GBP/USD 5M

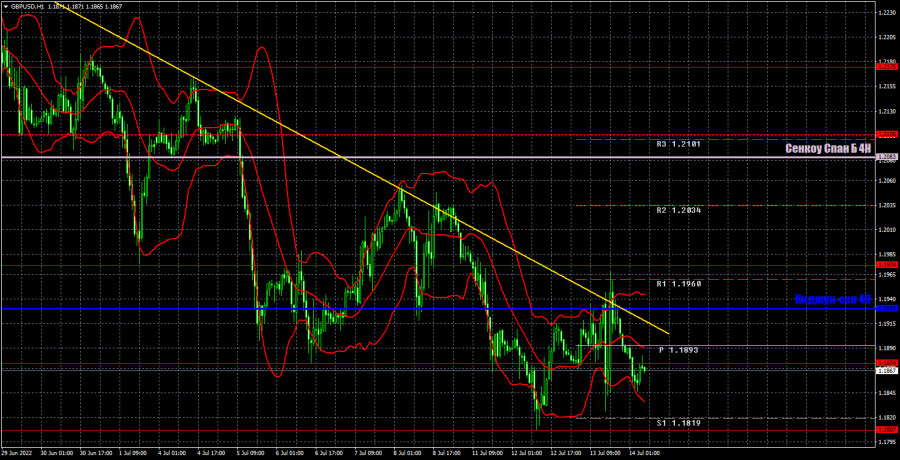

The GBP/USD currency pair also showed multidirectional movements on Wednesday, which were provoked, of course, by the US inflation report. Perhaps there is nothing more to say about the past day. There were also some relatively important reports published, but the market paid almost no attention to them. Data on GDP and industrial production turned out to be better than expected, but all that the pound managed to show was a 30-point gain. By the end of the day, the quotes of the British currency returned to the levels at which they were before the release of US statistics. So essentially nothing has changed.

As for trading signals, there is a very complex and interesting picture here. The first sell signal was formed near the critical line in the form of a rebound. Short positions should have been opened at this moment, and in a couple of hours the price dropped to the level of 1.1874, from which it also rebounded. Consequently, it was necessary to close short positions and open long positions. The pair rose after that back to the critical line, where longs should have been closed. The next rebound from Kijun-sen could have been worked out, but it could not have been worked out, since it was at that time that the inflation report was published in the United States. If it was worked out, then it could bring traders about 20 more points of profit, since the deal should have been closed when the price settled above 1.1874. And then open new longs. This time, the price managed to overcome the critical line, but it could not go much further up, so the last deal should have been closed when consolidating below the critical line. As a result, traders could get a profit of about 90 points yesterday.

COT report:

The latest Commitment of Traders (COT) report again showed insignificant changes. During the week, the non-commercial group opened 4,400 long positions and 7,500 short positions. Thus, the net position of non-commercial traders decreased by 3,100. But what does it matter if the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above? And the pound, in spite of everything, still cannot show even a tangible upward correction? The net position fell for three months, then grew for several weeks, but what's the difference if the British currency is still depreciating? We have already said that the COT reports do not take into account the demand for the dollar, which is probably still very high right now. Therefore, even for the strengthening of the British currency, the demand for it must grow faster and stronger than the demand for the dollar. The non-commercial group now has a total of 96,000 shorts open and only 39,000 longs. The net position will have to show growth for a long time to at least equalize these figures. Neither macroeconomic statistics nor fundamental events support the UK currency. As before, we can only count on corrective growth, but we believe that in the medium term, the fall of the pound will continue.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. July 14. The verdict on the euro and the pound has been passed, you can disperse.

Overview of the GBP/USD pair. July 14. The Scottish independence referendum will take place in autumn 2023.

Forecast and trading signals for EUR/USD on July 14. Detailed analysis of the movement of the pair and trading transactions.

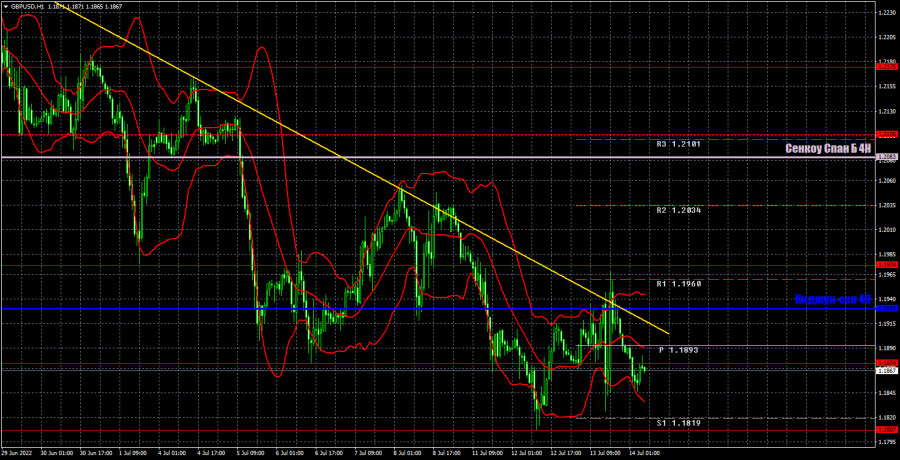

GBP/USD 1H

The pound began a new round of upward correction on the hourly timeframe, but again failed to overcome the downward trend line. Thus, until it is overcome, we do not count on a strong growth of the British currency. More can be said: even if the line is overcome, this does not mean at all that now the pound will perk up. The fundamental and geopolitical backgrounds remain very difficult for the pound. We highlight the following important levels on July 14: 1.1807, 1.1874, 1.1974, 1.2106, 1.2175. Senkou Span B (1.2083) and Kijun-sen (1.1930) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. No major events are scheduled for Thursday in the UK and US. Thus, today there will be nothing to react to. However, the pound now needs to solve its own puzzle: either finally overcome the trend line, or fall below 1.1807.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.