As the Australian Bureau of Statistics (ABS) reported last week, in June the employment rate in Australia rose to 88,400 (from 60,600 in May and against the forecast of an increase of 30,000), while unemployment decreased to 3.5% (forecast 3.8%, previous value 3.9%).

The ABS report is one of the key factors for the Reserve Bank of Australia (in addition to inflation and GDP) when making decisions on monetary policy parameters, and its strong data encourage the central bank to continue tightening monetary policy at its upcoming meetings.

Well, since inflationary pressure in Australia has an upward character, economists also expect the RBA to continue its active tightening. Now market participants are pricing in the probability that the RBA will again raise interest rates by 0.50% or even 0.75% at the August meeting.

And now, the minutes of the RBA's July meeting on monetary policy, released this morning, indicated that "further steps need to be taken in the coming months to normalize monetary conditions in Australia." "The level of interest rates is still very low for an economy with high labor market demand and facing a period of high inflation," and "CB members considered raising interest rates by 25 basis points or 50 basis points," the minutes said. For inflation to return to the target level, "further increase in the interest rate will be required over time."

This was also announced by the Deputy Governor of the Reserve Bank of Australia Michelle Bullock. Speaking in Brisbane, she said "further rate hikes will be needed in the coming months." They need to be raised "to some neutral level. It's a little higher than the one we're on right now."

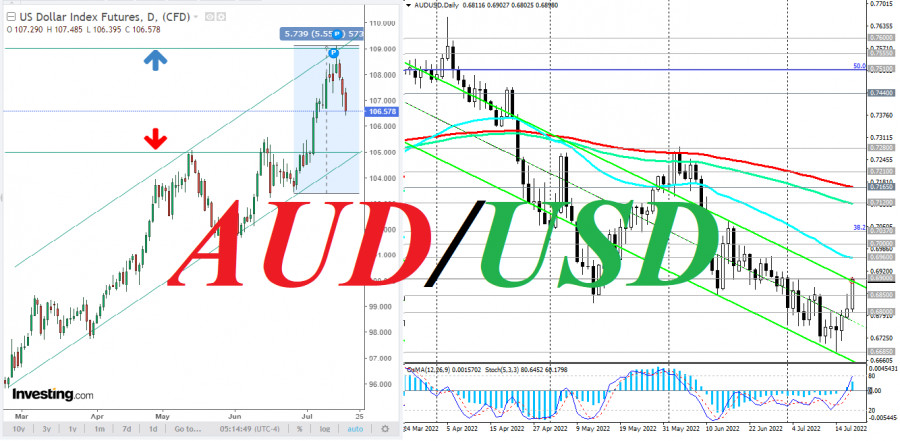

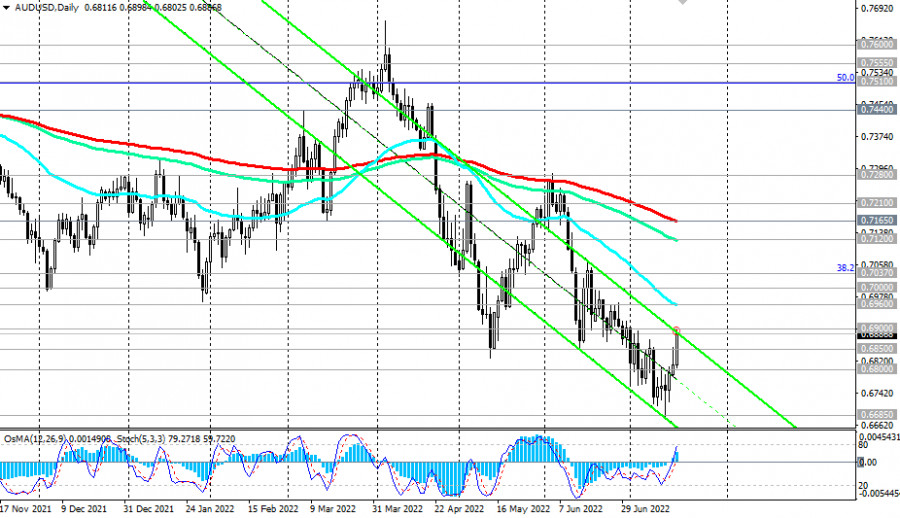

The aussie strengthened after the release of the RBA's July Minutes, while AUD/USD rose to an intraday and 12-day high of 0.6898, approaching the resistance level of 0.6900.

As you know, following the results of the July meeting on monetary policy, the members of the Board of the RBA raised the official monetary rate (OCR) by 50 basis points (from 0.85% to 1.35%), and as further stated by RBA Governor Phillip Lowe, the bank expects "further steps towards the normalization of monetary conditions", while the size and timing of future increases in interest rates "will be determined by incoming data and an assessment of the outlook for inflation and the labor market."

At the same time, it should also be noted that the growth of AUD/USD is also taking place amid the continuing weakening of the US dollar. As can be seen from the chart of the DXY dollar index, it has been falling for the 3rd consecutive day, after reaching a new local high above 109.00 last week.

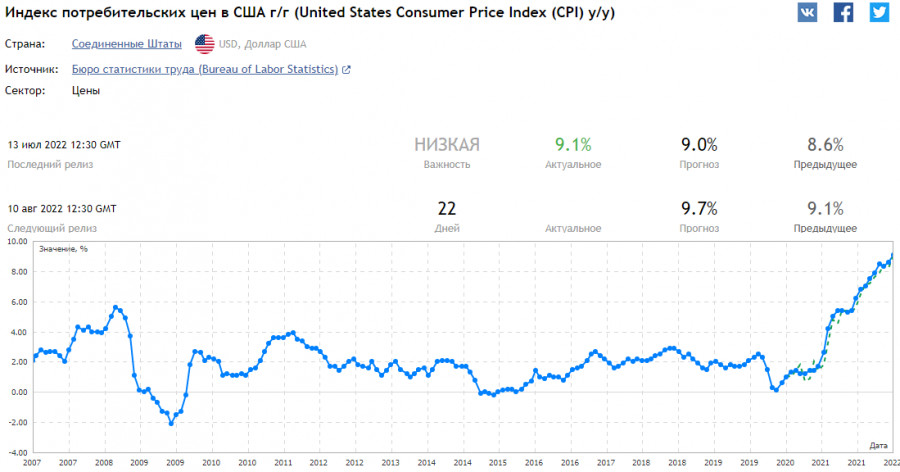

Market participants continue to evaluate the inflation indicators published last week, which pointed to the continuing rise in inflation in the US. As follows from the data of the US Bureau of Labor Statistics, published last Wednesday, in June, inflation in the US accelerated from 1.0% to 1.3%, and in annual terms jumped to the highest level in the last 40 years, amounting to 9.1%. (Y/Y) vs. 8.6% in May and market expectations of 8.8%.

Despite the current decline, the dollar continues to dominate the market, and given the strong bullish momentum and the long-term upward trend in DXY, the confirmed breakdown of the local resistance level of 109.00 will be a signal to increase long positions in DXY futures "with the prospect of growth towards multi-year highs of 121.29 and 129.05, achieved, respectively, in June 2001 and November 1985".

Such a sharp increase in inflation has strengthened the expectations of market participants regarding a more rapid tightening of the monetary policy of the US central bank, and this is still the main driver of USD growth.

The RBA's next meeting will take place on August 2, and in the coming days, market participants who follow the dynamics of the AUD will pay attention to Lowe's speech, and to the announcement tomorrow and Thursday of important economic indicators for Australia: on Wednesday at the beginning of the trading day and on Thursday.

In addition, market volatility, which will also affect the dynamics of AUD/USD, will increase this week on Thursday, when the meetings of the central banks of Japan and the eurozone take place).