The dollar remains under pressure, and the dollar index (DXY) continues to decline moderately within the descending channel formed in the middle of last month on the DXY daily chart. The low formed within this channel is around 103.94, and its lower limit is below 103.00. If the buyers of the dollar cannot reverse the situation in their favor, then after the breakdown of the 104.00 local support level, the DXY will head to around 103.00, and the dollar will continue its decline in the market.

Tomorrow, apparently, will determine the further direction of the dollar dynamics: at 19:00 (GMT), the Fed leaders will announce their decision on the interest rate. The market has already priced in a 0.50% interest rate hike at this Fed meeting, which starts today, and assesses the likelihood of a further slowdown in the Fed's monetary policy tightening. If such signals are received tomorrow, then further weakening of the dollar, as many economists believe, cannot be avoided.

However, a tougher Fed decision should not be ruled out either. But what will happen if the Fed raises its interest rate not by 0.50% as the market expects but by 0.75% as it did in June, July, September and November. Where would the dollar go in such a case? Obviously, we should expect a sharp strengthening of the dollar in this scenario. But how strong will it be, and how long will it last? This will depend on the rhetoric of the accompanying statements and speech of Fed Chairman Jerome Powell at the press conference, which will begin in half an hour after publication of the decision on rates.

Powell is likely to say that everything is under control and the Fed is moving in the right direction, continuing to fight with high inflation. He is also likely to say that the U.S. labor market is stable, and the recently released data on high business activity in the U.S. economy allows the Fed to continue its aggressive policy to curb inflation. But if Powell says, as he did recently in his introduction at the Brookings Institution in Washington, that the Fed can slow the pace of interest rate hikes and that it has already been "pretty aggressive" with its rate hikes, also hinting at a further slowdown, then the dollar is likely to get into a new wave of sell-offs.

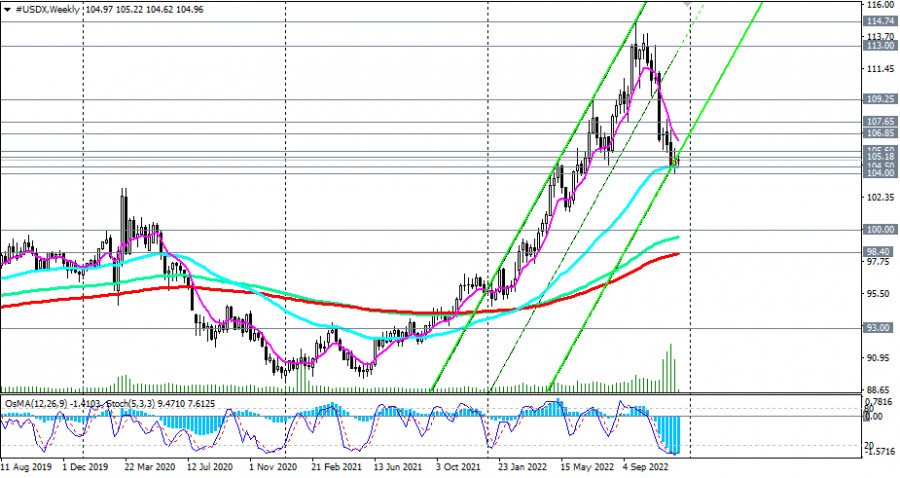

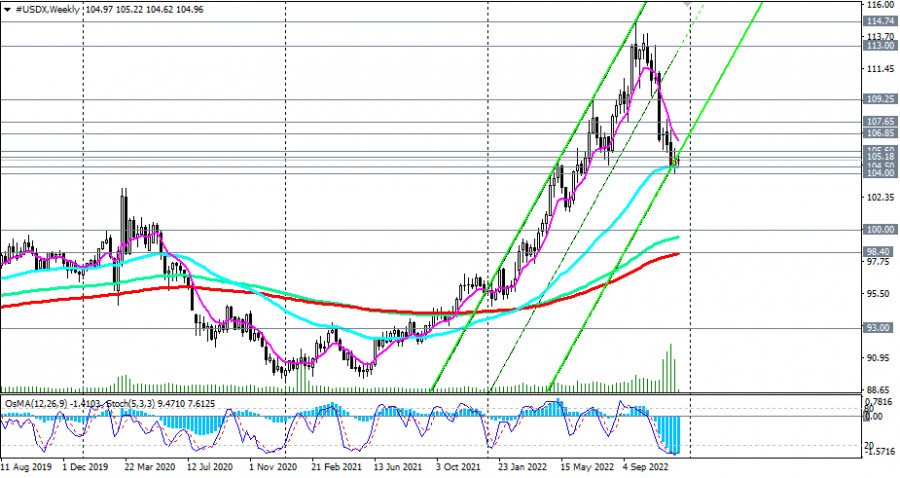

From a technical point of view, the first signal for new short positions will be a breakdown of the local support level and 50 EMA on the weekly chart of the DXY index (CFD #USDX in the MT4 trading terminal) passing through the 104.50 mark, and the confirmation signal will be a breakdown of the "round" support level 104.00.

With regards to today's economic calendar: the scheduled publication of the latest inflation data for the USA at 13:30 (GMT) and the expected slowdown of inflation in November will create preconditions for exactly the soft (or negative for the dollar) scenario of the course of the December FOMC meeting. Recall that the meeting will finish tomorrow with the publication of the rate decision at 19:00 (GMT), and at 19:30, the Fed's press conference will start, during and after which the main movement of the dollar will begin.

As for the euro, the main event will unfold on Thursday, on the release of the ECB's interest rate decision at 13:15 (GMT), and a news conference will start at 13:45, when ECB President Christine Lagarde will outline the country's monetary policy outlook.

The press conference will be of primary interest to market participants. In its course, a surge in volatility is possible not only in euro quotes, but also in the entire financial market, if Lagarde makes unexpected statements. In previous years, following the results of some ECB meetings and subsequent press conferences, the euro exchange rate changed by 3%–5% in a short time. The soft tone of the statements will have a negative impact on the euro. Conversely, the tough tone of the ECB head's speech regarding the central bank's monetary policy will strengthen the euro.

In the meantime, the euro is developing a positive dynamic against the dollar, moving in an upward correction within the global EUR/USD downward trend. As of writing, EUR/USD was trading near 1.0538, above the long term and important support level 1.0395, trying to consolidate in the zone above another important support level 1.0500. A breakdown of the local resistance level 1.0585 will confirm the bulls' serious intentions on the pair, pushing it further towards key resistance levels 1.1035, 1.1150.