The GBP/USD currency pair spent Thursday and Friday in a downtrend. During these days, the American currency strengthened quite significantly, even though there were no macroeconomic or fundamental reasons for this. The decline in both major currency pairs began after the US inflation report was published on Thursday, but the report itself was not sensational. Moreover, inflation indicators no longer have such an impact on the movement of any currency pair, as all three central banks (which we review) have almost reached their peak interest rates. The ECB, with a high degree of probability, has already finished tightening, and the Fed and the Bank of England can raise the rate at most once. Therefore, it is no longer particularly important whether inflation is rising or falling. The regulators have done practically everything they could.

In light of these events and the movements of the past week, we believe that the upward correction may not be completed. The drop below the moving average is a signal for selling or changing the local trend, but there are also situations when the market is in a "storm." We believe that there is a high probability of reestablishing above the moving average this week; the upward correction has been too weak, and the dollar's rise at the end of last week seems unfounded. Moreover, there are few significant events this week in any case.

The most important events this week could be the report on British inflation and Jerome Powell's speech. However, even this data may turn out to be very dull and unremarkable. Therefore, the current week may pass with purely technical movements.

Did Mr. Bailey hint at a new interest rate hike? The Bank of England remains a "wild card" for the market. It seems that everything is clear. However, at the last meeting, the rate was not increased, but the regulator is unlikely to abruptly end the tightening cycle. Moreover, inflation remains very high. Therefore, we believe that it is quite possible to count on another rate hike. On Saturday, Mr. Bailey, the head of the Bank of England, made some statements at the Institute of International Finance event. In particular, he said that the Bank of England's actions would remain tough. However, at the same time, he hinted that it was more about keeping rates at the highest possible level for a long time than new hikes. "The last stage of reducing inflation to 2% will be the most difficult," Mr. Bailey complained.

In general, it would be nice to call Mr. Bailey's rhetoric "hawkish," but no. The fact that the rate will have to be kept at its maximum value for a long time with inflation at 6.7% does not require any comments. This is obvious. However, the Fed will also keep its rate at a peak, so it's a clash. As a result, the fundamental background is not particularly important right now. The dollar can continue to rise simply because it fell for a long time. For the British pound, as there were no reasons for a strong rise 3 months ago or 6 months ago, there are still none.

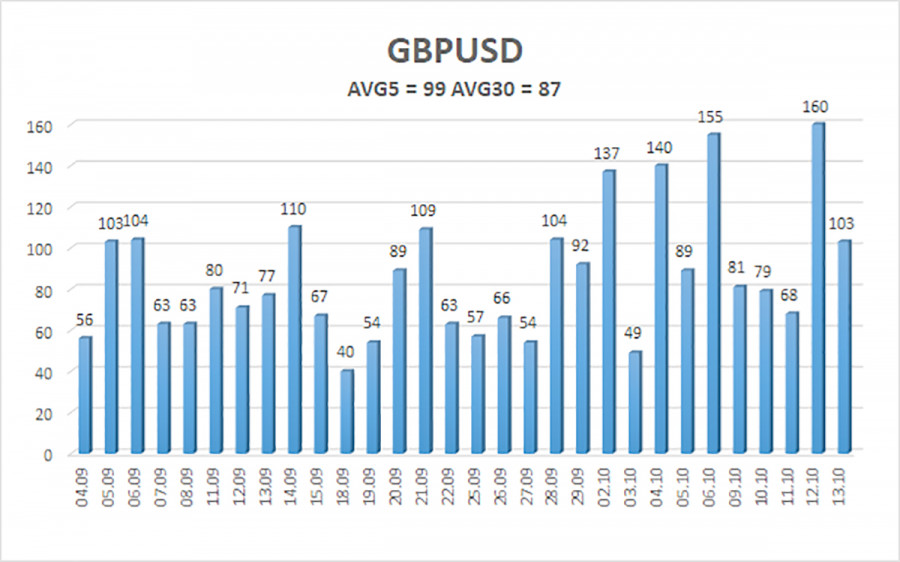

The average volatility of the GBP/USD pair over the last 5 trading days is 99 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, October 16, we expect movement within the range of 1.2039 and 1.2237. A reversal of the Heiken Ashi indicator upward will signal a possible resumption of the uptrend.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading recommendations:

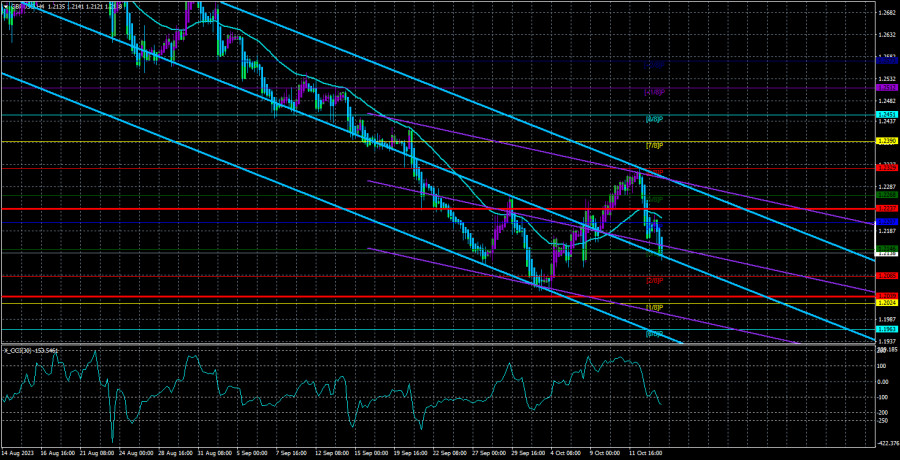

In the 4-hour timeframe, the GBP/USD pair unexpectedly fell below the moving average. Therefore, it's possible to continue holding short positions with targets at 1.2085 and 1.2039 until the Heiken Ashi indicator reverses upwards. In the event that the price consolidates above the moving average, long positions with targets at 1.2329 and 1.2390 will become relevant again. We support the second scenario.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

Murrey levels are target levels for movements and corrections.

Volatility levels (red lines) represent the likely price channel within which the pair will move over the next few days, based on current volatility indicators.

The CCI indicator, crossing into the oversold area (below -250) or overbought area (above +250), signals an impending trend reversal in the opposite direction.