The GBP/USD currency pair continued its upward movement on Friday and throughout the past week, and we have already begun to lose hope of seeing a logical movement. In the EUR/USD article, we noted that many experts explain the current decline in the US currency with the imminent end of the Fed's monetary policy tightening cycle, clearly forgetting that other factors in the market should affect exchange rate formation. If they don't, it means the market is now trading by its own rules, and it doesn't matter when the Fed finishes raising its rate. The Bank of England may also end tightening in May, which will be known this week, but the pound is growing regardless.

Therefore, we continue to stick to our opinion – the pound sterling is growing groundlessly, showing movement in the bitcoin style. Nothing can be done about it now, and you need to clearly understand that everything will fall into place sooner or later. The pound cannot grow forever without specific reasons. The Bank of England's meeting results will be known this Thursday. Markets believe in a new monetary policy tightening of 0.25%, which will most likely be the case. But the pound is growing, so the market is already making this BoE decision. Even the European currency traded almost sideways last week, and the British pound, which had even less news and less support, appreciated. Remember that the ECB raised the rate by 0.25% and clarified that tightening would continue. Therefore, it should have been the euro, not the pound, that grew last week!

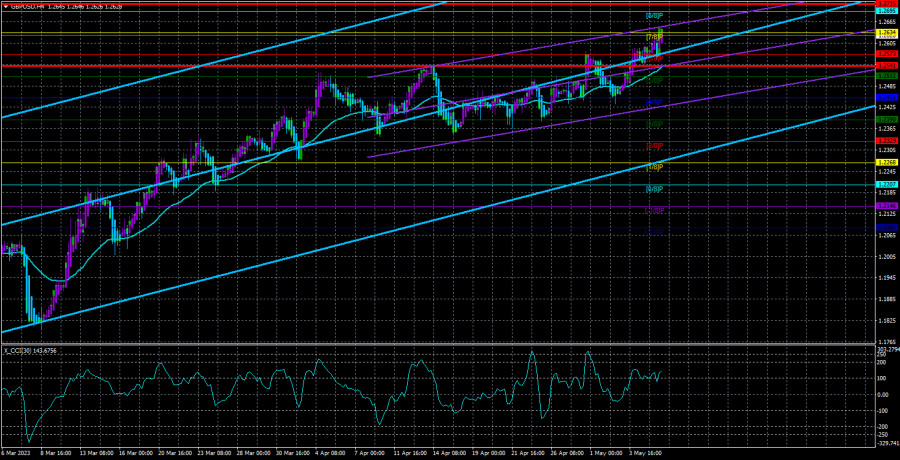

This week, the CCI indicator may enter the overbought area for the third time, drawing several new divergences. But what's the use of them if they don't affect anything? They only warn us that it's time for the pound to stop, but the market, not the indicators, decides. Therefore, growth will continue as long as the market buys the pound. Normally, the market buys or sells based on the fundamental background. Now it's just doing it for no reason.

A single report.

In the preview articles for the current week, we bypassed the events planned in the US. It's time to analyze them, as they are the most important for traders. Although it's not exactly the case now because market participants interpret any report or event favoring the pound or euro, it's still worth considering. The most important report of the week is, of course, the inflation report. According to forecasts, the indicator in April should slow down to 4.9% or remain at 5% y/y. Core inflation is also expected to remain unchanged or slow down by 0.1%. Now that the Fed has almost completed its tightening cycle, it's almost irrelevant how much inflation will fall or whether it will fall at all. If it doesn't, the Fed will not change its rhetoric to a tougher one. It will not start raising rates again. There are set limits – a rate from 5.25% to 5.75%. The US regulator will stick to these limits. Therefore, inflation can only cause a local reaction, as can all the events and reports of the past week, of which there were many.

All other reports are secondary. Unemployment benefit claims, consumer sentiment index, producer price index — all these publications can provoke a movement of 40 points at best. Our volatility is not the highest, and the movements are illogical. In general, the technical picture for the new week is likely to stay the same. The pound may continue to crawl upward, regularly retreating to minimal values, spoiling and confusing everything. As before, it is better to trade now on the youngest timeframes.

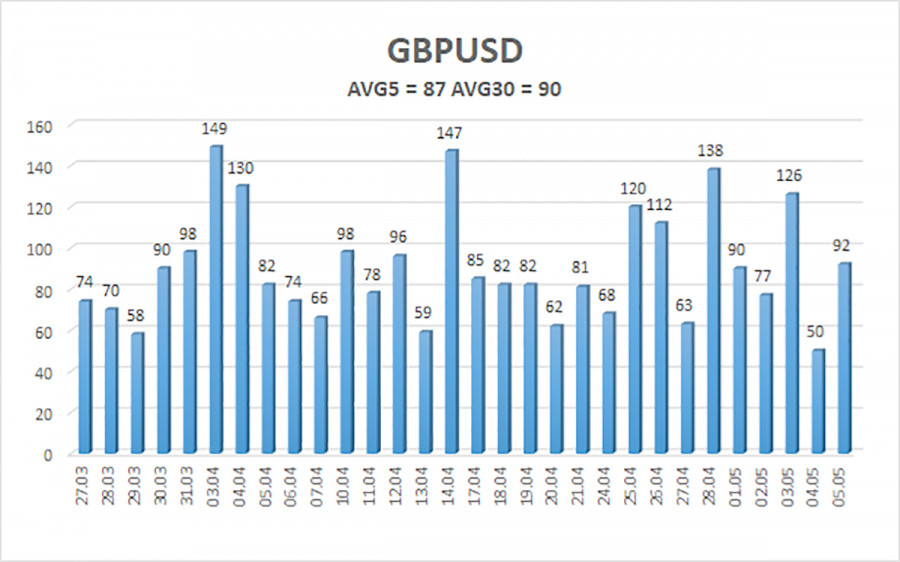

The average GBP/USD pair volatility for the last five trading days is 87 points. For the pound/dollar pair, this value is "average." On Monday, May 8, we thus expect movement within the channel limited by levels 1.2541 and 1.2715. A reversal of the Heiken Ashi indicator downwards will signal a downward rollback.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trade recommendations:

The GBP/USD pair in the 4-hour timeframe continues its upward movement. Sideways movement may resume, but now you can trade upwards with targets 1.2695 and 1.2715 until the Heiken Ashi indicator reverses downwards. Short positions can be considered after overcoming the moving average, but as practice shows, such signals do not lead to a pound's fall.

Explanations of illustrations:

Linear regression channels – help determine the current trend. If both are directed in one direction, the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murrey levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) means a trend reversal in the opposite direction is approaching.