The GBP/USD currency pair normally trades on Wednesday. Few people anticipated that the British pound would suddenly begin to appreciate for no apparent reason. In addition, it is incorrect, as this is typically how long-term trends terminate. We wish to express that the pound cannot and will not continuously decline. It may continue to rain for another week or two, but we should not assume that it will rain every day or tomorrow because it rained today. Such unidirectional movement of the pair dulls the alertness of traders, as it appears that the simplest trading is occurring: sell every day and make a profit. Nonetheless, the decline of the pound could end swiftly and unexpectedly.

However, yesterday it seemed evident that the fall would continue. The British pound updated its two-year lows on Tuesday and spent the majority of the day moving towards 1.1411, which is the lowest level in the last 37 years. As we have already stated, traders in the pound no longer require macroeconomic data to justify additional sales. Why would you purchase a pair during a clear and persistent downward trend? Thus, pure market variables come into play when, despite a solid basic foundation, no purchases materialize. Yesterday, however, there was no "excellent" basic basis and no macroeconomic figures. We cannot, therefore, conclude that the market has had enough of selling the pound and is prepared for a significant correction at this time. The market no longer cares that the Bank of England and the Federal Reserve will hold new meetings this month where decisions will be made on new major rate rises. The United Kingdom may have the most severe inflation, the most severe recession, the most severe decline in living standards, rising unemployment, and other enchantments. And nobody cares that the United States is already experiencing a recession, that unemployment has already begun to rise, and that the general economic situation will worsen (although probably not as much as in the Kingdom).

Once again, Andrew Bailey flooded the market with negativity.

The sole important event of the previous day was BA Chairman Andrew Bailey's address. Mr. Bailey rarely addresses the public, so each of his performances is noteworthy. His previous dismal prophecies prompted me to request that he talk even less frequently. Yesterday, while addressing the Treasury Committee of Parliament, he made a number of completely "vague" assertions. Specifically, he stated that the inflation targeting regime in the United Kingdom has failed; the Bank of England will be able to respond appropriately to the price shock; and there is a strong association between money supply and inflation. The weakening of the British pound is related to the "history of the country," and the United States is in a somewhat different economic scenario, one that is not as inflexible as that of the United Kingdom.

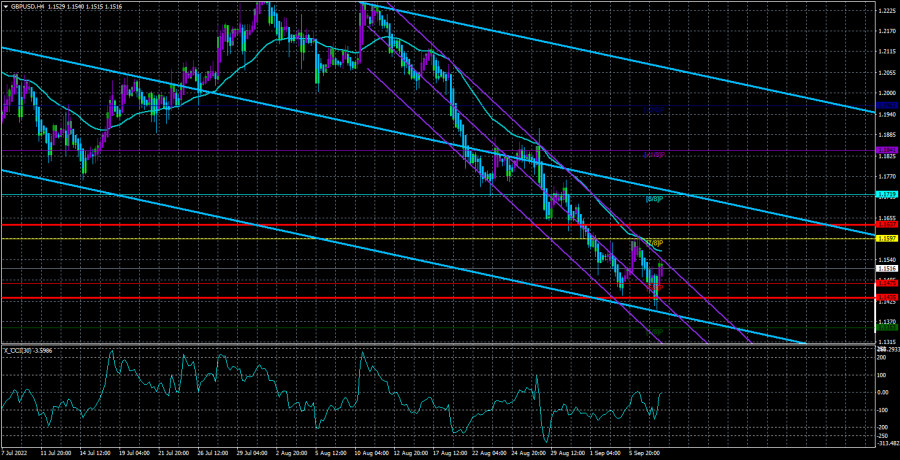

Bailey drew particular attention to the topic of inflation, predicting that the consumer price index will continue to rise in the near future, "which is not at all surprising." He voiced fear that inflation could rise over the medium and long term as well. The head of the Bank of England publicly blamed the Kremlin for the British recession and absolved his department of any responsibility for the state of the economy, stating, "BA's monetary policy has nothing to do with it." In his address, Mr. Bailey attempted to disavow as far as possible any charges of making poor decisions. He also identified others to blame for what was occurring and made a number of bleak predictions. May the British pound appreciate on the basis of this "clever" speech? This inquiry is rhetorical. The most essential factor is that inflation will continue to rise in the UK despite six consecutive major rate hikes. Similarly, US inflation could continue to drop. What is not another reason favoring the dollar's continued growth? Technically speaking, everything is crystal clear. The pair remains below the moving average, with both regression channels pointing downward.

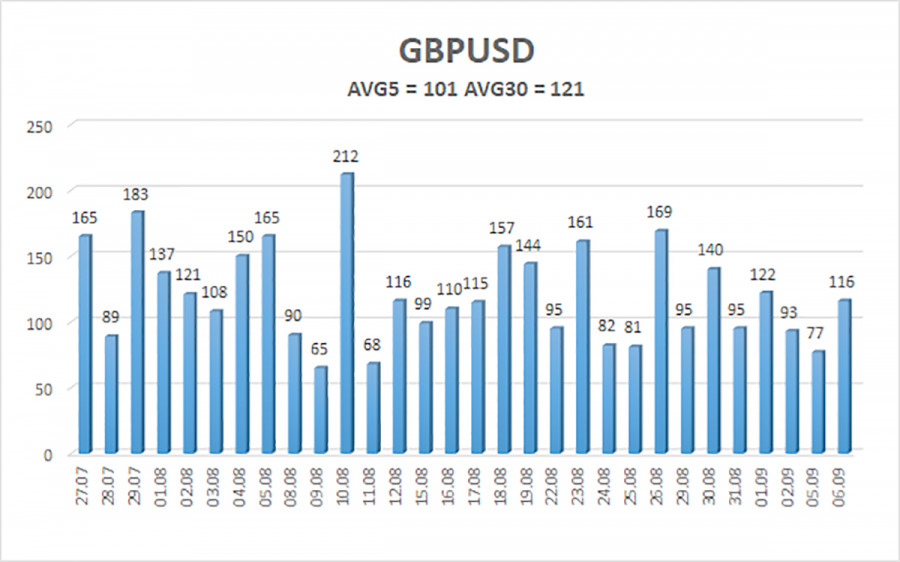

During the last five trading days, the average volatility of the GBP/USD pair was 101 points. This figure for the pound/dollar combination is "average." Thus, on Thursday, September 8, we anticipate price action within the channel, bounded by the levels of 1.1435 and 1.1637. The downward reversion of the Heiken Ashi indicator signifies the continuation of the downtrend.

Nearest support levels:

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

Trading Recommendations:

The GBP/USD pair has adjusted to the 4-hour moving average and is poised to resume its downward trend. Therefore, new sell orders with targets of 1.1475 and 1.1435 should be opened and maintained until the Heiken Ashi signal goes up. Open buy orders when the price closes above the moving average line with goals between 1.1658 and 1.1719.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.