GBP/USD rose sharply on Thursday after Huw Pill, the Chief Economist of the Bank of England, and Andrew Bailey, BoE's Governor, made a statement for the UK Treasury Committee. We will talk about this later and now let's analyze the technical setup. So, the pound advanced and settled above the moving average. It is not yet clear how long it will stay there but this is a definite change in the trend. In fact, such events often provoke movements that the market later regrets. When this happens, traders make decisions spontaneously, on emotions, and a little later the pair returns to its initial levels. This is exactly what happened on Tuesday when Jerome Powell spoke. For your record, the Fed Chair did not say anything unexpected. Still, USD fell by 100 pips and rose by the same 100 pips within an hour. Something similar could happen to the pound sterling. However, to develop a new downtrend, the price needs to hold below the moving average.

As with the euro, the market is currently a little confused by a mixed fundamental background. The future of the rates remains an open question both in the UK and the US. The approximate targets are clear and set. Yet, representatives of the BoE and the Fed repeatedly hint that everything will depend on macroeconomic indicators. In other words, both the British regulator and the US regulator want to bring inflation down to 2% at any cost, but the weak state of the economy or the labor market may force them to abandon their aggressive policy. The same is true about inflation. At the moment, inflation is decreasing at a fast pace in the US and at a very slow pace in the UK. It may seem that the Fed no longer needs to raise the rate, and the BoE, on the contrary, needs to lift rates at the maximum pace. But in practice, everything can be different, because you need to take into account other macroeconomic indicators.

GBP's surge looks ungrounded

Huw Pill and Andrew Bailey made several important announcements on Thursday. Here are some of them. "We see signs of a weakening in the labor market, perhaps not in rising unemployment, but in a reduction in hours and vacancies." "We are keen to see more evidence of a sustained slowdown in inflation." "There is a huge gap between wage growth in the public and private sectors." "Inflation will fall rapidly, which should be taken into account in wage requirements." "We are ready for further tightening of monetary policy." "There is a risk of an excessive rate hike as there is a time lag between the hike and the macroeconomic response."

We believe that there were two key statements. First, the statement about the risk of an excessive rate increase, which makes it clear that the BoE will not act aggressively. Secondly, a statement on salary requirements, taking into account the fall in inflation in 2023. Earlier, Bailey and other BoE representatives complained that wages in the country were growing too quickly, which further accelerates prices. At the same time, the low-paid UK workers threatened to go on strike if they were not given a raise. We see a clear conflict of interest. On the one hand, we can understand average citizens who have never seen inflation above 10% in their lives. The Bank of England, on the other hand, is trying to subdue rising inflation and, naturally, it is not satisfied with the strong growth in wages. Therefore, the statement about the requirements can be interpreted as "Do not raise wages so that inflation falls," and not vice versa. We think that the UK regulator finds itself in a difficult place when it becomes more and more difficult to raise the rate. The British economy is on the edge of a serious fall and may tip into recession sooner or later. Thus, we can say that the message delivered by Pill and Bailey was dovish. It is rather difficult to say why GBP went up on the news. I won't be surprised if it falls today. We still believe that the correction is not completed and we expect a new corrective cycle.

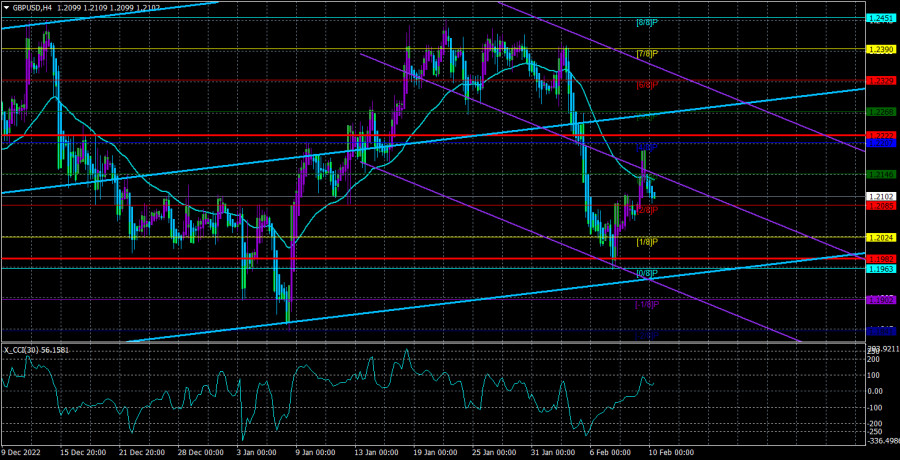

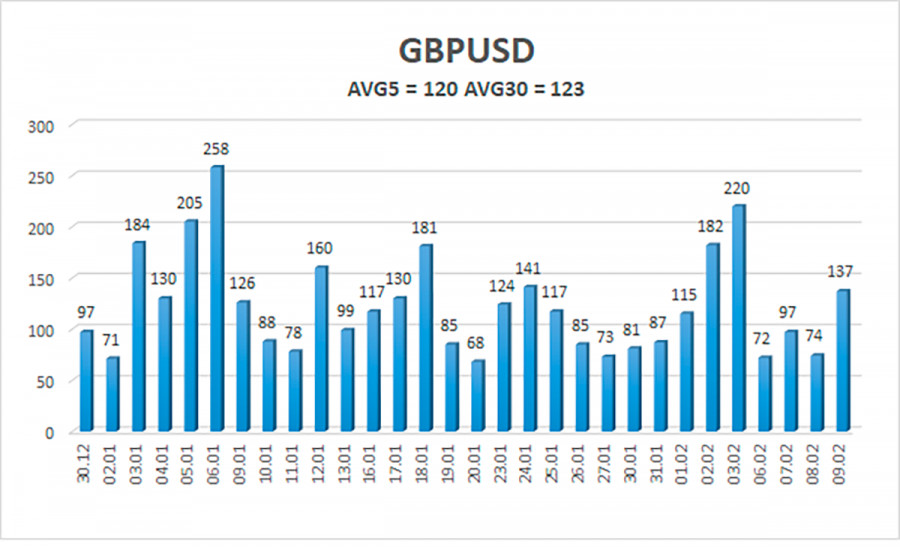

The average volatility of the GBP/USD pair over the last five trading days was 120 pips which is rather high for this asset. On Friday, February 10, we expect the instrument to move within a channel between 1.1982 and 1.2222. The upside reversal of the Heiken Ashi indicator will signal a possible resumption of the upward movement.

Nearest support:

S1-1.2085

S2-1.2024

S3-1.1963

Nearest resistance:

R1 - 1.2146

R2 - 1.2207

R3 - 1.2268

Trading recommendations:

GBP/USD is trying to resume the downtrend on the 4-hour time frame. Therefore, you can stay in short positions with the targets at 1.2024 and 1.1982 until the Heiken Ashi indicator turns upwards. You can go long if the price settles above the moving average line with the targets at 1.2207 and 1.2268.

What's on the chart:

Linear regression channels help to determine the current trend. If both are pointing in the same direction, then the trend is strong.

A moving average (20.0, smoothed) determines the short-term trend and the direction in which you should now trade.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are possible price channels where the pair will spend the next day, based on current volatility indicators.

If the CCI indicator enters the oversold area (below -250) or the overbought area (above +250), this means an upcoming trend reversal.