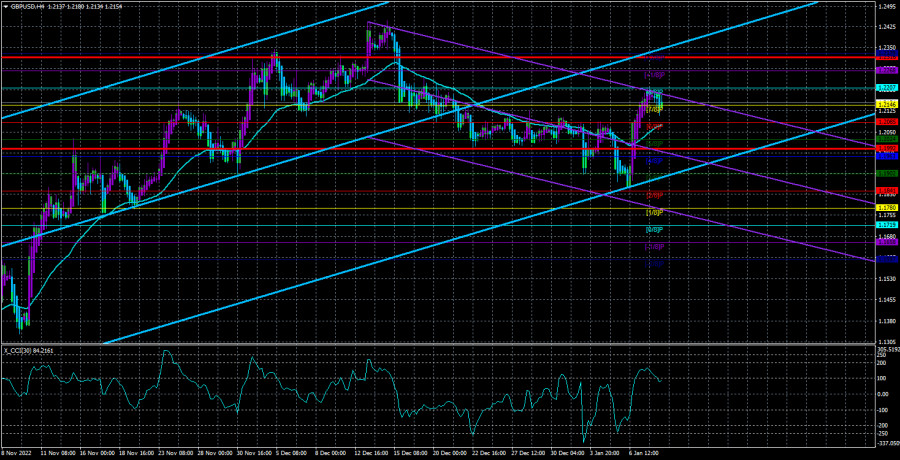

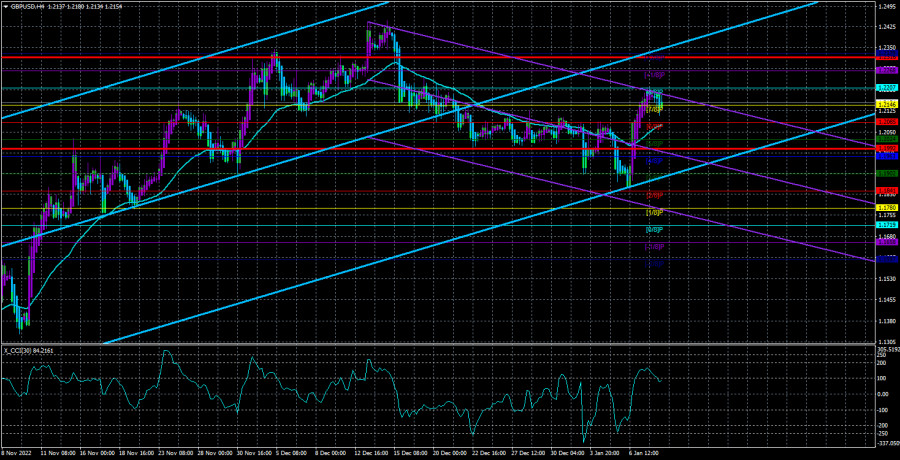

Although the GBP/USD currency pair started to fluctuate on Tuesday, it is now above the moving average line. As a result, the increasing tendency is still present at this time. We have emphasized numerous times that we are anticipating the devaluation of the pound and the euro. Since there has been a noticeable decline in recent weeks, if the pound sterling exceeds our expectations by at least 50% to 60%, the euro does not at all justify them. But the pound sterling is the subject of this article. Therefore, no significant macroeconomic data were released on Monday or Tuesday. It's perhaps even a good thing that there are no publications these days, especially in light of how the market reacted to numbers from abroad on Friday. We think that relatively positive statistics on the labor market and unemployment have caused an irrational decline in the value of the dollar. But that is the past. The pound is still declining, therefore, expect a new consolidation below the moving average line.

In the UK, you may only reserve Friday this week. Reports on the GDP and industrial production will be made public on this day. Since there isn't much logic in the current price swings and market participants are more interested in data from the USA than the UK, we won't lie: we don't anticipate a major response from traders to this data. To put it another way, everything in Britain is consistently bad. The pound sterling has lost 1.5 times its value since British citizens narrowly decided that leaving the EU was a good idea. The country is still experiencing political unrest, and the Conservative Party, led by Boris Johnson and Liz Truss, may already lose its majority in Parliament at the next elections. And Rishi Sunak, who was brought in as the economy's savior, has thus far made decisions that could force him into early retirement. Although Mr. Sunak has not yet drawn direct criticism, he simultaneously increased taxes, which has already sparked a protest among medical professionals.

The UK is once again experiencing the coronavirus.

A medical staff uprising during a recent "coronavirus" outbreak. If you recall, we said a few weeks ago that, as long as the COVID outbreak in China remains limited to China alone, it won't have a particularly negative impact on the world economy. But despite unofficial reports that the cost of treating people who contracted the "coronavirus" illness was already in the hundreds of millions, we were honestly shocked that hardly any nation in the world had cut off communication with China. The outcome was very apparent and unmistakable: cases of a new strain of Omicron have already been reported in 29 different nations, and on certain flights leaving China, nearly half of the passengers were sick. It is not unexpected that the number of cases of the disease is increasing globally.

On this particular occasion, an emergency meeting in the UK with Rishi Sunak as the chairperson was planned. The British medical system experiences an increase in flu and other seasonal viral infections every winter due to the country's relatively chilly climate. They now include the "coronavirus," a disease that spreads rapidly among people. As a result, there are too many patients for ambulances to transport, and many people have to wait for hours or even days for doctors to arrive. In addition, medical professionals decided to strike at the same time due to the lack of pay rises and the rapidly declining value of the pound as a result of high inflation and tax increases. Of course, nurses are exempt from the tax hike because they are unlikely to make 125 thousand pounds a year, but generally speaking, the financial situation of many medical professionals is getting worse, and their care is crucial to the country's health. According to the administration, salary increases are impossible because they can lead to further increases in inflation, which still hasn't subsided despite eight increases in the key rate and consequently slows down economic growth. The British economy, meanwhile, has entered a recession that might last for at least two years.

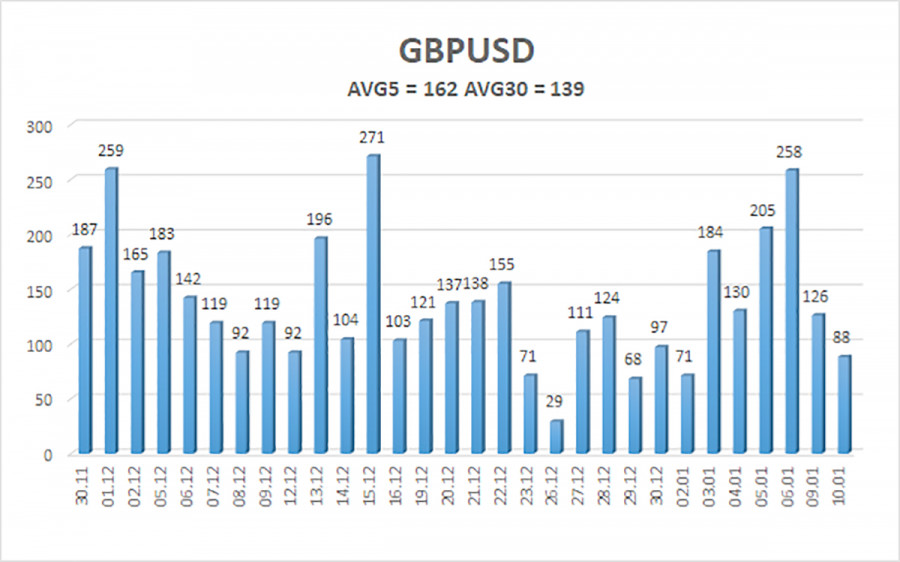

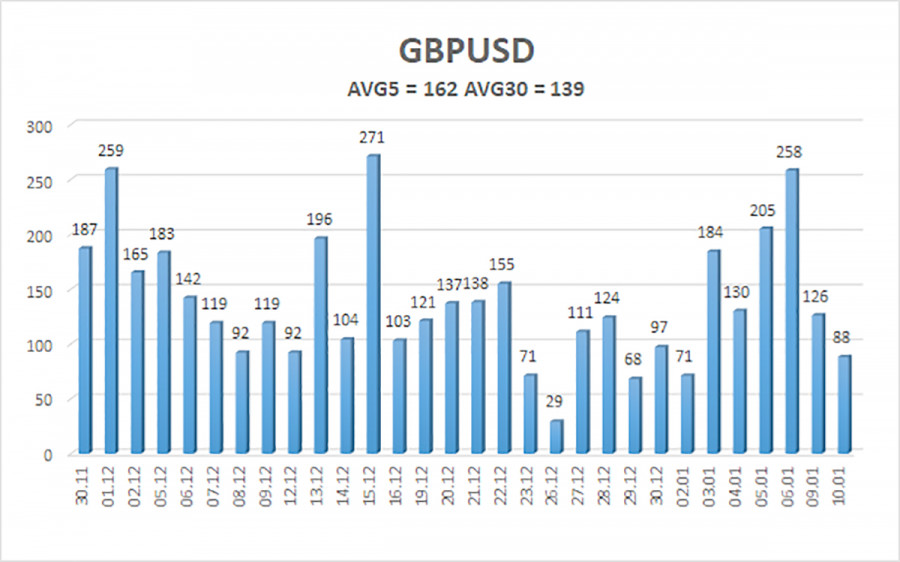

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 162 points. This figure is "high" for the dollar/pound exchange rate. As a result, on Wednesday, January 11, we anticipate movement that is constrained by the levels of 1.1992 and 1.2316. A potential continuation of the upward rise will be indicated by the Heiken Ashi indication turning back to the top.

Nearest levels of support

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest levels of resistance

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading Suggestions:

On a 4-hour timeframe, the GBP/USD pair is attempting to begin a new upward trend. Therefore, in the event of an upward reversal of the Heiken Ashi indicator, we can currently contemplate new long positions with goals of 1.2268 and 1.2351. If the price is firmly locked below the moving average, you can start short positions with 1.1992 and 1.1902 as your targets.

Explanations for the illustrations:

Channels for linear regression allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.