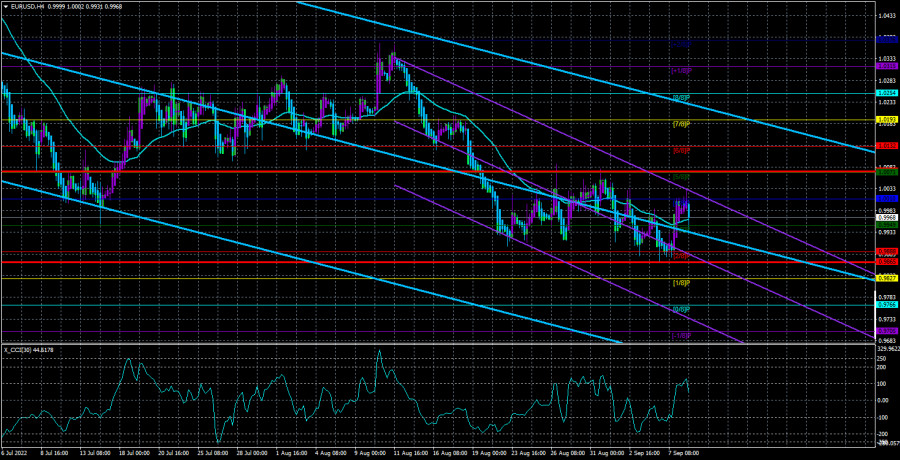

The EUR/USD currency pair was relatively inactive on Thursday. A day earlier, closer to tonight, the European currency still managed to gain a foothold above the moving average line. Still, this consolidation meant almost nothing because the pair remained inside the side channel, only slightly expanding it. If earlier we talked about the range 0.9900 – 1.0072, now we are talking about the levels 0.9888 and 1.0071, which are the Murray levels "2/8" and "4/8". Thus, practically nothing has changed in technical terms over the past week. Therefore, the rather strong growth of the European currency on Wednesday evening and Thursday night made almost no sense. Well, the euro has grown by 100 points, and what next if it remains inside the side channel? Moreover, it remains near its 20-year lows because it is hardly possible to consider a pullback of 100 points upwards as the end of a global downtrend, within which the pair fell by almost 2500 points!

And what about the fundamental and geopolitical factors? In short, they have not changed in any way lately. At the beginning of this week, we assumed that the fundamental background is slowly beginning to change in favor of the euro currency. But, as we can see, even if this is the case, the euro cannot extract any dividends from this. And he cannot do this because traders refuse to invest in the currency of the European Union since it is on the verge of an energy crisis and a recession and is also very close to Ukraine, in which a geopolitical conflict persists. Anti-risk sentiment in the market remains high; under such conditions, traders try to buy the safest possible currency, the US dollar.

The ECB made the most "hawkish" decision, but there is no sense in this for the euro.

As expected, the European regulator raised the key rate by 0.75%, bringing it to 1.25%. What does this mean for the European currency? On the one hand, this is a very good sign since the ECB has finally stopped doing nothing and started fighting inflation. On the other hand, we have had and still have a great example in the face of the Bank of England, which has raised its rate six times in a row and this month will probably raise it for the seventh time. Did it help the pound? No. So the assumption is the following: as long as the Fed rate is higher than the ECB rate, it will be extremely difficult for the European currency to count on strong growth. As we said earlier, it will be possible to expect the end of the global downtrend only when the Federal Reserve begins to at least hint at the end of the cycle of tightening monetary policy. From our point of view, this will happen no earlier than the end of 2022.

It should be noted that the deposit rate has also been increased to 0.75%, and now it is 0.75%! So now, by bringing their money to the European bank, owners can count on a minimum profit, which will naturally be "devoured" by the highest inflation. In the context of the ECB's struggle with high inflation, the 1.25% rate is just a mockery. The ECB was very late with the start of the fight, so it will have to raise the rate for a long time for inflation to begin to decline. Again, we have a great example in the face of the Fed, which has already increased its rate to 2.5%, but inflation has only slowed down a little. A new report on inflation in the US will be released next week, and we will be able to conclude whether the 2.5% rate is enough for inflation to move into a downward trend. If yes, then 2.5% will be a benchmark for the ECB. If not, it will become clear: the bid needs to be raised stronger. They are already talking about the need to raise it to 4% or more in the US. Will the European Union be able to afford such a luxury on the eve of the "cold winter"? If the gas crisis unfolds in the EU territory, the economy will go into recession without tightening monetary policy. And each ECB rate increase will only "finish off" it.

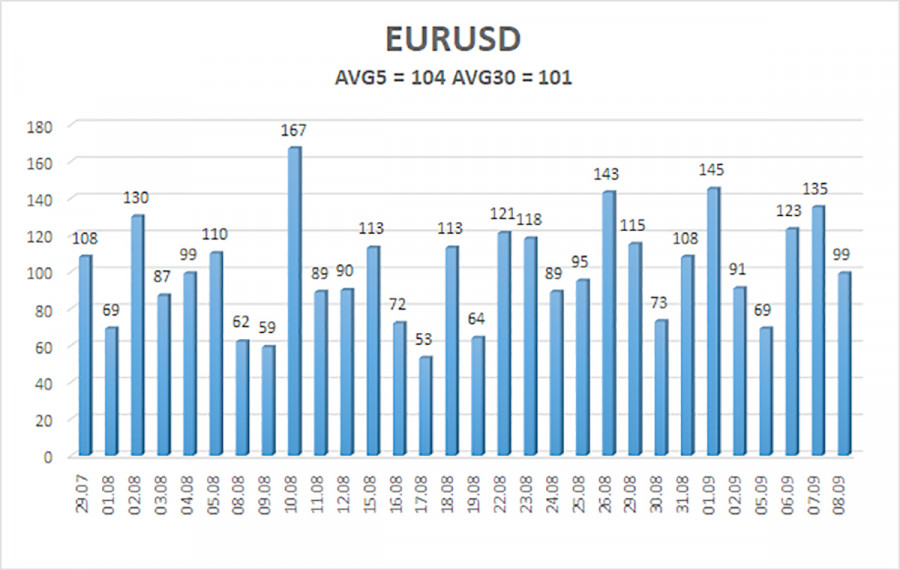

The average volatility of the euro/dollar currency pair over the last five trading days as of September 9 is 104 points and is characterized as "high." Thus, we expect the pair to move today between 0.9865 and 1.0073. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

S3 – 0.9827

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair continues to trade in the flat or "swing" mode. Thus, now it is possible to trade on the reversals of the Heiken Ashi indicator until the price leaves the 0.9888-1.0072 channel. Formally, she continues to remain in it.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.