On Tuesday, the currency pair GBP/USD experienced a slight upward correction and once again surpassed the moving average line. Although the British pound is not standing still (unlike the euro), its movements leave much to be desired. Trading is quite straightforward during periods of a strong trend. Unfortunately, such trend periods are not always observed. Between them, there are periods of consolidation flat periods. Currently, we are likely in a consolidation period.

The pair is ready to resume the downtrend, but it has yet to happen. The pound may form a few upward correction cycles since no pattern definitively tells us when the correction will end. Everything depends on the market itself. This is certainly not the most pleasant explanation, but there is no other, and it cannot be.

We still have to rely on the lack of growth factors for the British currency, the overbought condition of the CCI indicator, the unconvincing entry into the Ichimoku cloud on the 24-hour timeframe, and the rest of the MACD indicator's oversold condition on the same timeframe. What speaks in favor of further growth? Frankly, nothing. There are no fundamental and macroeconomic factors for the pound's growth or technical signals to buy. Overcoming the moving average, both upward and downward, cannot currently be considered a signal for a trend change because the pair easily crosses this line. Thus, the technical picture could be more favorable at the moment.

Today, in the UK, reports on unemployment and wages will be released, and the second report may significantly affect the pound. The point is that the Bank of England "blames" high wage growth rates for inflation and is working to reduce them. Therefore, inflation may also slow down if growth rates drop significantly. A slowdown in inflation means a decrease in the chances of additional tightening by the British regulator and a reason to sell the pound. Therefore, today, we advocate for a decline in the pair.

This is another completely unimportant statement from a Fed representative. Meanwhile, the head of the Philadelphia Federal Reserve, Patrick Harker, said on Monday that the next rate decision would entirely depend on incoming data. He noted that now is the time to analyze the effects of the previous tightening of monetary policy and draw new conclusions. According to Harker, the regulator will keep rates at the maximum level for an extended period, the labor market is becoming more balanced, the unemployment rate may continue to rise (but not too much), no recession is expected in the US economy, and inflation will fall to 3% in 2024 and 2% in 2025. Thus, Mr. Harker should have provided new and important information. He repeated what we have long known, thanks to the speeches of other representatives of the Federal Reserve.

No news could currently affect market sentiment. And this means that sharp movements, swings, consolidation, and sometimes flatness will continue. Currently, we have a kind of "soup" of all the mentioned types of movements, which further complicates the process of analysis and trading. Therefore, we recommend not trying to predict where the pair will be tomorrow or the day after tomorrow but thinking more globally.

For now, on the 24-hour timeframe, the downtrend persists, and it is impossible to develop an upward correction. Therefore, until there are powerful signals to buy and a trend (upward) change, considering medium-term growth in the pair is not worth it. And for a change in the upward trend, significant fundamental reasons are needed. And we cannot even hypothetically imagine what these reasons could be right now. The Federal Reserve will not even mention lowering the key rate soon, as inflation in the US is rising.

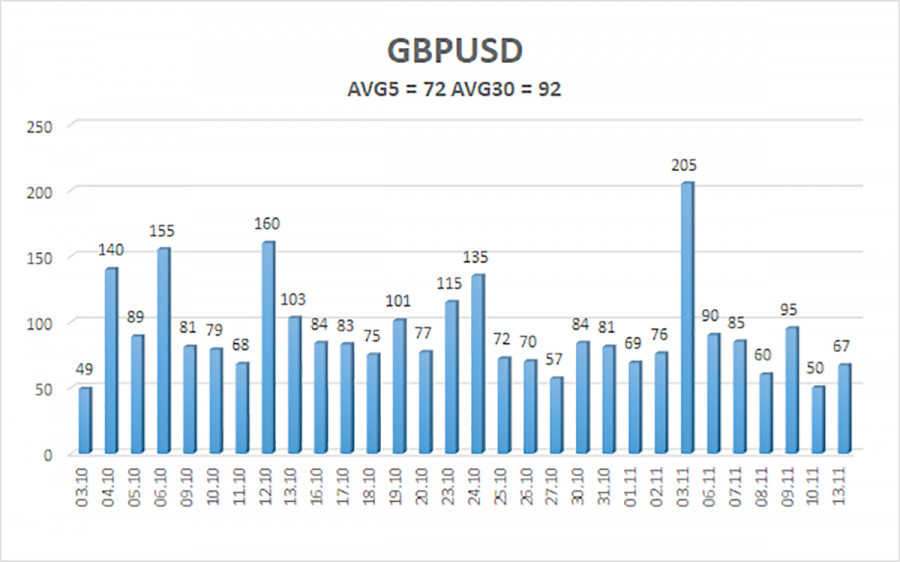

The average volatility of the GBP/USD pair over the past five trading days is 72 points. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, November 14, we expect movements within the range limited by the levels of 1.2196 and 1.2340. A downward reversal of the Heiken Ashi indicator will indicate a new downward movement phase.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

R3 – 1.2390

Trading recommendations:

The GBP/USD currency pair has started a new downward movement phase, which may be the beginning of a new downtrend. Short positions can now be considered with targets at 1.2196 and 1.2146 if the price returns below the moving average. Long positions can formally be considered since the price has settled above the moving average, with targets at 1.2329 and 1.2340. However, at the moment, everything is heading towards the resumption of the downtrend.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.