The past week has been significant for the medium-term prospects of Bitcoin and stock assets. The Federal Reserve raised the key interest rate to 5.25%, and stock indices showed positive performance. At the same time, several more U.S. regional banks were on the verge of bankruptcy, which strengthened interest in BTC.

Despite this, the asset continues to consolidate within the range of $27k–$29.9k. This has been influenced by several factors, such as the overall decline in trading activity and local overheating of the BTC network. Additionally, several fundamental economic factors have affected investments in Bitcoin.

Strong labor market and stable stock market

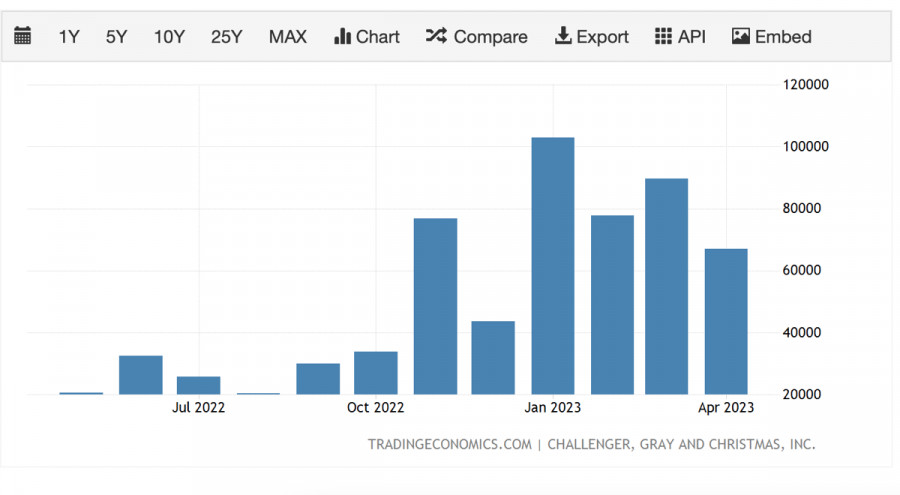

Last week, in addition to the Fed's decision to raise the key interest rate, other important economic data emerged. The U.S. labor market remains strong, and unemployment continues to decline. With expectations at 3.6%, the actual unemployment rate was 3.4%, the number of unemployed decreased by 182,000 to 5.657 million, and the employment level increased by 139,000 to 161.031 million.

This is an important signal for the Fed, as a strong labor market gives the regulator more opportunities to raise the key interest rate. Considering this factor, investors have reduced their investment appetites for BTC. If the inflation rate turns out to be higher than expected, the likelihood of an interest rate hike will sharply increase.

Moreover, attempts by well-known publications to convince investors of the stock market's weakness have failed. Contrary to market expectations for one of the S&P 500's weakest reporting periods, the figures are encouraging and point to rising sales. As a result, SPX recovered above $4,100, which also weakened interest in BTC.

Amid a relatively positive week for the U.S. economy, companies are seriously concerned about the onset of a technical default. The premium for insuring U.S. government bonds against default for 1 year has risen to 152 basis points. This is a record level in history, reflecting financial market anxiety.

Bullish BTC market gains momentum

Bitcoin continues to attract new investors due to the fundamentally positive sentiment, which indicates the early stage of a bull market. However, positive economic performance last week reduced investor interest in BTC and forced them to turn to more traditional assets.

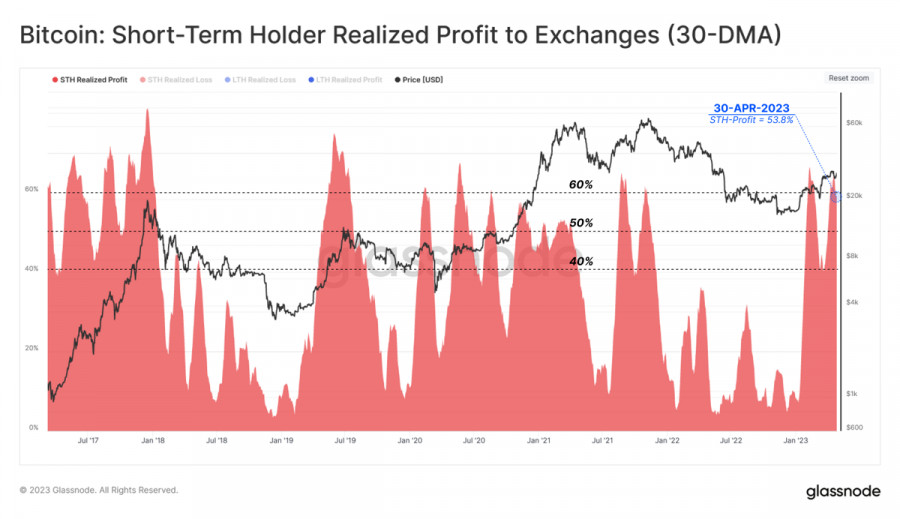

This triggered a local decline in the BTC price to the $28k level. The process of reducing BTC quotes took place against the backdrop of profit-taking by short-term investors. Glassnode analysts note that the number of transactions in the cryptocurrency network last week reached a historical high of 682,000 transfers.

Also, the fact that 77% of the total BTC supply was in profit last week indicates that investors are taking profits. This also speaks to the gradual completion of the Bitcoin coin redistribution period and the beginning of the cryptocurrency's upward movement.

BTC/USD analysis

Amid profit-taking and the overall decline in trading activity, Bitcoin dropped to the $28.1k level, where the local support zone is located. Gradually, another "wedge" figure is forming on the daily cryptocurrency chart, which can lead to an increase in volatility and impulsive price movement.

As of 08:00 UTC, the asset appears bearish on the 1D timeframe due to high selling pressure. The main technical indices indicate further decline and full realization of the bearish impulse. The situation may change with the opening of the American markets or with a price drop below the $28k level.

Over the past seven days, buyers have defended the $27.5k mark, so it can be assumed that the situation will repeat this time. However, the growing bearish pressure is undeniable, and this may trigger a downward breakthrough of the $27k level, as liquidity below $26k has not been collected.

Conclusions

Bitcoin remains a strong asset that is within the framework of forming a long-term upward trend. However, in the short term, we will observe a gradual compression of the price and an increase in volatility. In the coming days, BTC will be in a consolidation phase with a high probability of retesting the lower border of the $27k–$29.9k channel.