5M chart of EUR/USD

The EUR/USD pair showed only one thing during the first trading day of the week - it refuses to move. In fact, such behavior of the pair and the market is absolutely logical, as no important events or reports were planned for Monday, and the pair's volatility began to fall a few weeks ago. Thus, we only witnessed what was supposed to happen. There was actually one report - Germany's industrial production data for March. But even in the conditions of a "thin" market, there was still no reaction, although the report's value was much worse than forecasts. Or the reaction was such that it is impossible to distinguish it on the charts.

As a result of Monday, the euro remained very high and again failed to show a normal correction. Nothing changes. If there is a fundamental background, the euro grows. If there is no fundamental background, nothing happens or the euro grows.

There was only one trading signal during the US trading session. However, by that time it became absolutely clear that there would be no movements, so there was no point in working it out. It's a good thing that there was only one signal, as the pair spent most of the day in a flat, which was fraught with false signals. Ichimoku indicator lines are very weak when facing a flat, so the signals around them are also weak.

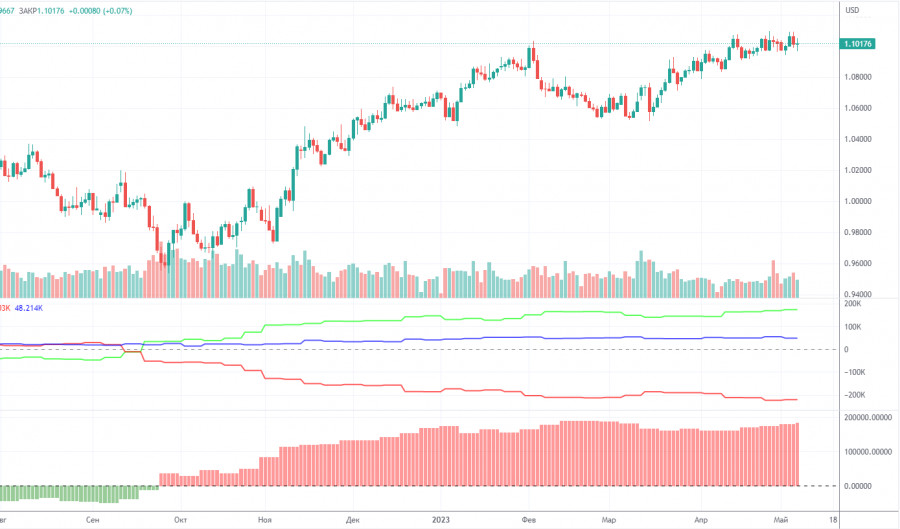

COT report:

On Friday, a new COT report was released for May 2. In the past 8-9 months, the COT report data has been completely in line with market developments. The illustration above clearly shows that the net position of large market players (second indicator) began to grow in September 2022. Around the same time, the European currency also began to appreciate. Currently, the net position of the non-commercial group of traders remains bullish and so does the position of the European currency, which is hesitating to develop a proper downward correction.

We have previously drawn your attention to the fact that a relatively high net position value suggests a possible end of the uptrend. This is signaled by the first indicator where the red and green lines have moved significantly away from each other, which often precedes the end of a trend. The European currency attempted to start a decline, but we only saw a simple pullback. During the last reporting week, the number of Buy contracts in the non-commercial group of traders increased by 3,300, while the number of Sell contracts decreased by 700. Accordingly, the net position grew again by 4,000 contracts. The number of BUY contracts is higher than the number of SELL contracts among non-commercial traders by 174,000, which is very significant. The difference is almost threefold. A correction is still overdue, so even without COT reports, it is clear that the pair should start falling. However, we still only see an upward movement.

1H chart of EUR/USD

On the 1-hour chart, the pair continues to exhibit strange and incomprehensible movement. Last week, the fundamental and macroeconomic background was very strong, and there was some good news for the US dollar. However, the US currency did not appreciate, the ascending trend line was broken for the second time, and the price continued to move in a sideways channel, staying near its upper limit. The euro is still trading too high. It is overbought and unable to start a correction.

On Tuesday, important levels are seen at 1.0762, 1.0806, 1.0868, 1.0943, 1.1092, 1.1137-1.1185, 1.1234, 1.1274, as well as Senkou Span B (1.1007) and Kijun-sen (1.1017) lines. Ichimoku indicator lines can move intraday, which should be taken into account when determining trading signals. There are also support and resistance although no signals are made near these levels. They could be made when the price either breaks or rebounds from these extreme levels. Do not forget to place Stop Loss at the breakeven point when the price goes by 15 pips in the right direction. In case of a false breakout, it could save you from possible losses.

On May 9, no important events or reports are planned in the European Union and the United States. No minor events either. Therefore, most likely, the pair will remain within the vague sideways channel. Volatility may also remain low.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.