The GBP/USD currency pair also traded on Friday, seemingly reluctantly, with volatility not being zero but still relatively low. The price remains below the moving average line, so the short-term downward trend persists. Nevertheless, we have a persistent feeling that the upward correction is not yet complete. First, the pair is declining, as if doing a favor. Second, the initial leg of the upward correction was too weak compared to the preceding drop. Therefore, we advocate for a new rise in the British pound. It may reach the range of 1.2330–1.2450. Such a correction should be enough to resume the downtrend, which we are not currently doubting.

Unfortunately, the pound received too much weak economic data from the United Kingdom last week to consider any rise. This is why the European currency is gradually moving upward, albeit with difficulty, while the pound leans more towards a decline. Central bank meetings are starting this week, with the ECB's meeting coming first, which has a somewhat indirect impact on the pound and the dollar. However, next week, the Bank of England and the Federal Reserve will hold their meetings, and in the event of unexpected decisions (especially from the British regulator), the British currency may receive some upward momentum. However, this is just a hypothesis.

The fact remains that the British pound is extremely weak after a year of growth, and the market is unsure on what basis to invest in the pound now. Nevertheless, we believe that the correction scenario will persist, and the pair may reach the level of 1.2330 or higher, but with each passing day, the chances of this happening decrease. Instead, the likelihood of a flat is growing, as can be seen, for example, in the hourly timeframe.

Inflation in Britain may decline in November. While the British pound tends to decline again amid weak economic statistics and the Bank of England's unsuccessful battle with inflation, the bank's governor, Andrew Bailey, continues to remain optimistic. In an interview on Friday, he stated that he expects a sharp drop in inflation next month. It is unclear which specific month he is referring to, as the report for October will only be released in December. He noted that the September data practically did not differ from the regulator's expectations, but core inflation still decreased slightly more than expected, which is a positive development.

Bailey still attributes the high inflation to the rapid wage growth. The latest report showed an increase of 8.1%, only 0.4% below the previous month's record high. Earlier, his colleague Huw Pill stated that wage growth is beginning to slow, although, from our perspective, it remains at its maximum. However, Mr. Pill may have more recent information because the last wage report was for August. Currently, inflation in the UK stands at 6.7%, significantly higher than in Europe and the United States. The Bank of England took a "wait-and-see" approach at its last meeting, and it is now uncertain whether they intend to further tighten. Considering the 5% figure, which Bank of England representatives mention much more often than 2%, that is likely the target for now. However, reaching even that level will take some time.

Bailey and his colleagues have repeatedly stated that they expect inflation to be around 5% by the end of the year. But there are only two months left until the end of the year, and it is unlikely that inflation will drop by 1.8% during this period if the Bank of England is not planning to raise the key interest rate further. All this uncertainty is putting pressure on the British pound, and strong macroeconomic data from across the ocean is also hindering any correction.

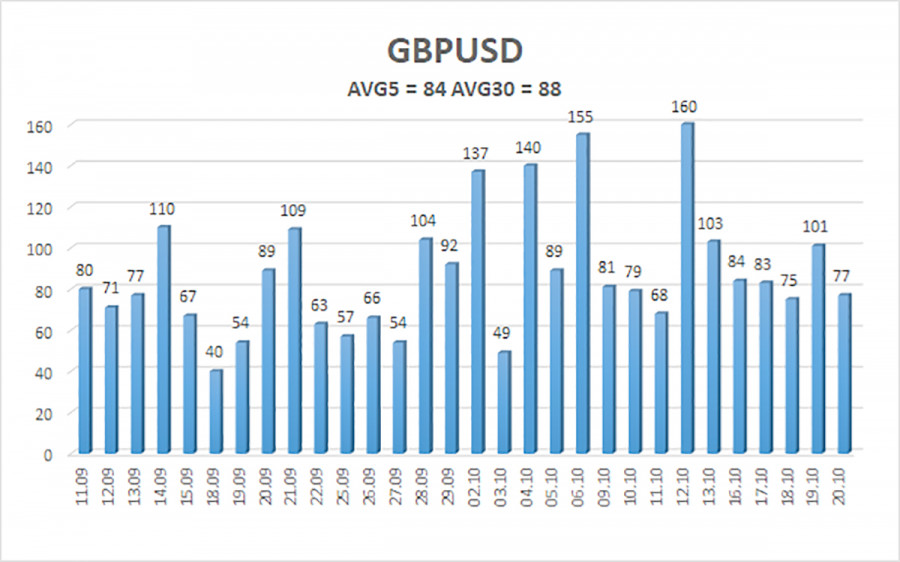

The average volatility of the GBP/USD pair over the last 5 trading days, as of October 23rd, is 84 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, October 23rd, we expect movement within the range of 1.2078 and 1.2244. A Heiken Ashi indicator reversal downward will signal a continuation of the downtrend.

Nearest support levels:

S1 – 1.2085

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair continues to stay below the moving average. Therefore, it is advisable to remain in short positions with targets at 1.2085 and 1.2078 until the price consolidates above the moving average. In the event of price consolidation above the moving average, long positions with targets at 1.2244 and 1.2268 may become relevant once again.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are pointing in the same direction, it means that the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted at the moment.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.