On Tuesday, the euro/dollar pair resumed rising as though there were strong fundamental and macroeconomic reasons. The eurozone published its GDP data for the third quarter. It was the second estimate and it matched the previous one, which unveiled a rise of 0.2%. There were no other important events neither in the eurozone nor in the US. However, the euro resumed climbing before the publication of the GDP report. Thus, the euro's appreciation was not caused by the report.

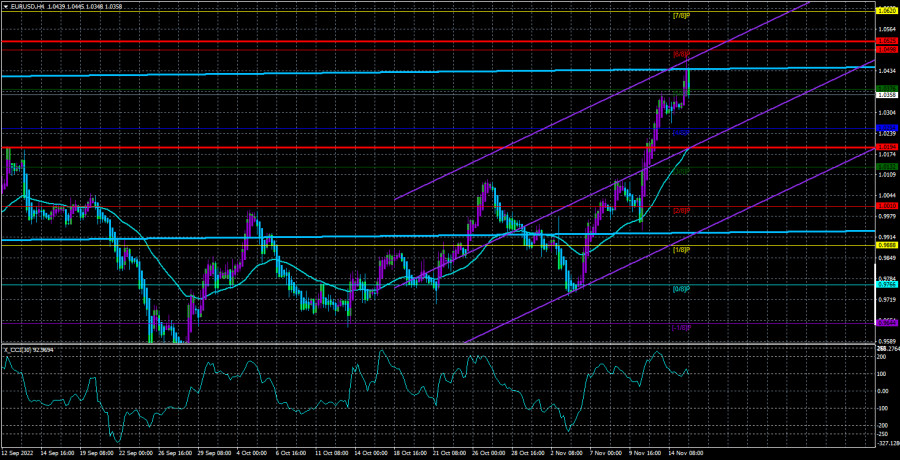

The pair continues trading above the MA. Now, almost all technical indicators are pointing to the uptrend. Traders have long been waiting for such signals. The fact is that in the last two years, the euro failed to show a full-scale correction. That is why the rise came as a real surprise. On the other hand, there are a lot of questions about such a strong jump in the euro. Now, almost all analysts explain the US dollar depreciation by the expectations of a slower key interest rate hike by the Fed. Notably, in October, the US inflation slackened. Some members of the FOMC said that at the following meetings the benchmark rate would be raised slower than before that. That is why it is not a strong reason to sell off the greenback.

Firstly, it was already known that the Fed would slacken its monetary policy tightening. Secondly, the key interest rate will be hiked at least at the next three meetings. Thirdly, the ECB will hardly remain stuck to an aggressive approach for a long time. There are whispers that the Bank of England may start slackening the interest rate growth pace as early as December. What is more, the ECB is unlikely to raise its benchmark rate higher than the Fed's final interest rate. That is why the euro's rise could be explained by the existing conditions, but it should have shown slower growth.

In other words, such a movement is not logical and could be replaced by a decline once traders realize that the Fed will go on raising the interest rate for a long time. What is more, all geopolitical problems have not been solved yet.

Traders of EUR are not taking into account most factors that may lead to a slump.

Under the current conditions, the inflation report and Christine Lagarde's speeches may lose sense. Inflation is likely to accelerate. Traders may consider this to be a new buy signal since the likelihood of the 75-basis-point hike in December will become higher. However, demand for the euro has almost no room to rise. We can say that traders have already priced in all the bullish factors of this week.

The ECB's chair may repeat that the regulator intends to return inflation to the target of 2%. However, we have already said that not all European countries are able to cope with high interest rates. What is more, inflation in the eurozone is higher than in the US. Thus, the ECB may either keep interest rates high longer than the Fed or hike them more than the Fed. Notably, early this year, Christine Lagarde said that inflation might return to the target without any measures. Thus, the regulator will hardly be able to reach the goal. Although the euro is rising now, it may slump at any moment.

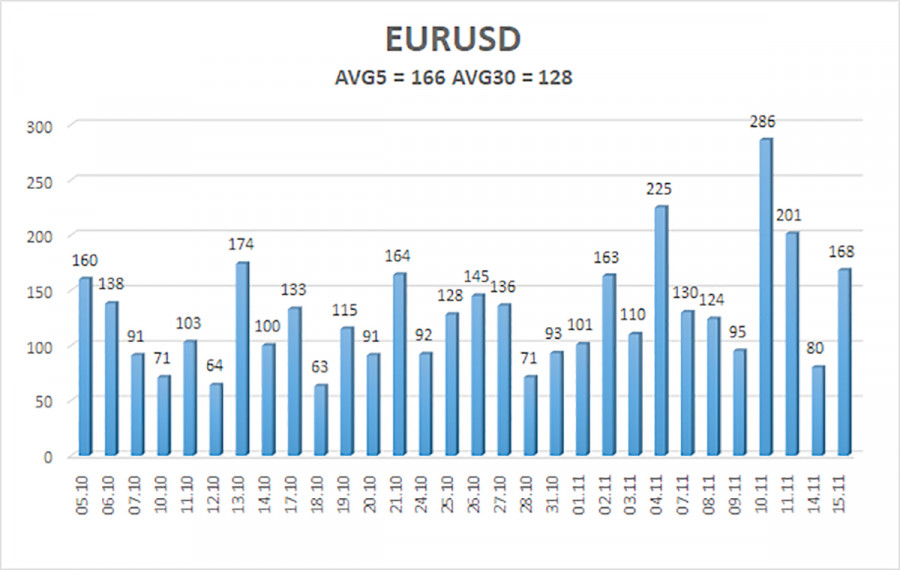

As of November 15, the average volatility of the euro/dollar pair in the last 5 days is 166 pips. Such volatility is considered to be high. On Wednesday, the pair is likely to hover between 1.0194 and 1.0525. A downward reverse of the Heiken Ashi indicator points to a new downward correction.

The nearest support levels:

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

The nearest resistance levels:

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading recommendations:

The euro/dollar pair continues moving upwards. Thus, traders may continue opening long orders with the targets at 1.0498 and 1.0525 until the Heiken Ashi indicator reverses downwards. If the price settles below the MA, traders may go short with the targets at 1.0010 and 0.9888.

What we see on the chart:

Linear regression channels help determine the current trend. If both are headed in the same direction, the trend is strong now.

A moving average (settings 20.0, smoothed) determines a short-term trend and trading direction.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator: its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal will take place soon.