The GBP/USD currency pair was trading with an increase for most of the day on Wednesday but, at the same time, showed quite low volatility. However, more important was that the price continued to be located above the moving average line, which means that almost all technical indicators continued to indicate an upward trend. The fall in the pound's quotes began only today when there was no single important event or report in the UK. Moreover, there was only one important event in the United States if we considered macroeconomic and fundamental data. Therefore, based on why the dollar suddenly began to rise sharply today, it isn't easy to say. It is because it has been falling for the last two weeks. Recall that our opinion is this: the last round of growth of the euro and the pound was unreasonable and illogical.

There were certain reasons for traders to sell the dollar. For example, the greatly reduced inflation in the United States in October. We have already said that this report means that the Fed no longer needs to "gallop" by raising the key rate. Therefore, the market regarded this report as a signal to sell the US currency, but we want to remind you that this is just one report. Next month we may see a slowdown in the rate of decline in inflation, and then what? Will there be talk about the need not to weaken the Fed's monetary pressure and new dollar purchases? After all, the Fed will raise the key rate for several more months. The Fed's key rate will still be higher than the rate of the Bank of England or the ECB. Therefore, we still see no reason for a long and strong growth of the euro and the pound. If the pair gains a foothold below the moving average this week, this may be the beginning of a new, rather significant drop in the pair.

British inflation continues to rise, no matter what.

The "report of the week" was published in the UK yesterday. British inflation at the end of October rose to 11.1% y/y, increasing by 1%. For a monthly increase, this is a lot. And this report needs to be considered in detail. To begin with, let's remember that the Bank of England has already raised the rate to 3%. However, the last rate increase of 0.75% could not affect the October inflation report since it happened later. In October, the rate was 2.25%, so we are not surprised by the absence of a slowdown in the consumer price index in the UK. According to many experts, the rate of 2.25% is a "neutral level." That is, the level at which the pressure on the economy is not strong, but the impact on inflation is small. Therefore, the inflation report for November, which will be released next month, will be much more interesting. If it also does not show a slowdown, then we will consider that the British economy has been "sentenced." If inflation does not start to decline even at the 3% rate, then this can only indicate one thing: the BA will have to raise the rate to at least 6% to achieve a drop in inflation to 2%.

And we have serious doubts that the British regulator is capable of such a tightening of monetary policy. Even if the next report shows a slight slowdown, more than the 4.75% rate (at the moment, this level is considered the most likely final level for the BA rate) may also be needed. Therefore, inflation in the UK will remain high for a long time. Longer than, for example, in the USA. The recession in the British economy has already begun, and each subsequent rate increase will only increase the fall in GDP. The British currency can grow while the BA raises the rate, but it remains unclear to what level it will raise it and how traders will look at the recession and ever-increasing inflation. From our point of view, more factors will be needed to help the pound to continue its growth.

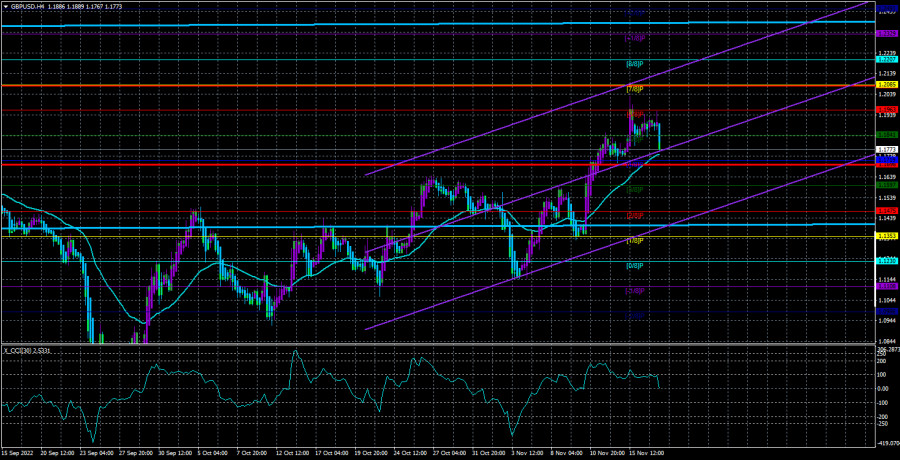

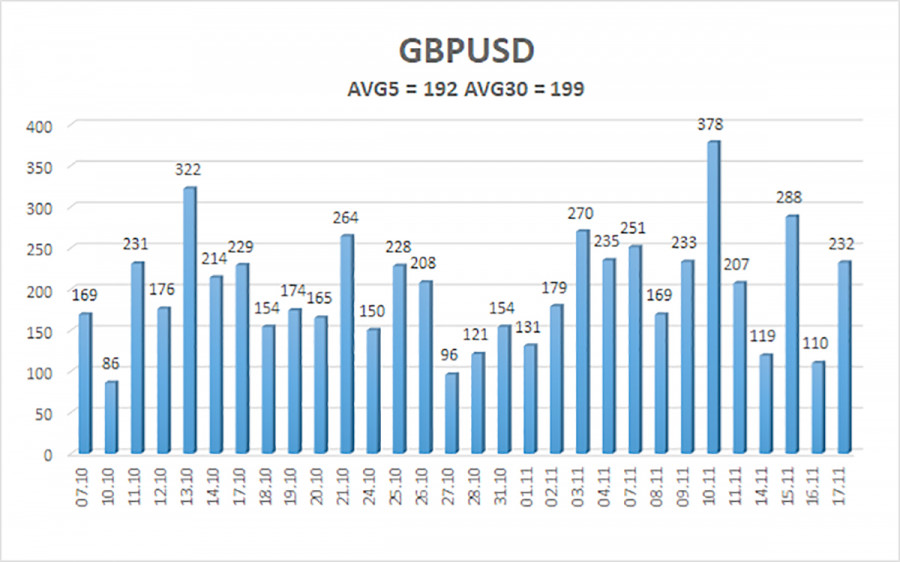

The average volatility of the GBP/USD pair over the last five trading days is 192 points. For the pound/dollar pair, this value is "very high." On Thursday, November 17, thus, we expect movement inside the channel, limited by the levels of 1.1698 and 1.2082. The upward reversal of the Heiken Ashi indicator signals the completion of the correction movement.

The nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

The nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

R3 – 1.2085

Trading Recommendations:

The GBP/USD pair has started a downward correction in the 4-hour timeframe. Therefore, at the moment, buy orders with targets of 1.1963 and 1.2082 should still be considered in the event of an upward reversal of the Heiken Ashi indicator. Open sell orders should be fixed below the moving average with targets of 1.1597 and 1.1475.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.