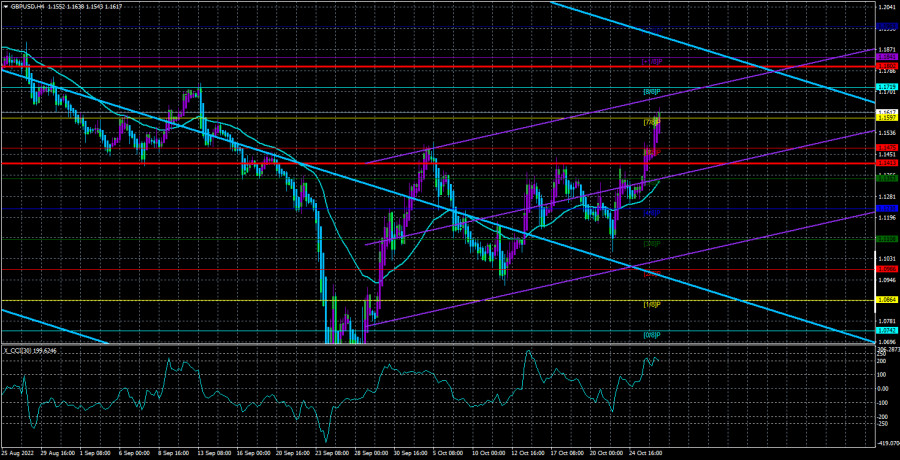

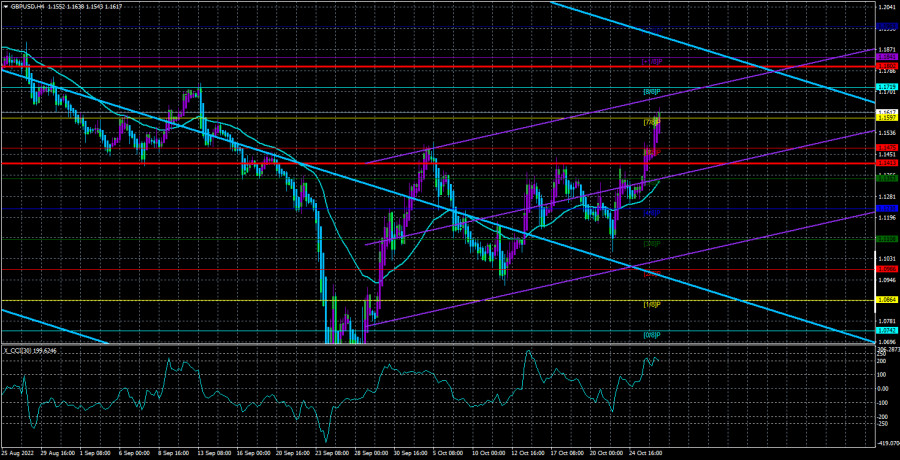

The GBP/USD currency pair also continued to grow easily and freely on Wednesday. The same groundless growth as the euro continues. However, in the case of the pound sterling, there are certain grounds for an upward movement, since it is in the case of this currency that we can say that the downward trend is over. However, this is just one technical factor. As soon as we recall the geopolitics or the foundation that confidently pushed traders to more and more sales in 2022, serious doubts immediately arise that the pair can continue its growth. Moreover, on the 24-hour TF in the coming days, the price may encounter the same Senkou Span B line, which is very strong, and may simply not let the pair go higher. However, the current technical picture of the 4-hour TF speaks in favor of an upward trend, since the junior channel of linear regression has turned upward, and the price is located above the moving average line. Therefore, so far there is no reason to sell the pair anyway. Recall that if there is any fundamental hypothesis, it must necessarily be confirmed by technical signals. If there are none, then it is dangerous to open deals based on expectations alone.

It should be understood that a market is a huge number of subjects, and not all of them make transactions based only on the desire to make money on the difference in exchange rates. There are large companies that buy this or that currency for their operating activities. There are large banks, there are even governments of various countries that can also buy this or that currency for their reserves. Therefore, it is unequivocal to say that the pound cannot and will not grow under any circumstances. But at the same time, it can hardly be assumed that the pound is now growing because Rishi Sunak has become prime minister. Why is the euro growing in this case? Why are the movements of both pairs almost identical again, if the factors that affect them are different? Is someone pulling someone up? Well, then it would be logical if the euro pulled the pound up, and not vice versa. In general, the situation is not quite clear now.

Either a prolonged consolidation or a resumption of the downtrend.

It should also be noted that in the long term, there are also periods of flat or "swing". It's just that on a 24-hour TF it will be a "swing", and on a 4-hour one, there will be a lot of small trends, each of which in itself will be strong enough, both for the short term. We may be now entering one of these periods for the same reason: there is no reason for the pound to grow. Corrective growth is good, but it will end sooner or later, and then the main trend will have to recover.

Remembering how many problems there are in the UK now, it is difficult for us to imagine that the British currency will grow for a long time, at least a year. The economic problems associated with Brexit, because of which most Britons already want to return to the EU. The "Scottish referendum", because of which Britain could lose a third of its territory. The highest inflation was not stopped even by seven increases in the BA rate. Falling living standards, the highest energy prices, constant perturbations in power, budget deficit, the discontent of the population, and the upcoming parliamentary elections, in which the Conservatives may already suffer a defeat commensurate with the failure of Labor in 2019.

Rishi Sunak now faces the task of simply not making the economy worse, but at the same time quickly restoring confidence in the Conservative Party. Please note that Sunak was, in fact, the only candidate for the post of prime minister, although a couple of months ago there were seven of them. And why is that? There is an influence of some force that understands that a conditional Penny Mordaunt will only worsen the position of the Conservative Party among the electorate. If the Conservatives lose their majority in Parliament, they will not be able to make any decision without the consent of the opposition. Naturally, no one wants to allow this, but this is what everything is coming to. Conservatives first tarnished their reputation under Johnson, and Liz Truss finished it off in just 44 days.

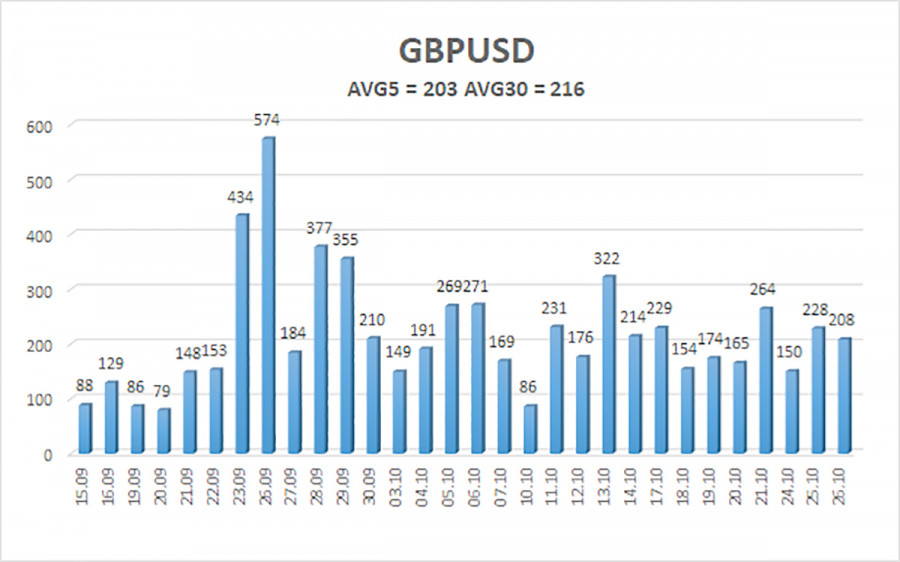

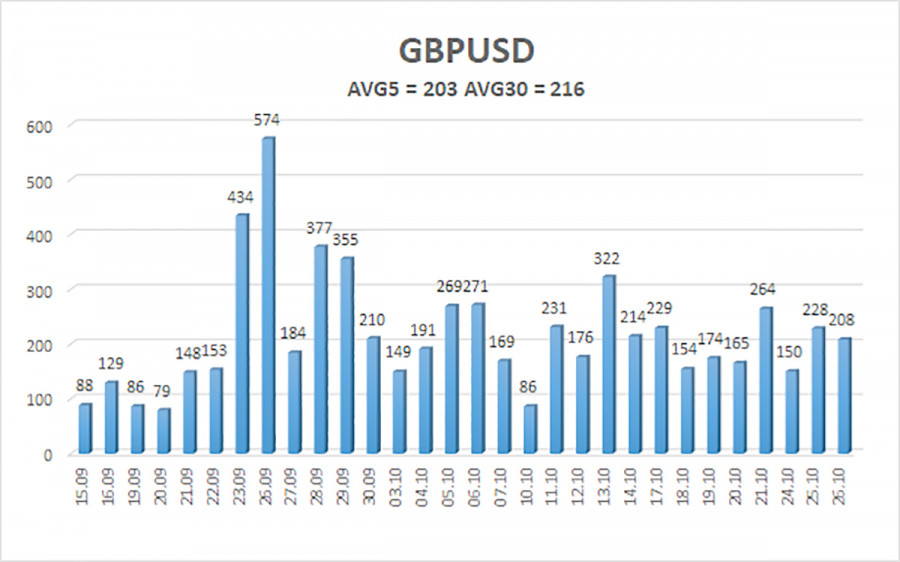

The average volatility of the GBP/USD pair over the last 5 trading days is 203 points. For the pound/dollar pair, this value is "very high." On Thursday, October 27, thus, we expect movement inside the channel, limited by the levels of 1.1413 and 1.1802. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1,1475

S2 – 1,1353

S3 – 1,1230

Nearest resistance levels:

R1 – 1,1597

R2 – 1,1719

R3 – 1,1841

Trading Recommendations:

The GBP/USD pair continues to move up in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.1719 and 1.1802 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1230 and 1.1108.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.