On Wednesday, the GBP/USD currency pair nearly made up all of its losses from Tuesday. It is likewise impossible to pinpoint what caused the British currency to increase yesterday, just as it was difficult to pinpoint what caused the American currency to increase the day before. However, if the strengthening of the dollar makes sense technically, then the rise of the British pound makes no sense whatsoever. Remember that in 2023, the British economy will be the main source of worry for specialists. Taxes have grown, inflation in the UK is still quite high, monetary policy tightening has slowed down, and a recession that could last two years is unavoidable. In the United States, the economy is doing considerably better. There may not be a recession; inflation has been dropping for nearly six months, and rates will cease climbing in the next few months. We think that these variables by themselves will be more than enough for the US dollar to recover from its 2000-point decline against the pound over the previous three months.

The past six years have seen enough other issues for Britain. Potential risk factors for the British pound include an ongoing political crisis with frequent changes to the state apparatus, an unclear and unprofitable trade agreement with the EU, the British government's inability to capitalize on Brexit, and the potential separation of Scotland from the United Kingdom. Therefore, we anticipate that the pound will continue to drop over the next few months. Of course, it could expand during a single or two-day period, but in general, we anticipate a greater reduction. A consolidation like this should hardly be regarded as a "trend change," since the pair is currently only a few points above the moving average line. The pair may already have returned to the region below the moving average today.

The Fed's protocols could be characterized as "hawkish."

We stated in the post from yesterday that the market rarely reacts to the Fed's minutes. This is because the information they contain rarely surprises or is new to the market. That's how last night was. None of the 19 members of the monetary committee, who voted in favor of a rate increase in December, anticipates a rate drop in 2023. The majority of experts predicted there would be no "soft landing" of the American economy after the publication of the protocol since the Federal Reserve is still taking a "hawkish" stance. The US economy can, however, land as smoothly as possible, in our opinion. Both the first and second indices are now staying stable, despite worries about the labor market and unemployment. Alarm bells will need to go off when non-farm payrolls fall below 200,000 per month and unemployment rises above 4%. However, it should be noted that 4% is still a very small amount, even in this instance. For instance, it is anticipated that the unemployment rate in the UK will increase to 5.5–6% when it is already very high in the European Union. It will take another 3–4 months for the Fed to boost the benchmark interest rate to 5.5%.

It's currently challenging to predict what the Bank of England will do. This is because many experts ignore the monetary policy of this central bank and its governor, Andrew Bailey, does not frequently give speeches or provide economic or monetary policy forecasts. His final remarks were about the inevitable severity and duration of a recession. So, even though the Bank of England can hike rates by 0.5% for a very long time, the recession will only worsen with each further tightening. A rate increase is good for the pound, but a recession is terrible. Due to the recession, investment in the UK will decline, which will result in a decline in demand for the pound. Additionally, it's possible that the Bank of England won't raise rates "to the bitter end," which would mean that inflation might exceed the target rate of 2% for a considerable amount of time. We continue to think that the pound will drop another 400–500 points before beginning a period of consolidation and market equilibrium, during which neither the dollar nor the pound will have a clear edge.

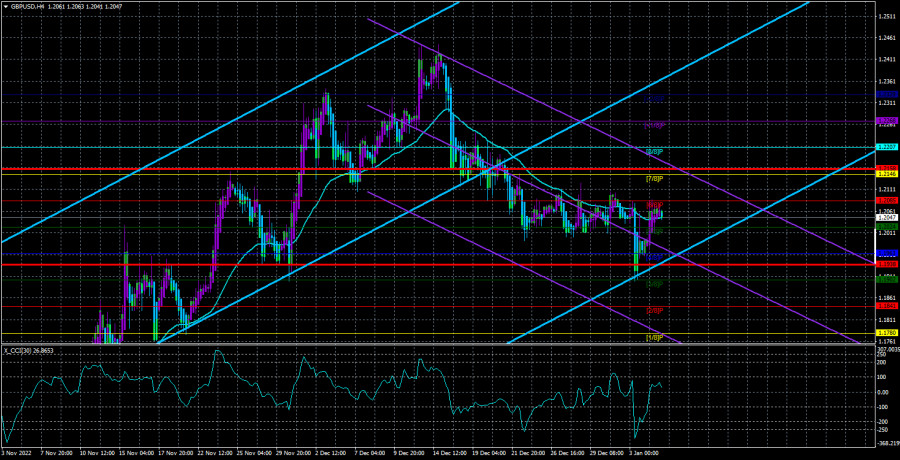

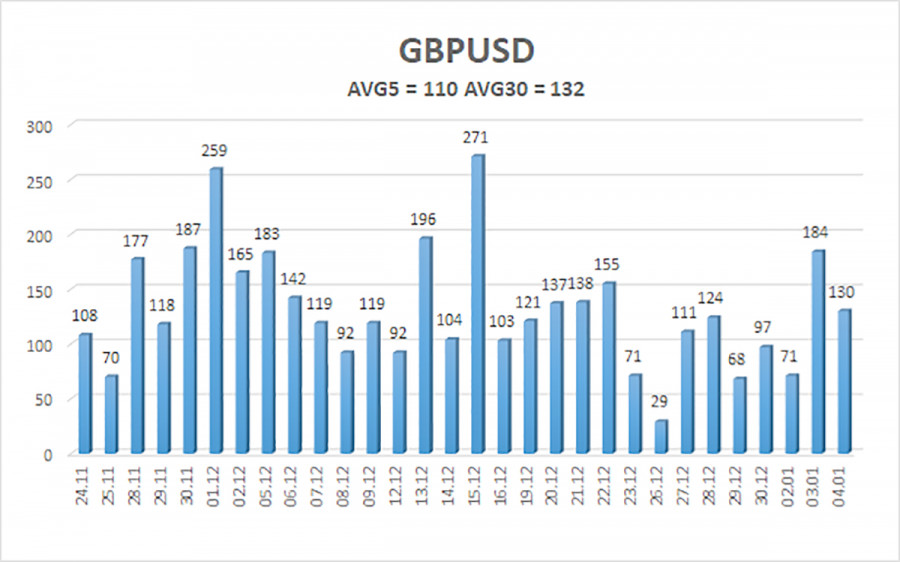

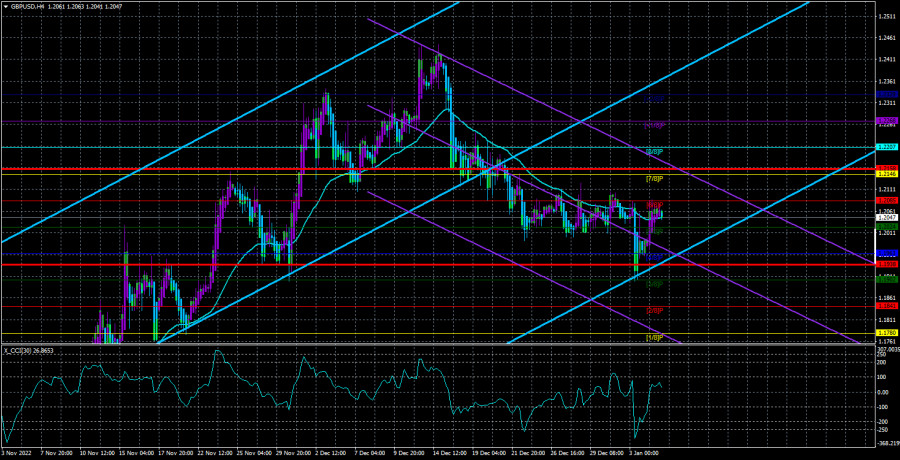

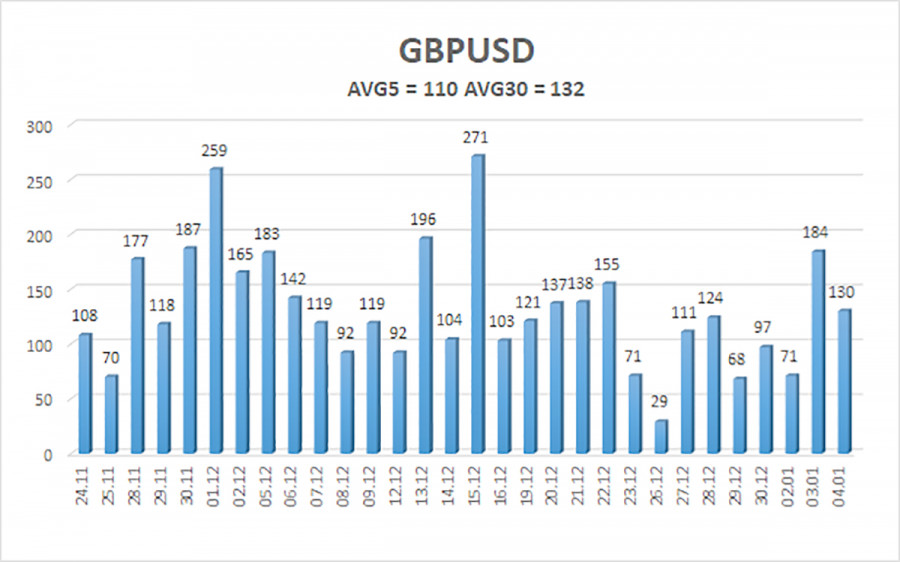

Over the previous five trading days, the GBP/USD pair has averaged 110 points of volatility. This figure is "high" for the dollar/pound exchange rate. Thus, on Thursday, January 5, we anticipate movement that is contained inside the channel and is constrained by the levels of 1.1938 and 1.2158. The Heiken Ashi indicator's downward turn indicates that the downward momentum has resumed.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair finished its sideways pattern and started back down. As a result, if the Heiken Ashi indicator reverses downward at this time, new short positions with objectives of 1.1963 and 1.1938 should be taken into consideration. Open long positions with targets of 1.2146 and 1.2158 if the price confidently consolidates above the moving average.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.