This week, the EUR/USD currency pair could swing quite a bit or perhaps remain still. Let's take a dispassionate look at the calendar's numbers. The most significant meetings are, of course, those between the Fed and the ECB. However, the European regulator is almost certain to increase the key rate by 0.5%, and it is unlikely that Christine Lagarde will mention during a press conference that she is willing to limit the rate growth pace to the barest minimum. It is challenging to anticipate anything negative from the Fed at this time. Ninety-eight percent of market players are confident that the rate will rise by 0.25%. If by some miracle, someone has not had time to figure out these answers, then you are welcome to the market. Experts write about this virtually every day. Both meetings promise to be as "walk-through" as possible, assuming I'm not exaggerating. No, even Powell's speech is not scheduled in the United States, although the response to it may still be extremely emotional.

As a result, both encounters have the potential to cause the pair to move in either direction, after which everything will return to its proper place. For the market to decline or continue on an upward trajectory, some very important components are now required. For the European currency to continue rising simply and freely, it has been increasing too much and for too long. It has become abundantly obvious in recent weeks that the price is already rising more slowly than it is trending. The ability of the market to decline despite weak fundamentals is what I find most intriguing. It might easily come to a point where the majority of its members determine that it is not necessary to make any more purchases. Sadly, it is hard to foresee such an occasion. We have been arguing for more than a month that given the totality of the circumstances, the pair should fall rather than rise. What kind of decline can we discuss, though, if the majority of traders keep increasing their long positions without justification?

What may we anticipate from the ECB in the next few months?

The ECB has already let us know what will be discussed at the upcoming two meetings. The rate will increase three more times by 0.5% each, then once more by 0.25%, according to market participants. As a result, a rate increase of 1.25 percent is all but assured. Another question is whether, if the hike has been known about for a while, the market has already priced it in. The subject of inflation is the most intriguing one, as the key indicator has been falling for the past two months and is most likely to continue falling this week. However, the fundamental measure, which disregards the cost of food and energy, keeps rising. How, therefore, can the regulator accurately determine inflation? What inferences can be made regarding whether inflation is rising or falling?

We think that this out-of-the-ordinary behavior of inflation, which is undoubtedly brought on by sudden increases in the price of oil and gas, could serve as justification for a prolonged ECB rate hike. Although it is now obvious to everyone that the 3.75% rate is unlikely to be sufficient to bring inflation down to 2%. It's uncertain whether the rate increase in the United States, which will bring it to at least 5.25%, will be sufficient. As a result, if we solely consider inflation, the rate needs to be increased further. The ECB is unlikely to continue its most aggressive monetary policy, nevertheless. The regulator will most likely start acting on the situation and hike the rate irregularly by 0.25% after two sessions. It should be kept in mind that if the cost of "blue fuel" and "black gold" does not increase once more, inflation may continue to decrease. But it is challenging to predict how traders will act going forward given the situation with the European currency. Even with all the potential tightening, we think this element has already been fully accounted for. However, the price has thus far been unable to settle even below the moving average line. Consequently, we can discuss a decrease without mentioning a single sell indication.

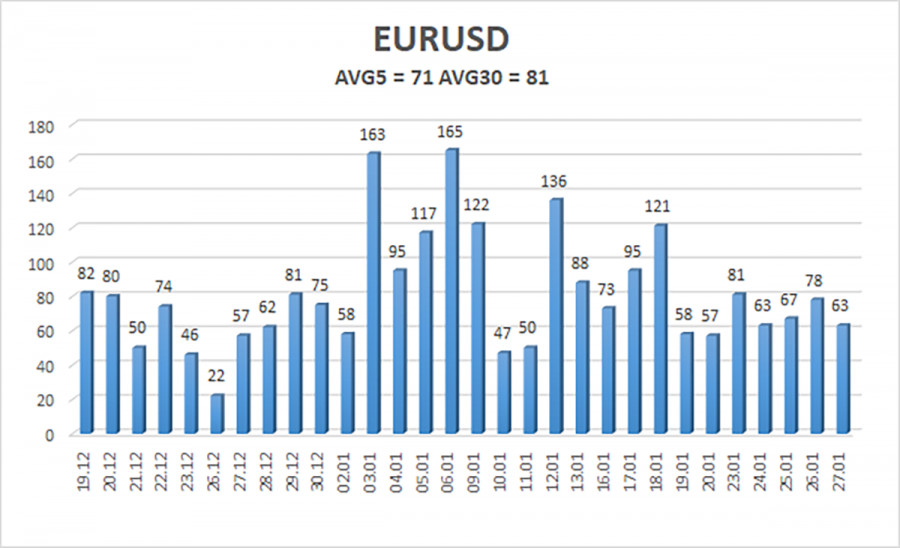

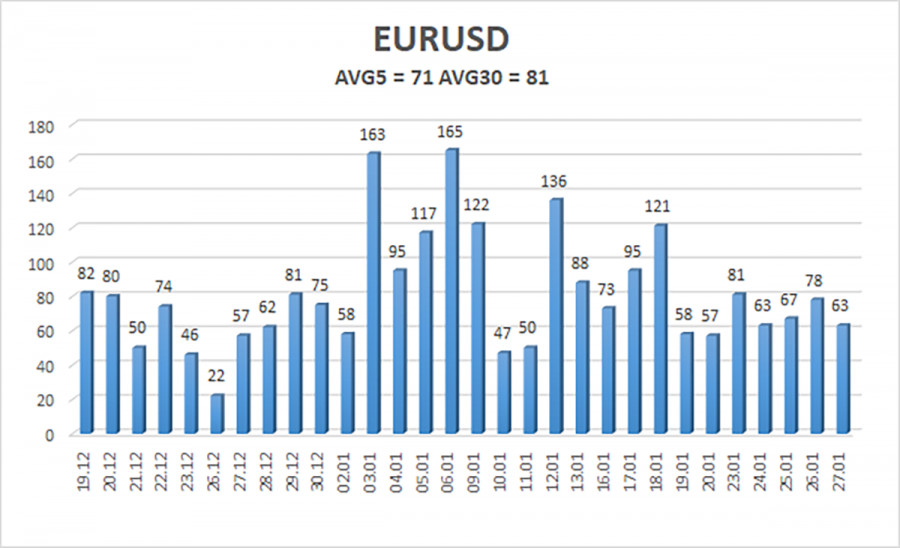

As of January 30, the euro/dollar currency pair's average volatility over the previous five trading days was 71 points, which is considered "normal." So, on Monday, we anticipate the pair to fluctuate between 1.0797 and 1.0939. The Heiken Ashi indicator's upward turn will signal a potential continuation of the upward momentum.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

Trading Advice:

The EUR/USD pair is still moving upward. In the case of a price recovery from the moving average or when the Heiken Ashi indicator reverses higher at this time, long positions with targets of 1.0939 and 1.0986 might be taken into consideration. With goals of 1.0797 and 1.0742, short positions can be opened after the price is locked beneath the moving average line.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.