During the Asian session on Friday, Japan published key data on inflation growth for May. The data was released at the level of forecasts, confirming the positive dynamics of inflationary growth. But the Japanese currency reacted to this fact quite phlegmatically, with an eye to the latest statements by representatives of the Bank of Japan. And the results of the last meeting of the Japanese Central Bank were clearly not in favor of the yen. Therefore, the growth of inflation indicators did not excite traders: the price showed a formal reaction, falling by only a few dozen points.

Looking at the USD/JPY weekly chart, we can see that the pair is in the next wave of an upward trend. The first wave was rather protracted: from the beginning of March to the beginning of May. During this period of time, the price rose by 1600 points. Then the bears organized a 400-point correction, after which the second wave of the upward trend began, which we are now seeing. However, USD/JPY buyers now face a more difficult task: they need to overcome 24-year price highs, which is unattainable since 1998. That is why the second wave of the upward trend bogged down much earlier—in the fourth week of growth.

Judging by the results of the last five-day period, the buyers of USD/JPY were too tough for the resistance level of 136.50 (the upper line of the Bollinger Bands indicator on the daily chart). Having reached the mark of 136.70, the pair began to slowly but surely retreat, dropping by 200 points.

As you can see, the growth of the USD/JPY pair has a wave-like character—a large-scale price rise is replaced by an equally large-scale correction. Therefore, the current decline in prices must also be viewed through the prism of a corrective pullback. Moreover, downward pullbacks are simply necessary in the current conditions, since it is quite risky to open longs in the area of 24-year highs. Whereas corrective pullbacks allow you to open buy orders at a better price.

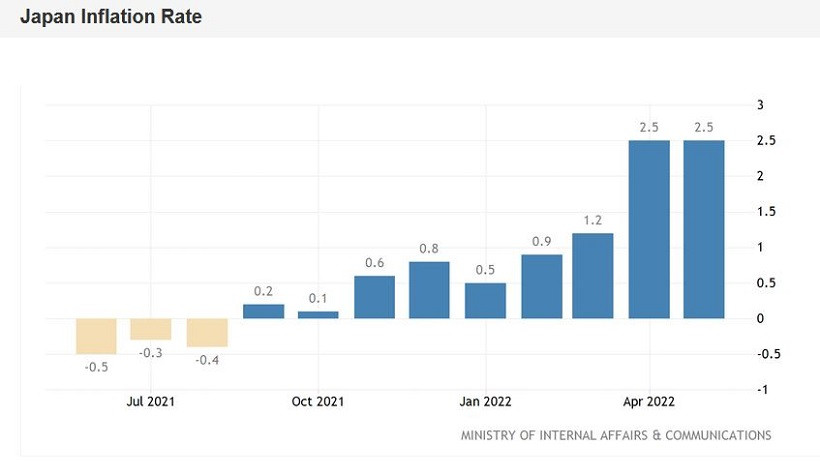

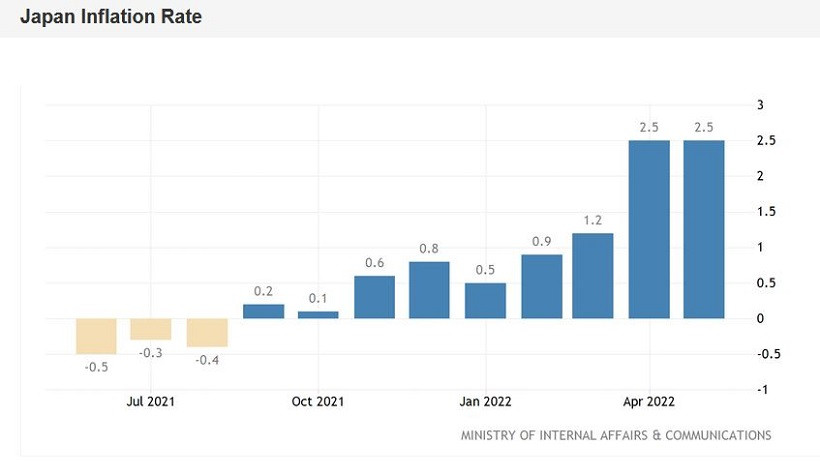

But back to Japanese inflation. Today's release showed that consumer inflation has exceeded the Bank of Japan's 2% target for the second month in a row. The general consumer price index rose to 2.5% in May (a similar result was achieved in April). This is the strongest growth rate of the indicator since November 2014. The consumer price index excluding fresh food prices (the most monitored inflation indicator by the central bank) also showed positive dynamics, rising to 2.1%. The growth rate of this indicator also became the highest since March 2015.

Commenting on the April figures, the trajectory of which was exactly the same as the May release, Bank of Japan Governor Haruhiko Kuroda said that the regulator needs to create conditions for "sustainable inflation" in the country's economy, while the increase in the consumer price index this year "is due to single factors, such as rising energy prices." Arguing his position, he recalled that consumer prices excluding food and energy increased by only 0.8% in annual terms (he ignored the fact that this indicator left the negative area for the first time in many months). In May, this component of the release also came out at around 0.8%. Given this fact, one should not expect tougher rhetoric from the Japanese regulator.

By the way, just today, Bank of Japan Deputy Governor Masayoshi Amamiya repeated the main message of his "boss" that the regulator will adhere to a relaxed monetary policy to further support the economy.

Thus, the yen paired with the dollar, in the foreseeable future, will be guided by the behavior of the American currency: the Japanese currency has no own arguments for its strengthening.

Greenback, in turn, took a break after the recent rally. The US dollar index has been fluctuating in the range of 103.80–104.50 for several days, reflecting the indecision of both dollar bulls and their opponents. US Fed Chair Jerome Powell left a double impression during his speech in Congress: on the one hand, he announced further steps to tighten monetary policy, but, on the other hand, he did not specify the expected pace of the rate hike. This factor put some pressure on the dollar, temporarily extinguishing its ambitions.

Nevertheless, the divergence of the positions of the Fed and the Bank of Japan still persists. The Fed is pondering how much to raise the interest rate in July (the choice is between a 50-point and 75-point increase), while the Japanese regulator continues to declare a dovish position.

That is why it is advisable to use any corrective price declines as an excuse to open long positions. On the D1, W1, and MN timeframes, the pair is either on the top or between the middle and top lines of the Bollinger Bands indicator. In addition, on the daily and weekly charts, the Ichimoku indicator has formed one of its strongest bullish signals. The upward targets are 136.00 and 136.70 (24-year highs).