On Tuesday, the EUR/USD currency pair attempted to begin a downward correction, but it was unsuccessful. Therefore, no new inferences can be made in light of the outcomes from Tuesday. When we look at technical or fundamental issues, it becomes quite difficult to explain why the European currency is expanding once again. Remember that, in theory, any movement of any instrument on the foreign exchange market can be explained with relative ease. Another query is whether each movement should merely be explained after the fact rather than being predicted. Sadly, it is not always feasible to forecast a movement, if only because there are so many players in any market, even major ones, and they are not always motivated by the desire to benefit from a currency transaction. The euro currency may not have any specific growth drivers now, but if demand for it increases, it may still increase. Additionally, the requirement for large firms and banks to perform business activities may increase demand. In this instance, the situation looks like this: macroeconomics and the foundation at least claim that the expansion of the euro currency is unreasonable, but it is still increasing. We have been observing this exact image for a month.

From the perspective of macroeconomics and the "foundation," yesterday was essentially empty. Only Jerome Powell's speech was scheduled, but new language or theses from the president of the Fed are necessary for a response to such an event to occur. What is there to react to if Mr. Powell simply reiterates what traders have known for a long time? The Fed's monetary policy intentions are now public knowledge and include no secrets, so it makes no sense to expect a language change. Recent articles on macroeconomics cannot be characterized as resonant; rather, they were framed by expectations and forecasts. We continue to think that nonfarm payrolls and unemployment should have caused the dollar to appreciate rather than sink, and this week may mark the sixth week of falling inflation. Powell, therefore, has no incentive to alter his rhetoric at this time.

The QT program is still in use.

Recently, everyone has forgotten that the Federal Reserve uses additional measures to combat excessive inflation in addition to raising the key rate. Since around six months ago, the QT program, which is a reduction in the Fed's balance sheet, has been in effect. In other words, the regulator removes additional money from the economy, which contributed to previously high inflation, by selling government and mortgage bonds that it had actively purchased as part of the QE program. As a result, the decrease in inflation is not just a result of the key rate rising. The Federal Reserve's balance sheet was around $8.5 trillion as of December, having decreased by $350 billion. Using the M1 money supply indicator, we can see that it is currently 19.9 trillion dollars and has dropped by roughly 1 trillion over the past six months. As you can see, this method is likewise quite effective, although the M1 money supply was 4.8 trillion dollars before the epidemic. It has thus multiplied four times. There shouldn't be any more doubts about why inflation has risen at this point.

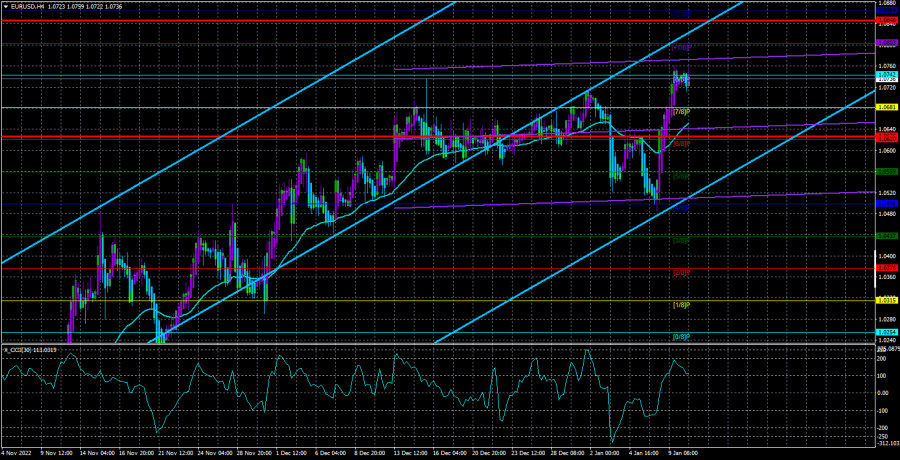

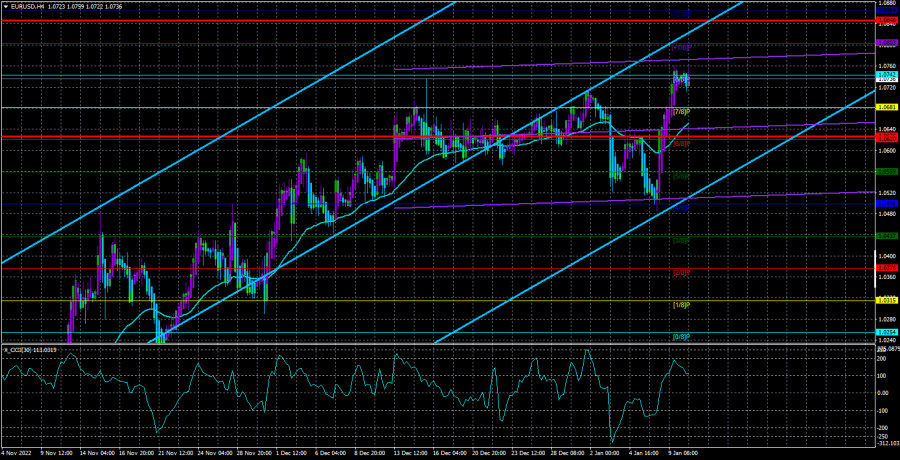

Consequently, the first conclusion is that the QT program should be in place for a very long time because rates are high but the Fed won't keep them that way indefinitely. For a new acceleration of the economy, which can result in a new acceleration of the consumer price index, the rate of inflation must be lowered when it returns to 2%. Therefore, the Fed will attempt to maintain this value only with the aid of the QT program after inflation recovers to 2%. This is a favorable development for the dollar, but the ECB has also begun to cut its balance sheet at this time, and the market isn't exactly keen to purchase US dollars. Therefore, in the near future, a greater emphasis should be placed on technical analysis, but keep in mind that there aren't many fundamental grounds for the euro to increase in value. The Murray level of "8/8" can temporarily halt the expansion of the euro, but for it to decline, there must at least be consolidation below the moving average.

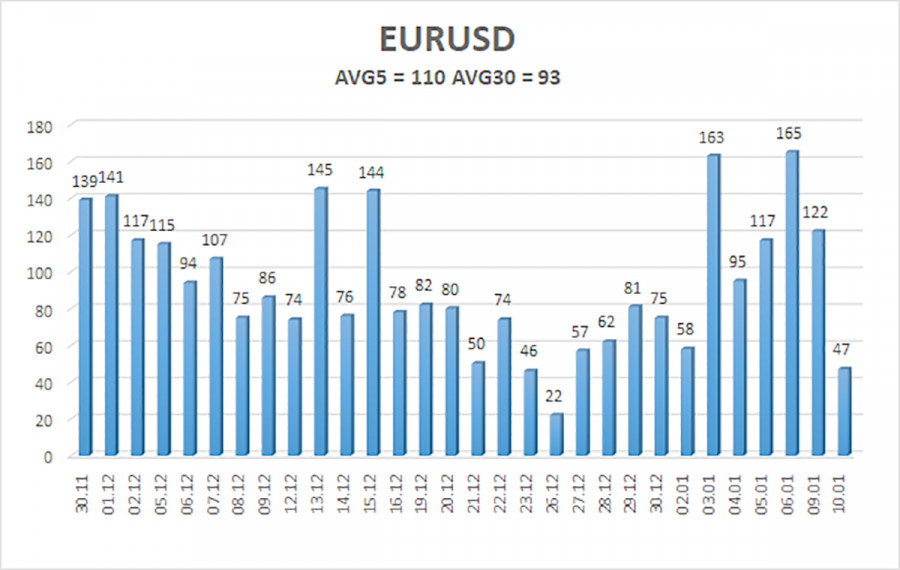

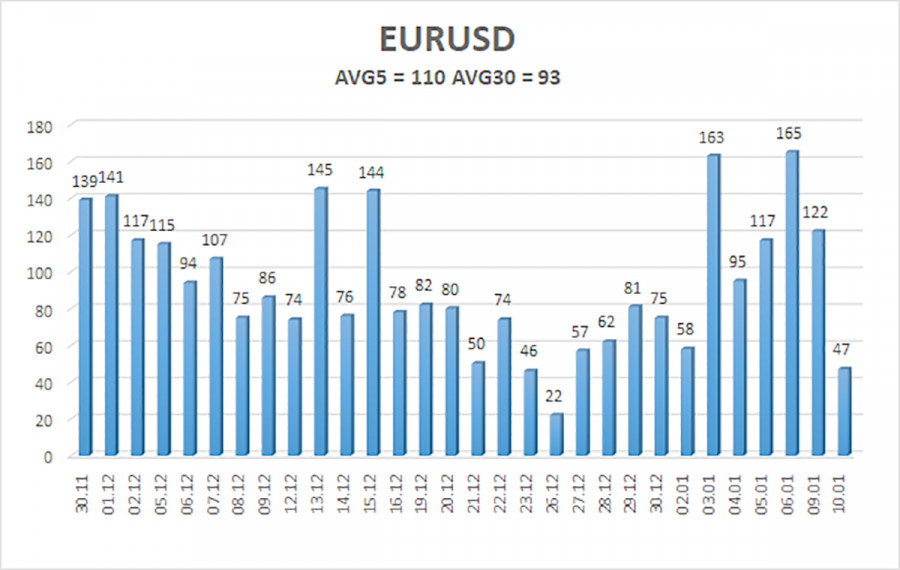

As of January 11, the euro/dollar currency pair's five most recent trading days had an average volatility of 110 points, which is considered "high." So, on Wednesday, we anticipate the pair to fluctuate between 1.0626 and 1.0846. A bout of corrective movement will begin when the Heiken Ashi indicator reverses to the downside.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Suggestions:

The EUR/USD pair is attempting to maintain its ascent. You can continue to hold long positions at this time with a target price of 1.0864 until the Heiken Ashi signal turns down. After fixing the price below the moving average and setting a target price of 1.0498, you may start opening short positions.

Explanations for the illustrations:

Channels for linear regression allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.