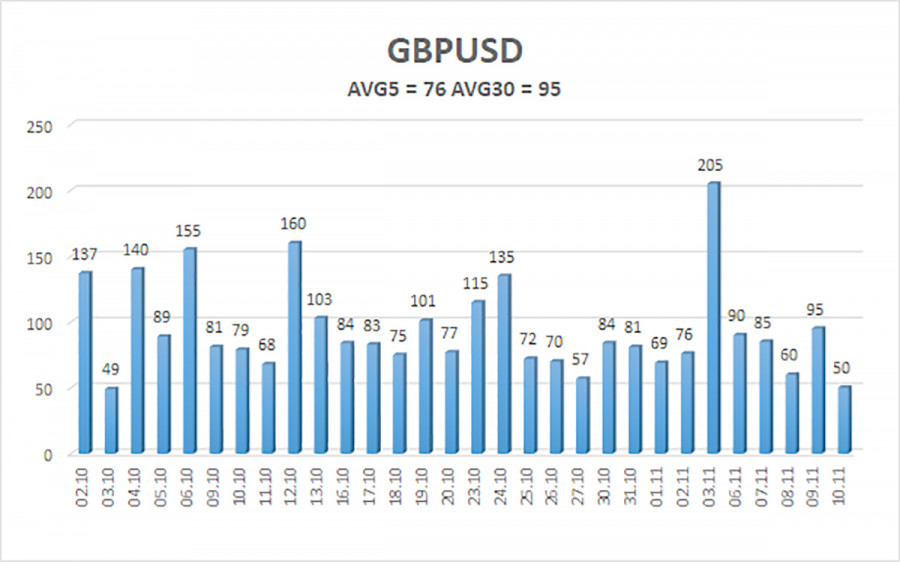

The GBP/USD currency pair was also virtually unchanged on Monday. In principle, there is nothing more to say here. Central bank interest rates still play a crucial role in the market, but they have remained unchanged recently, resulting in much slower movements. As seen in the illustration below, in about 60% of cases, the pair's volatility does not exceed 80 points. For the pound, "average" volatility is up to 110 points, and above that is considered "high." However, we haven't seen this "high" average volatility for long. The pair almost every day passes its legitimate 70-80, allowing traders to open trades. However, this is still a fairly "average" volatility value, making trading much more challenging than with 100-110 points daily.

The British pound has been on a seesaw for about a month and a half. Yes, it has managed to correct quite well during this time, so it can now resume its downward movement, the main trend. The level of 1.1844 is still the minimum target for the current trend. Remember that the forex market is not a betting game where the result of your decisions can be clear in 2 hours. Sometimes, you must wait several months for the desired level to be reached. Or, during all this time, sit and wait for the end of the flat. Forex is more complicated.

In the near future, regardless of any fundamental and macroeconomic background, we expect a decline to 1.2085. On the 24-hour TF, the price has already crawled out of the Ichimoku cloud and moved below the critical line. Strong support is difficult to expect now, either for the dollar or the pound. Therefore, the price will continue to slide down gradually. It may take another week or two to cover a distance of 150 points. Or more, as the price has long been in a limited price range.

Mary Daly: we haven't finished the tightening cycle yet

Last Friday, Federal Reserve Committee member Mary Daly spoke. It can be noted right away that there are at least ten similar speeches during the week. In most cases, the officials' statements do not differ. There is no question here: all officials have the same information, and all talk about the same economy, inflation, and rates. Therefore, Mrs. Daly's speech was not as resonant as someone might have wanted.

Nevertheless, Mrs. Daly stated that the current interest rate level is very good, and the risks of too high or too low rate hikes are balanced. However, at the same time, the current monetary policy may not be tight enough to return inflation to 2%. We got another semi-hint at possible tightening in the future, all with the same condition "if necessary." Mrs. Daly also mentioned that she understands market participants who want information about future rate changes, but the Fed is still determining what will happen. Decisions are made from meeting to meeting, considering all incoming information. "We should continue to monitor the data and intervene if necessary. No one knows whether such a need will arise," Daly believes.

As we can see, we didn't hear anything fundamentally new. Federal Reserve representatives continue to beat around the bush, but probably they have no other way. Everything now depends on inflation and other indicators. If there are serious changes, then changes in the rate are possible. If there are none, then the rate will not be raised further.

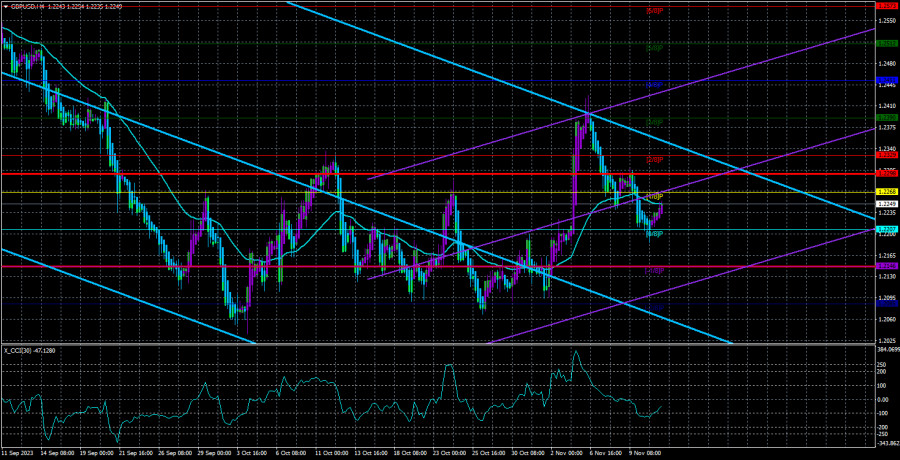

The average GBP/USD pair volatility for the last five trading days is 76 points. For the pound/dollar pair, this value is considered average. Therefore, on Monday, November 13, we expect movement within the range limited by the levels of 1.2146 and 1.2298. A reversal of the Heiken Ashi indicator upwards will indicate a small pullback before a new downward movement.

Nearest support levels:

S1 – 1.2207;

S2 – 1.2146;

S3 – 1.2085.

Nearest resistance levels:

R1 – 1.2268;

R2 – 1.2329;

R3 – 1.2390.

Trading recommendations:

The GBP/USD currency pair has started a new downward movement, which may be the beginning of a new downtrend. Short positions can be considered now, with targets at 1.2146 and 1.2085 until the Heiken Ashi indicator reverses upwards. Long positions will become relevant with a new consolidation above the moving average line with targets at 1.2329 and 1.2390. Still, at the moment, everything is heading towards resuming the downtrend.

Explanations for the illustrations:

Linear Regression Channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving Average Line (Settings 20,0, smoothed) - determines the short-term trend and direction in which it is currently worth trading.

Murray Levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.