5M chart of GBP/USD

On Tuesday, the GBP/USD pair also also tried to correct downward even just a bit, but nothing came of it. If the EUR/USD pair was at least within a sideways channel, which is at least a little bit consistent with the fundamental and macroeconomic background (although very weakly), the pound is still rising, and even falling by 100 pips would be quite a difficult task. The uptrend persists, and the next ascending trend line supports the bulls. Perhaps traders are waiting for Thursday and the Bank of England meeting, but for now, no other conclusions can be drawn except that the pound continues to rise for no reason.

Speaking of trading signals, there was only one on Tuesday. The Kijun-sen line gradually increased and crossed 1.2576, so this value was plotted on the chart. The rebound from the critical line along with the level of 1.2589 should be considered as a buy signal and you should have opened long positions. By the end of the day, the price went up about 20 points, which traders could get by closing the deal manually. The pound continues to maintain an ultra-high position and it is still completely unclear what could make it correct even just a bit. Today, the pair may continue to grow if inflation in the United States slows down more than forecasted.

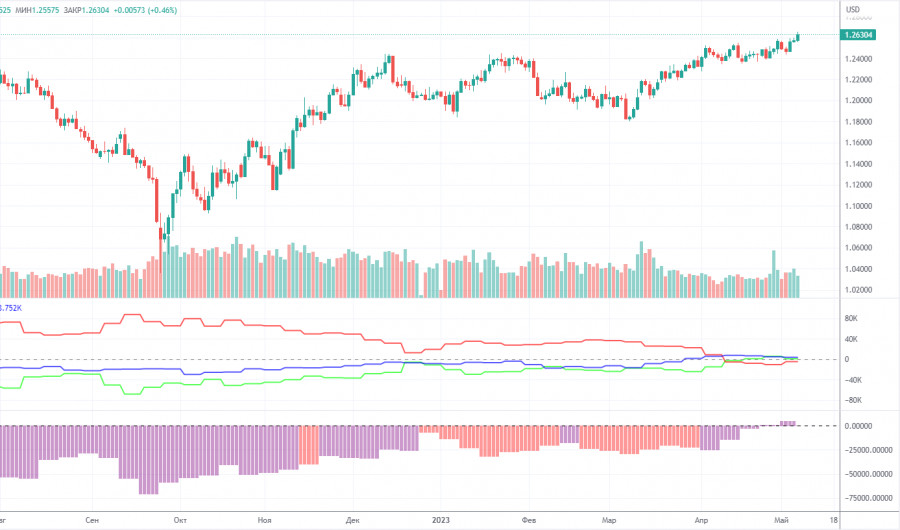

COT report:

According to the latest report on the British pound, the non-commercial group of traders closed 700 BUY contracts and opened 4,000 SELL contracts. Thus, the net position of the non-commercial group of traders decreased by 4,700 but in general, it continues to grow. The net position has been steadily rising for the past 8-9 months, but the sentiment of major market players remained bearish during this time. It has turned slightly bullish just recently. Although the British pound is strengthening against the US dollar in the medium term, it is hard to explain this behavior from the fundamental point of view. There is still the possibility of a sharp decline in the pound.

Both major pairs are moving in a similar way now, but the net position of the euro is positive and even implies the imminent completion of the upward momentum, while the net position of the pound still suggests further growth. The British currency has already risen by more than 2,200 pips, which is a lot, and without a strong downward correction, the continuation of growth would be absolutely illogical. The non-commercial group of traders currently has a total of 58,600 sell contracts and 57,600 buy contracts. I remain skeptical about the long-term growth of the British currency and expect it to decline soon but the market sentiment remains largely bullish.

1H chart of GBP/USD

On the 1-hour chart, GBP/USD continues its upward movement and is staying above the Ichimoku indicator lines. Thus, besides the fact that the pair is overbought, there are also no sell signals. And when they do appear, traders refuse to execute them. Therefore, the pair continues to rise without any justification.

For May 10, we highlight the following important levels: 1.2349, 1.2429-1.2458, 1.2520, 1.2589, 1.2659, 1.2762. Senkou Span B (1.2517) and Kijun-sen (1.2607) lines can also generate signals. Rebounds and breakouts from these lines can also serve as trading signals. It is better to set the Stop Loss at breakeven as soon as the price moves by 20 pips in the right direction. The lines of the Ichimoku indicator can change their position throughout the day which is worth keeping in mind when looking for trading signals. On the chart, you can also see support and resistance levels where you can take profit.

On Wednesay, there are no important publications planned in the UK. On the other hand, the US will release its inflation report, which is always very important. The dollar has to rely only on a weak slowdown in inflation or even a slight increase. But the market will decide, not the report. In practice, the pair can still rise regardless of the report's content.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.