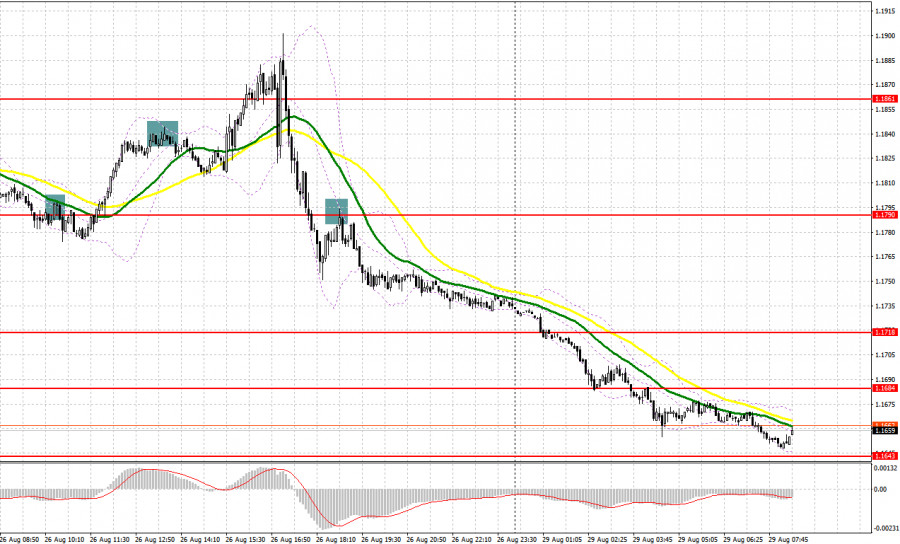

Several interesting market entry signals were formed on Friday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.1794 level in my morning forecast and advised making decisions from it. A breakthrough and reverse test from the bottom to the top of this range resulted in an excellent sell signal for the pound, however, there was no major move down. After a 20 point decline, pressure on the pair eased ahead of an important speech by Federal Reserve Chairman Jerome Powell, which led to the closing of short positions and an upward correction in GBP/USD. A false breakout at 1.1840 also did not give a serious result for the same reason. And in the middle of the US session, after a breakthrough and update from the bottom to the level of 1.1790, it was possible to get an excellent entry point for short positions, which brought at least 50 points of profit.

When to go long on GBP/USD:

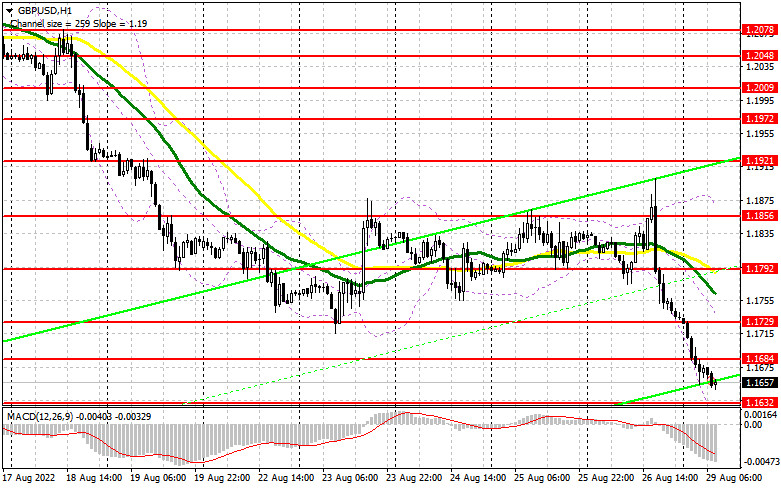

Powell's speech on Friday led to a sharp fall in the British pound. He said that reducing inflation to the target level of 2% is the main task of the central bank, even though consumers and businesses will be forced to endure the economic shock. He also noted that another unusually large increase in the key interest rate may be appropriate. Against this background, the demand for the dollar returned, and a breakthrough of a fairly significant support in the area of 1.1770 led to a new major wave of short positions on the pound. Now it is difficult to say what bulls need to do to stop the new bearish trend, so I advise you to act very carefully with long positions. Forming a false breakout in the area of the nearest support at 1.1632 will lead to the first signal to open long positions in anticipation of a correction to the area of 1.1684. A breakthrough and test from top to bottom of this range will indicate a return of demand for the pound and form a buy signal with growth to a more distant level of 1.1729, just above which the moving averages play on the bears' side. The farthest target will be the area of 1.1792, where I recommend taking profits.

If the GBP/USD falls further, which is more likely, and there are no bulls at 1.1632, the pressure on the pair will increase. Surpassing this range will lead to the renewal of the next annual low. In this case, I advise you to postpone long positions until the next support at 1.1573, but you can act there only on a false breakout. I recommend opening long positions on GBP/USD immediately for a rebound from 1.1499, or even lower - around 1.1419, counting on correcting 30-35 points within the day.

When to go short on GBP/USD:

The bears coped with all the tasks and in today's Asian trading session, they dropped the pound to another annual low, testifying to the resumption of the bearish trend. Today's lack of statistics on the UK will only push the bears' presence, as the bulls are unlikely to be able to rely on something. The best scenario for selling the pound would be forming a false breakout at the level of 1.1684, which will make it possible to reach the support of 1.1632. A breakthrough and reverse test of this range will provide an entry point for selling with a fall to 1.1573, and the area of 1.1499 will be a further target, where I recommend taking profits.

In case GBP/USD grows and there are no bears at 1.1684, there will be a ghostly chance of an upward correction, and bulls will have an excellent opportunity to return to 1.1729. Only a false breakout there will provide an entry point into short positions based on the pair moving down. If there is no activity there, I advise you to sell GBP/USD immediately for a rebound from 1.1792, counting on the pair's rebound down by 30-35 points within the day.

COT report:

According to the Commitment of Traders (COT) report from August 16, both short positions and long positions increased, but these changes no longer reflect the real current picture. Serious pressure on the pair, which began in the middle of last week, continues now, and for sure those who want to buy the pound in the current difficult macroeconomic conditions will become less and less. Ahead of us is a meeting of American bankers in Jackson Hole, which may lead to even greater strengthening of the dollar against the pound. This will happen on the condition that Federal Reserve Chairman Jerome Powell announces the preservation of the committee's previous position regarding the active and tough increase in interest rates, counting on the further fight against inflation and bringing it back to normal. The latest COT report indicated that long non-commercial positions rose 1,865 to 44,084, while short non-commercial positions rose 506 to 77,193, further narrowing the negative non-commercial net position to -33,109 versus -34,468. The weekly closing price remained virtually unchanged at 1.2096 versus 1.2078.

Indicator signals:

Moving averages

Trading is below the 30 and 50-day moving averages, which indicates the pair's succeeding decline.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If the pair goes down, the lower border of the indicator around 1.1620 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.