The EUR/USD currency pair did not show anything noteworthy on Monday. Throughout the day, the pair adjusted after failing to break the Murray level of "2/8" - 1.0376. Remember that the pair is currently nearing its 20-year lows. However, all stock exchanges and banks were closed because the United States celebrated Independence Day yesterday. It naturally harmed the pair's volatility, but we warned about this in a previous article. Thus, Monday can be safely classified as a "semi-final" day. The main question right now is when the pair will be able to update its 20-year lows. After all, if this occurs (and so far, everything points to it), the pair will head for a price parity of 1.0000. This amounts to a verdict on the euro currency. After all, there was a chance six months ago, when the downward trend was already quite long, that it would end soon and the euro currency would begin to form a long-term upward trend. However, the fundamental and geopolitical backdrops have shifted, and the global downward trend has resumed, with the pair potentially falling anywhere.

By the way, this is in response to the question that in the modern world, nothing can be guaranteed. Nobody expected the ECB to take such a passive stance at a time when fighting inflation is critical. Nobody predicted a military conflict would erupt in Europe, affecting half of the world. And these variables had a significant impact on the currency and stock markets. The euro currency now has nothing to oppose the dollar as the "reserve currency," whose demand always increases as the world's geopolitical situation heats up. And it's difficult to think of a time when the geopolitical situation has been more tense than it is now.

There is almost no hope for the ECB.

On Monday, there isn't much to consider. As previously stated, all of this week's major events are scheduled for the second half. We do not believe that macroeconomic reports, even those as important as Nonfarm Payrolls, will significantly impact market sentiment and that the downtrend will abruptly end. There will almost certainly be a local reaction from traders. It could be almost anything. The euro may begin another round of upward correction (hardly stronger than the previous ones). However, our experience shows that the more frequently a pair tests a certain level of strength, the more likely they will overcome it. As a result, we have almost no doubt that the euro currency will revisit its 20-year lows. It is possible to speculate on how long the euro will fall and how much it will eventually fall. And much will be determined by the actions of the Fed and the ECB.

And unfortunately for the euro, the Fed's and ECB's actions continue to favor the American Central Bank. The Fed does not even consider stopping raising interest rates. Furthermore, it may rise to 3.5 percent this year. Moreover, we do not believe such a key rate level will definitively and unequivocally return inflation to 2%. If this does not occur, the regulator will have no reason to lower the rate in 2023, as many economists now believe. The entire calculation is based on the fact that without options, inflation will fall. However, no one can predict how much it will fall. Remember that the acceleration to the current levels of this indicator took approximately a year. Generally, "breaking is not building," so returning to 2% may take longer. And the consumer price index hasn't even started to slow down yet. As a result, the period of high rates in the United States may last longer than previously anticipated. And if the ECB tightens monetary policy for the duration of the period "for the show" (if it tightens at all), the euro will remain under pressure.

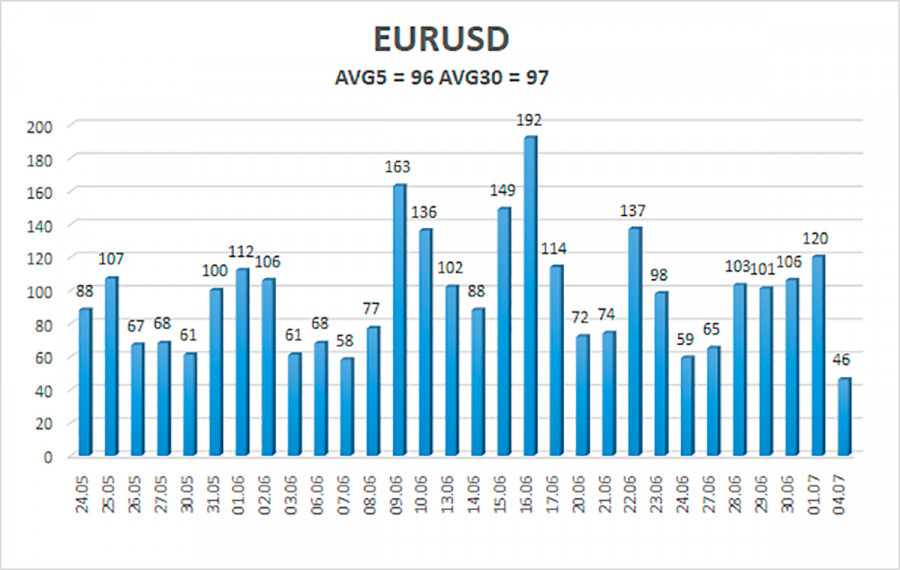

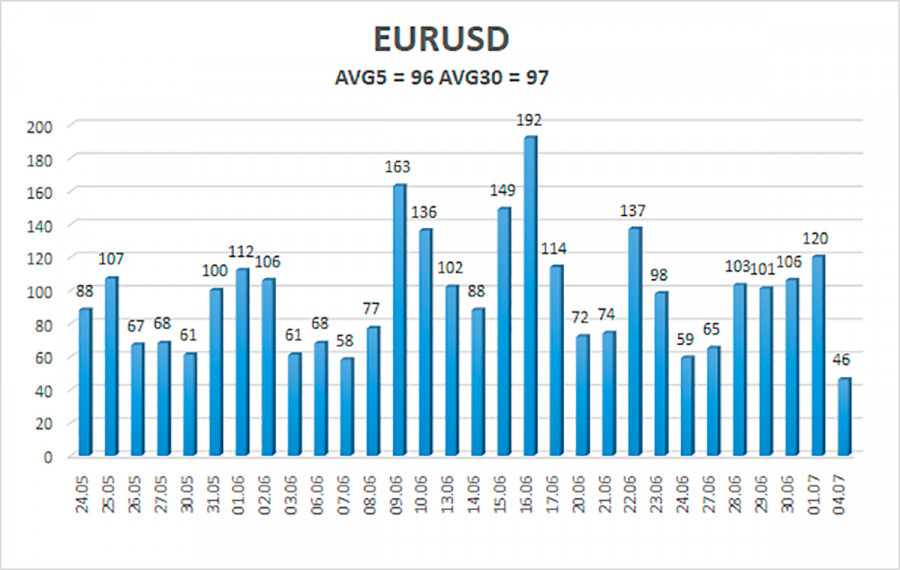

As of July 5, the average volatility of the euro/dollar currency pair over the previous five trading days was 96 points, classifying it as "high." As a result, we expect the pair to trade today between 1.0327 and 1.0519. The upward reversal of the Heiken Ashi indicator will indicate a new attempt by the pair to correct.

Nearest levels of support:

S1 - 1.0376

S2 - 1.0315

S3 - 1.0254

Nearest levels of resistance:

R1 - 1,0437

R2 - 1.0498

R3 - 1.0559

Trading recommendations:

The EUR/USD pair appears to have resumed its downward trend, but it could begin a new round of upward correction at any time, as it is now close to the strong support level of 1.0376. As a result, as long as the Heiken Ashi indicator points downward, we should consider short positions with targets of 1.0376 and 1.0327. Purchases of the pair will be relevant once it is fixed above the moving average, with targets of 1.0519 and 1.0559.

Illustrations' explanations:

Linear regression channels can assist in determining the current trend. If both are pointing in the same direction, the trend is strong right now.

Moving average line (smoothed, settings 20.0) - determines the short-term trend and the direction in which trading should be conducted right now.

Murray levels are movement and correction targets.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will spend the next day.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates the onset of a trend reversal in the opposite direction.