The EUR/USD currency pair on Tuesday continued to trade with "mind-boggling" volatility. Of course, after the publication of the ISM business activity index in the United States, volatility increased slightly, but overall, the strength of movements remained unchanged. The nature of the movements also leaves much to be desired. Over the past two weeks, the pair has tested the Murray levels of "2/8" and "4/8" several times. Thus, even in the 4-hour timeframe, a sideways channel is visible. It does not look as massive as on the hourly chart, but it is still present.

What can be said about the euro and the dollar? This week will see a significant number of important events and publications, so we will likely have to wait for them to see the market move a bit. The question is whether all the important events of the week can influence traders' sentiment enough for them to start trading more actively. After all, there is the example of the British pound, which has been trading flat for three months. Hardly anyone can say that there has been no reason to leave this channel in three months. Not to mention the fact that the pound remains overbought and unreasonably expensive.

A similar situation may develop with the euro this week. Important reports and speeches by Lagarde and Powell may trigger a local reaction, but overall sentiment may remain the same. What does this threaten us with? Within the sideways channel, we will see sharp spikes in activity, but the price will remain within the channel. We need to be prepared for this scenario.

In essence, there is no intrigue in the ECB meeting now. Rates this Thursday will remain unchanged with a 100% probability. Christine Lagarde announced a month ago that the regulator could consider lowering key rates in the early summer. Some of her colleagues stated that it is necessary to wait at least until May to get new data on inflation and GDP, as well as updated forecasts for these indicators. Only after that can the discussion on easing monetary policy take place.

The EU's inflation rate in February dropped to 2.6%, which is already quite near to the desired level. Will Christine Lagarde, though, discuss past rate reductions if they aren't actually required? Yes, a recession is about to strike the European economy, and its engine, the German economy, has already started. However, the pattern is essential to the issue of inflation. A month or two of economic growth is not very important if the consumer price index keeps going down.

As a result, we think Christine Lagarde won't reveal anything that could be crucial on Thursday. The pair's odds of emerging from the sideways channel are greatly diminished, and one can only hope that the US labor market and unemployment statistics improve. There's also not much hope for Jerome Powell's talks. He will provide a report to Congress twice and respond to inquiries from lawmakers. But major macroeconomic indicators have not undergone any structural changes, so his rhetoric is unlikely to shift significantly.

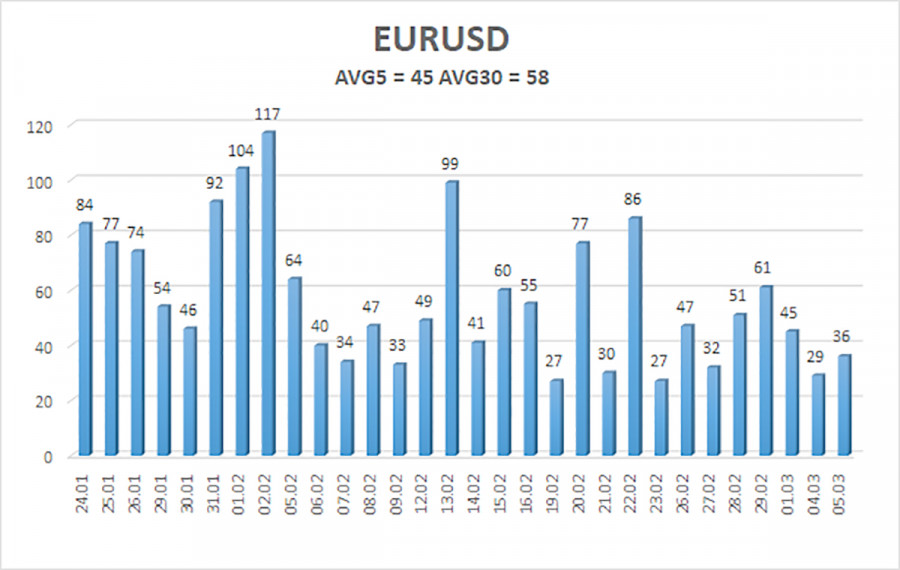

As of March 6th, the EUR/USD currency pair has 45 points of average volatility over the last five trading days, which is considered "low." As a result, on Wednesday we anticipate the pair to fluctuate between the levels of 1.0815 and 1.0905. The senior linear regression channel is still directed downward, so the downward trend persists. The oversold condition of the CCI indicator has triggered a small upward correction, which may end soon.

Nearest support levels:

S1 – 1.0834

S2 – 1.0803

S3 – 1.0773

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0895

R3 – 1.0925

Trading recommendations:

The EUR/USD pair has once again changed its position relative to the moving average, but we continue to look towards short positions with a target of 1.0681, at least. The correction is still ongoing, and with the current volatility, it may continue for some time. Whichever way the pair moves in the near future, these movements are extremely difficult to trade, as they are very weak. We see no reasons for a global rise in the euro currency. Long positions are unlikely to be considered in the near future, as any pair's rise now is corrective.

Explanations for illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.