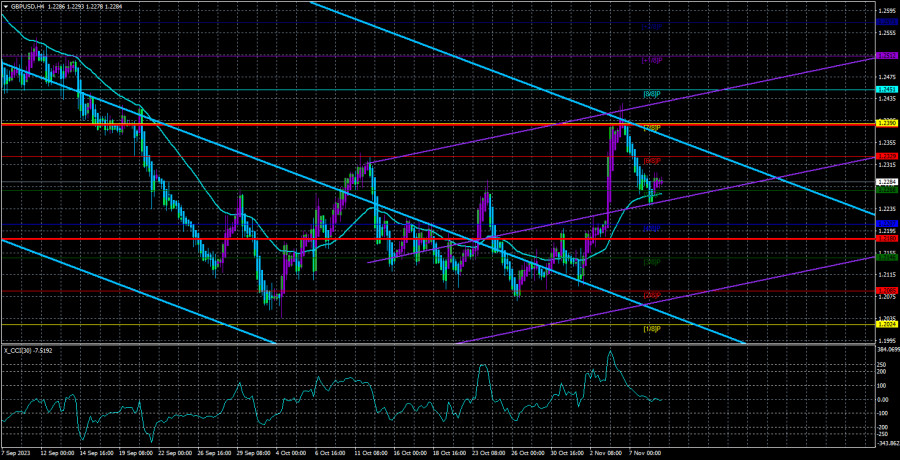

The GBP/USD currency pair also corrected towards the moving average line on Wednesday but failed to overcome it. Thus, the upward correctional trend is still intact for the British pound. However, we also expect a new decline for the pound. The correction has taken on a convincing form, and now the main decline of the pair may resume, which looks much more logical and justified than the rise of the British currency. Unfortunately, for the pound, nothing changes in the fundamental and macroeconomic plans. There are no new signals from the Bank of England that it is ready to raise the key rate again. Recall that the BoE raised the rate 14 times in a row but left it unchanged at the last two meetings. Thus, it eloquently informs the market that the tightening cycle is over.

Most likely, the Bank of England has taken the same position as the ECB. That is, in the event of a "situation with inflation," the regulator may decide on another tightening, but for now, such an option is unlikely. The situation with inflation has long been considered since it was initially much higher than in the US or the European Union. Currently, it is 6.7%, and we have serious doubts that it will slow down to 5% by the end of the year, as Andrew Bailey expects. Even if this happens, how will the Consumer Price Index fall next year? In the European Union, inflation is 2.9%, so it is realistic to talk about reducing it to 2% over the next 12–18 months. In the case of the UK, we are talking about inflation that is twice as high, and it has not even reached that level to talk about it seriously.

In the 24-hour timeframe, the GBP/USD pair entered the Ichimoku cloud and may try to continue moving upward. But all the current movement to the north is a correction, so it must end sooner or later. Moreover, rather sooner than later.

The Bank of England may start lowering the rate next year. Despite the fact that inflation and wage growth rates in the UK are off the scale, rumors are circulating that in 2024, the BoE will start lowering the key rate. The market admits that next year monetary policy may be softened by 0.3-0.5%. Of course, if we are talking about a rate cut by the end of next year, when inflation may already be at acceptable levels, then everything is fine, and there is no question for the BoE. However, the British economy may begin to react more negatively to tight monetary policy. So far, the economy has balanced on the brink of negative growth rates, but the "tale" cannot go on forever. In any case, talk of a possible rate cut against the backdrop of the increasingly tough rhetoric of Federal Reserve representatives does not add optimism to pound buyers.

Thus, even this factor is more likely to support the US dollar than the British pound. In the near future, we expect a retest of the moving average line, which should be successful. In this case, the pair will head towards its monthly lows, which are located in the range of 1.2035–1.2085. Next, it will be quite possible to expect a continuation of the decline since our trend is still downward, and two overbought indicators of the CCI hint at its preservation and resumption. Naturally, the decline will not be fast and sharp. Most likely, we will continue to observe the systematic roll-off of the pound.

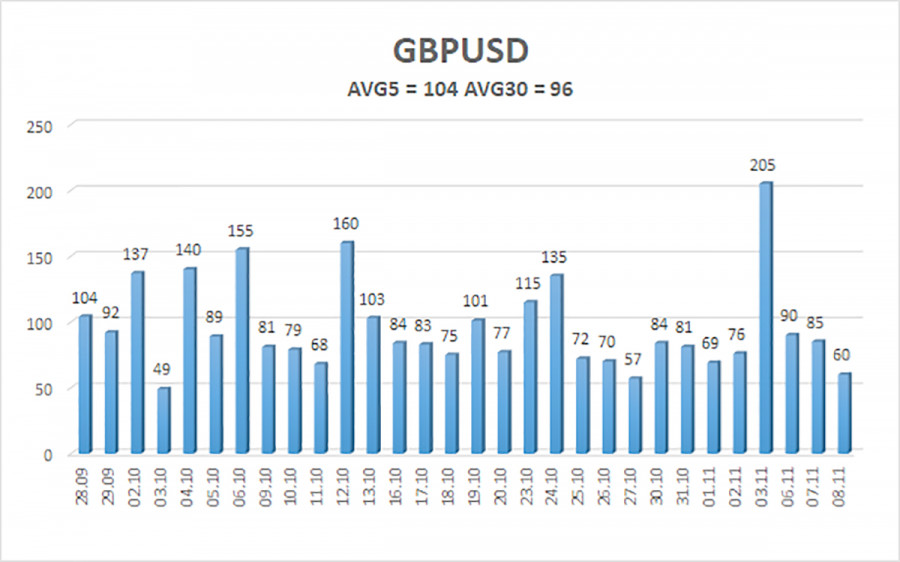

The average volatility of the GBP/USD pair for the last 5 trading days as of November 9 is 104 points. For the pound/dollar pair, this value is considered "average." As a result, on Thursday, November 9, we anticipate movement that stays within the range defined by levels 1.2180 and 1.2388. A reversal of the Heiken Ashi indicator downward signals a new attempt to resume the medium-term trend.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading recommendations:

The GBP/USD currency pair has started a new stage of the downward movement but has not yet overcome the moving average. Short positions can be considered if the price consolidates below the moving average, with targets at 1.2207 and 1.2171. Long positions will be relevant when rebounding from the moving average, with targets at 1.2329 and 1.2381, but at the moment, everything is heading towards the resumption of the downward trend.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are pointing in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal towards the opposite direction is approaching.