The EUR/USD currency pair calmly continued to fall on Monday. In principle, the fall has lasted for more than a week, during which time the European currency has fallen by 350 points. Recall that before that, the pair had been correcting for more than three weeks within the framework of a long-term downward trend and managed to grow during this time by 400 points. Since the current fall may well be called a collapse, many analysts and traders are desperately trying to find an answer to the question, why is the euro currency falling so much? As if the answer to it would help predict the further movement of the pair.

From our point of view, everything is going according to the scenario that we outlined a few months ago and regularly talk about. In short, it can be called "geopolitics and the foundation." Geopolitics in Europe remains quite difficult, and no one knows what, where and when it will "shoot" next time. Recall that unprecedented EU sanctions against Russia are in effect now, and we said that any sanctions are not a "one-sided story." Any sanctions work both ways. In particular, if the EU refuses Russian oil, it will begin to experience a shortage of oil, and prices for "black gold" on European platforms will begin to rise. Also, do not forget about the long-term play factor of the monetary approaches of the ECB and the Fed. The American regulator continues to raise the rate, and the European regulator continues to "pretend" that it is increasing the rate. And the rate is one of the most important factors in the foreign exchange market. We also recall that the QT (quantitative tightening) program began to operate in the United States when it was aimed at reducing the money supply. Simply put, the number of dollars will be reduced. And if there are fewer dollars and there are no fewer people who want to buy them, then the dollar is growing. Well, the very fact of the geopolitical conflict in Ukraine affects the European economy much more than the American one. As you can see, there are plenty of factors that continue to support the dollar. And all these are serious factors, not one-dayers.

Why is the gas story in Europe artificially inflated?

Recently, it has become fashionable to associate the new collapse of the euro with the gas crisis in Europe. In fact, the latter has not even started yet, but many analysts believe that it is the possible shortage of "blue fuel" in the EU that is the reason for the collapse of the euro at this time. From our point of view, this is incorrect. First, from the very beginning of the introduction of EU sanctions against Russia, it became clear that oil and gas would also fall into the "sanctions lists". Second, when Brussels began to openly declare that it would be very difficult for it without Russian gas, it became clear as day that Moscow would use "blue fuel" as a lever of pressure on the EU. The price of gas is growing and already exceeds $ 3,000 per 1,000 cubic meters. This is an absolute cost record! But is it that bad? Firstly, the problem with gas can be really serious, but for what? For the euro currency or for the EU economy? As we have already seen, the euro does not pay too much attention to macroeconomic statistics, in particular to GDP reports. Secondly, gas can be purchased anywhere.

Of course, if the European Union has been receiving it from Russia for many years, it is now very difficult to take it and abandon it in a couple of months, as well as to establish other sources of "blue fuel." Therefore, the winter in the European Union will indeed be difficult, but this absolutely does not mean that "Europe will freeze". Europe has enough financial capacity to switch from gas power supply to alternative energy sources within a few years. Europe has enough opportunities to negotiate gas supplies from other countries. Yes, it will be more expensive, yes, it will be longer and more inconvenient. But no one in Europe will freeze, and industrial production, if reduced, will not be much. And the euro currency has such a number of factors in order to continue falling, now that there is one more, one less – there is no difference at all. Oil was also growing by leaps and bounds a few months ago, and now it has rolled back to a quite acceptable $ 90 per barrel. In a few months, gas may also become cheaper, or does someone seriously believe that gas will now be "more expensive than gold"?

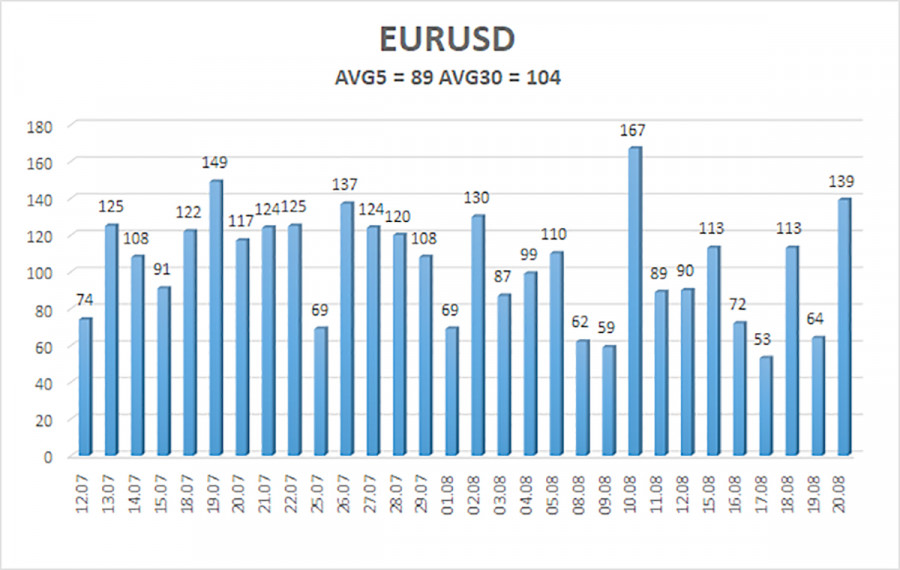

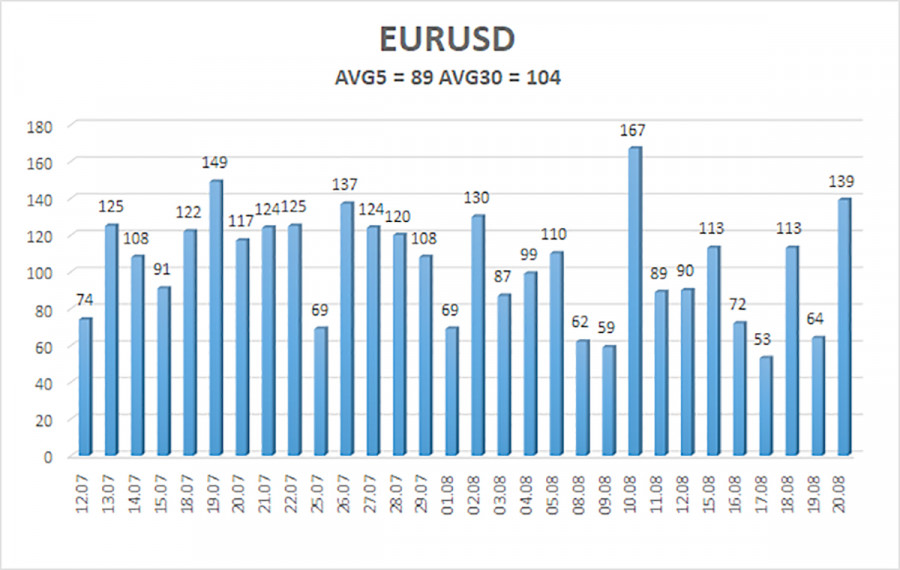

The average volatility of the euro/dollar currency pair over the last 5 trading days as of August 23 is 89 points and is characterized as "average." Thus, we expect the pair to move today between the levels of 0.9846 and 1.0024. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair continues its downward movement. Thus, it is now possible to stay in short positions with targets of 0.9888 and 0.9846 until the Heiken Ashi indicator turns up. It will be possible to consider long positions after fixing the price above the moving average with targets of 1.0193 and 1.0254.

Explanations to the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.