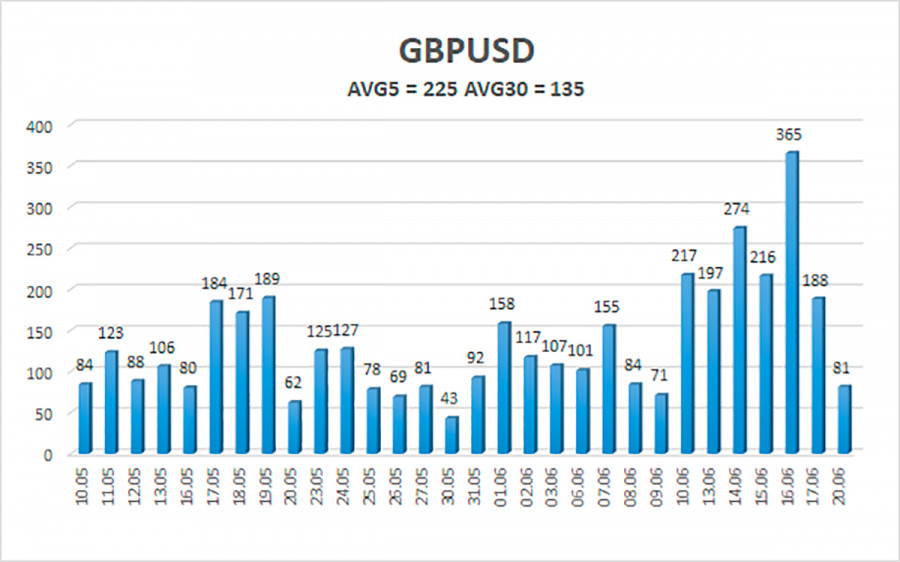

The average volatility of the GBP/USD pair over the last 5 trading days is 225 points. For the pound/dollar pair, this value is "very high". On Tuesday, June 21, therefore, we expect movement inside the channel, limited by the levels of 1.2019 and 1.2470. The reversal of the Heiken Ashi indicator downwards signals a possible new attempt to resume the downward trend.

Nearest support levels:

S1 – 1.2207

S2 – 1.2085

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2451

R3 – 1.2573

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe very quickly consolidated back below the moving average line. Thus, at this time, you should stay in sales orders with targets of 1.2085 and 1.2019 until the price is fixed above the moving average. It will be possible to consider long positions again if the price is fixed above the moving average with targets of 1.2329 and 1.2451. At this time, there is a high probability of a "swing".

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.