Unlike the EUR/USD pair, the GBP/USD currency pair remains volatile and, more importantly, trending. This movement can be viewed as a "gift under the Christmas tree," as the euro/dollar pair is now stationary. In general, we have stated numerous times that the pound is heavily overbought, the dollar is oversold, and the pound's most recent monthly growth was illogical. As a result, we were expecting a downward correction, but only this week did the pair convincingly gain a foothold below the moving average (for the first time in a month), so we can now enjoy a trending downward movement.

We do not believe it is necessary to inquire as to why the dollar is rising alongside the pound but not alongside the euro. You should be grateful that at least one of the two pairs enables you to cooperate with it, initiate transactions, and generate revenue. We think that since the pound has risen too much, the decline in quotes should continue. There are drop targets between levels 12 and 14. What will occur after this correction is difficult to predict because much will depend on the health of the British economy and the degree to which the Bank of England will be willing to raise its key rate. And there are lots of uncertainties and questions surrounding this. Since Rishi Sunak, Jeremy Hunt, and Andrew Bailey have all openly admitted that the British economy will experience a recession, this is a fact. The regulator will have less opportunity to raise the rate as the economy worsens. We already have doubts about his ability to raise it to the Fed rate level. If not, the British pound should have even less support considering that one of the main factors driving its recent growth was market expectations of a slowdown in the pace of monetary policy tightening in the US.

The UK economy has shrunk by 0.3%, but this is only the start.

Yesterday, we presumed that those market participants would ignore the inflation report. We anticipated that there might be a response, but we did not anticipate a strong one. But the issue that the dollar has been dealing with for the past two months is now being faced by the pound. The market uses macroeconomic publications as justification to open trades on a trend and trade in the direction it sees fit. Although GDP reports (especially not in the first estimates) rarely cause significant movements, the pair fell by about 130 points yesterday. However, the US GDP increased more than anticipated, while the UK GDP shrank more than anticipated. When taken as a whole, these reports provided a solution to the dilemma of what to do with the pound on Thursday. But let us point out that the pound dropped on both Tuesday and Wednesday. We think the fall should have occurred on Thursday, when it might not have been as severe.

The market shouldn't be uncertain about the direction of movement because it is obvious that the market won't "flatten." The British economy can now experience losses every quarter, which is bad not just in terms of the actual economic contraction. This is problematic because BA might reduce the rate of tightening financial conditions once more in early 2023. The BA did it after the first slight slowdown, just as the Fed did after five inflation decreases. As a result, it is already concerned about a severe and abrupt recession. Additionally, it might have to slow down to 0.25% if the economy experiences a significant decline in the fourth quarter. So, we think the pound should drop another 300–400 points. Every day, however, there are fewer and fewer reasons to expect a new, powerful upward movement.

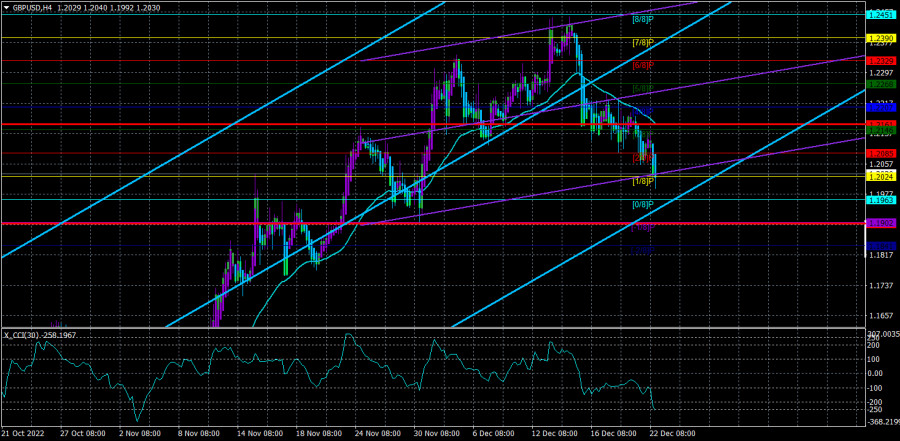

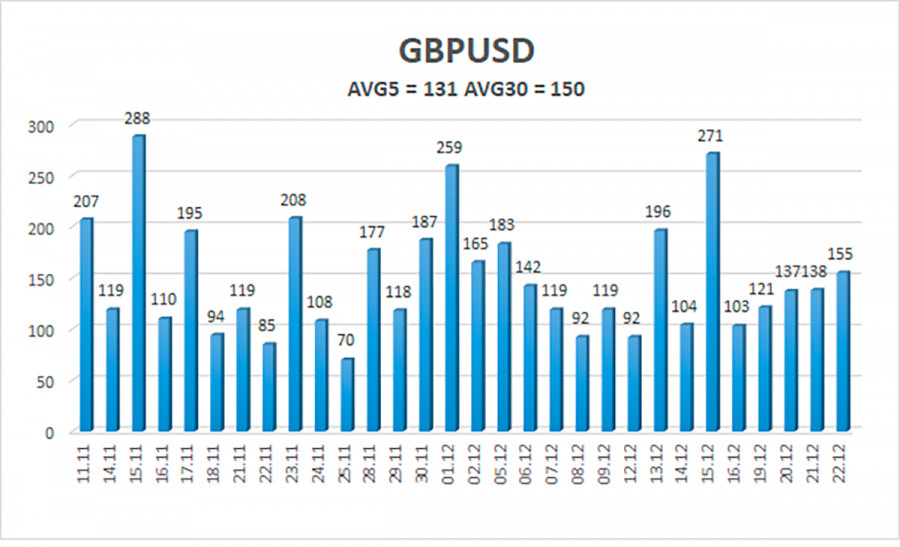

Over the previous five trading days, the GBP/USD pair has averaged 131 points of volatility. This value is "high" for the dollar/pound exchange rate. As a result, on Friday, December 23, we anticipate channel movement that is constrained by levels of 1.1899 and 1.2161. A round of upward correction will begin if the Heiken Ashi indicator reverses direction upward.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair is still trending downward. Therefore, until the Heiken Ashi indicator appears, you should maintain sell orders with targets of 1.1963 and 1.1899. When the moving average is fixed above, buy orders should be placed with targets of 1.2207 and 1.2268.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they are both moving in the same direction.

The short-term trend and the direction in which to trade right now are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.