The EUR/USD currency pair continued its sluggish decline on Tuesday, which has been going on for three days. However, look at the illustration above, a 4-hour timeframe illustration. Based on it, can you say that the euro has been falling for three days? It's because the decline is too weak. Yes, the pair has once again consolidated below the moving average line, but how often have we seen such breakthroughs in recent months? In every case, without exception, the decline was not continued. Currently, the chances of starting the long-awaited fall of the pair are higher, as the price still needs to overcome the 1.1065 level three times. Three rebounds from it and a systematic weakening of the upward movement. The euro currency has long been due for a decline, but what can you do if the market still interprets almost all fundamental and macroeconomic events in favor of the euro? On Monday, the ISM business activity report in the US was finally processed logically. On Tuesday – weak data on German retail sales. However, the inflation report that caused the pair's fall can be interpreted differently, and we will try to figure it out below.

In the meantime, it should be noted that there are still few technical sell signals. However, the pair is heavily overbought, and we last saw normal corrections two months ago. Factors in favor of the growth of the euro currency have been absent for a long time. Even if we assume that the market has been actively working on the future ECB rate hike for the last eight weeks, this factor has also been neutralized. Expecting the euro's growth to continue is increasingly difficult, no matter where you look. Thus, we expect the pair to fall at least to the 1.0500 level, or approximately 500 points. Central banks are nearing the end of monetary policy tightening, and the market, as a rule, takes into account all known rate hikes in advance.

Inflation in the EU increased in April.

The inflation report for April turned out to be quite bland. Despite the seemingly resonant growth of the indicator, the market expected such a development of events. Recall that official forecasts ranged between 6.9% and 7.0%. In the end, we saw a figure of 7.0%. An acceleration of inflation by 0.1% is not critical. And it certainly will not affect the ECB's decision on Thursday. Simply because there is nothing to affect here. If inflation had accelerated to 7.5%, the chances of tightening by 0.5% would have sharply increased. If inflation had shown a record slowdown for the second month, we would not see more than +0.25% in the rate. Most experts tend to increase by 0.25% but admit a "surprise" from the ECB. Thus, nothing became clear after the release of the inflation report.

Core inflation has also decreased for the first time in almost a year. It amounted to 5.6% in April, showing a result of 5.7% a month earlier. This indicator has begun to decline, which cannot but please the representatives of the ECB's Monetary Committee. The decline in core inflation will play a decisive role on Thursday. Since the indicator has slowed down, the risks in favor of increasing by 0.5% have become smaller. And the probability of raising it by 0.5% was initially less than 50%. Thus, the EU inflation report slightly lowered the chances of implementing the most "hawkish" scenario. We believe the market has already worked out an "advance" rate increase of 0.25%, so we may see a drop in the euro currency on Thursday. Unless Christine Lagarde makes loud statements about a stronger tightening of policy in the future at the press conference. No matter how you look at it, finding new reasons for the growth of the European currency takes a lot of work. However, we remind you that the market only looks at purchases. We will not be surprised if the upward trend also recovers this time.

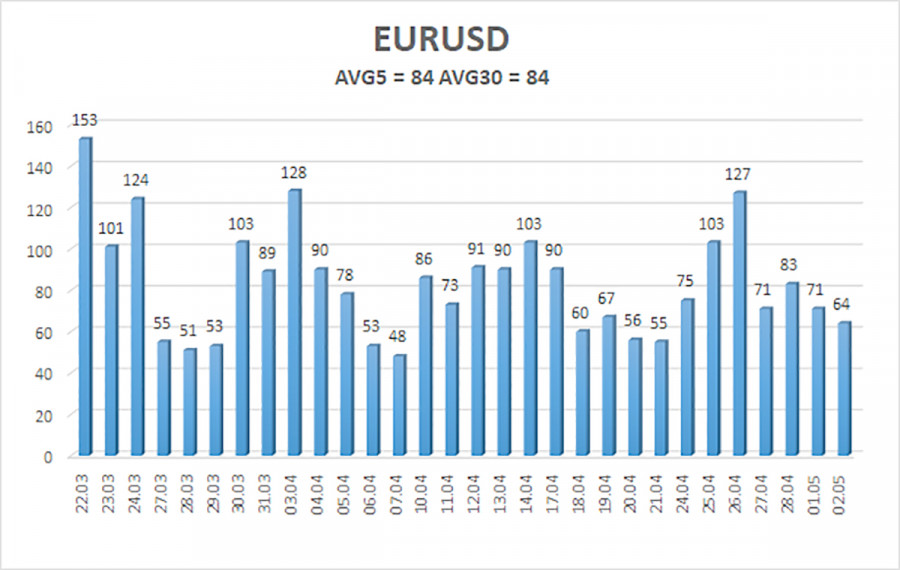

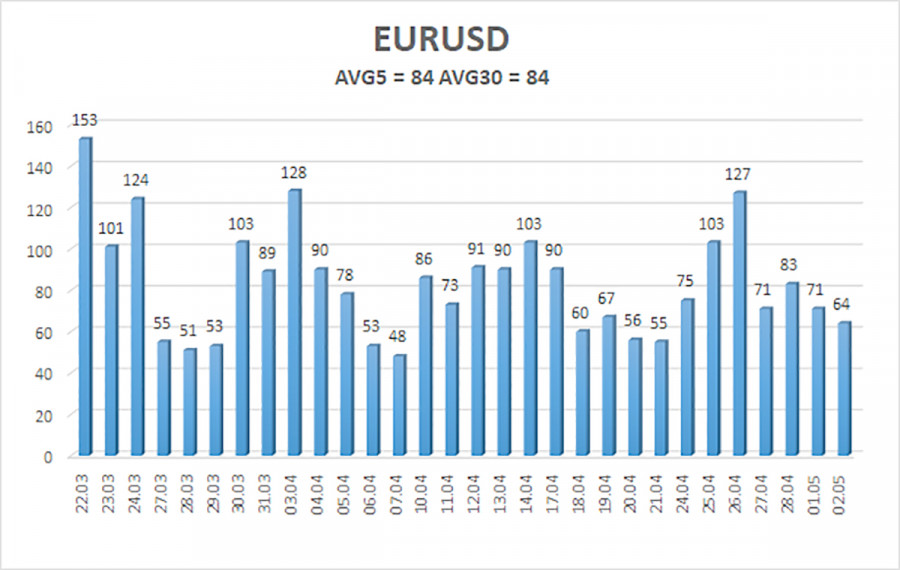

The average volatility of the euro/dollar currency pair for the last five trading days as of May 3 is 84 points and is characterized as "medium." Thus, we expect the pair to move between levels 1.0914 and 1.1082 on Wednesday. The reversal of the Heiken Ashi indicator back up will indicate a possible resumption of the movement to the north.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is trying to correct this again. Currently, the movement is more horizontal, so trading can be done only based on the reversals of the Heiken Ashi indicator. Or on the youngest timeframes, where at least intraday trends can be captured.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term tendency and direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means a trend reversal in the opposite direction is approaching.