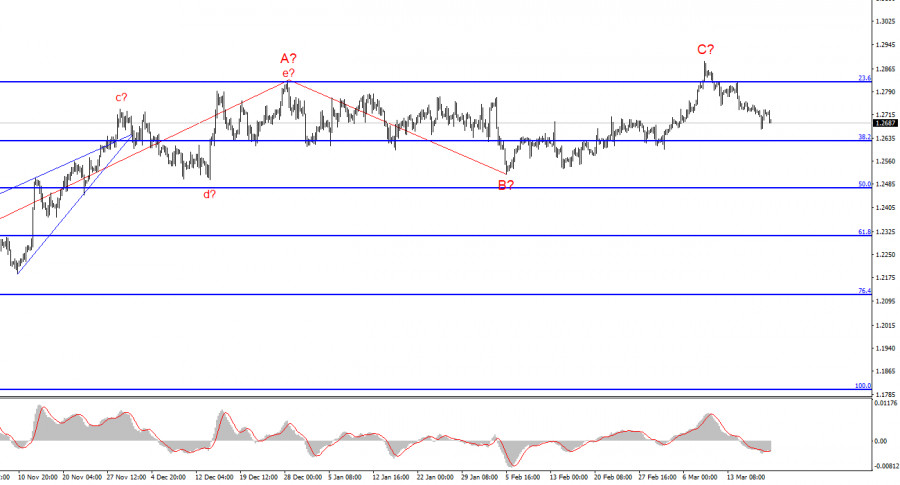

The wave analysis for the GBP/USD pair remains sufficiently clear yet complex at the same time. The construction of a new downward trend segment continues, the first wave of which took on a rather prolonged form. The second wave also turned out to be quite extensive, giving us every reason to expect a lengthy construction and a third wave.

At the moment, I have no confidence that the construction of wave 2 or b is complete. Wave 2 or b has taken on a three-wave appearance, but its internal wave structure is very complex. Theoretically, wave 2 or b could extend up to 100% of wave 1 or a. An unsuccessful attempt to break through the level of 1.2876, which corresponds to 76.4% according to Fibonacci, may indicate the long-awaited completion of the uptrend wave.

Targets for the downward movement of the pair within the presumed wave 3 or c are located below the level of 1.2039, which corresponds to the low of wave 1 or a. Unfortunately, wave analysis tends to become more complex and may not correspond to the news background. At the moment, I am not abandoning the working scenario, but the market does not yet see reasons for long-term sales of the pair.

Bulls continue to retreat after the inflation report.

The GBP/USD pair rate decreased by another 30 basis points by the beginning of the American session on Wednesday. Today, the decline in demand for the British currency was predictable, as the UK inflation report for February was released in the morning, which recorded a more significant decline than the market expected. As with the ECB and the euro, the faster and stronger inflation falls, the greater the likelihood that the regulator will start softening its hawkish stance, which has been maintained for the past couple of years. At the same time, there is no need to expect a softening of monetary policy from the Fed now. Already tonight, it may become known that the American regulator doubts the rate cut in June, and doubts the appropriateness of three rounds of easing this year. If this information is confirmed, the American currency may strengthen even more.

Unfortunately, the current strengthening of the dollar is very weak, if viewed in general. The market continues to look for any foothold to avoid selling the pound and buying the dollar. In my opinion, there are many more pieces of news supporting the US currency. However, in the current circumstances, my readers should be pleased even with such a decrease in the pair. In recent months, the market has rarely delighted us with sales. In the near future, I expect the pound to decline towards the 26 figure. It would not be superfluous to drop even below the low of wave b in 2 or b. Only after that can we be confident in transitioning to the construction of wave 3 or c, as required by the wave pattern.

General conclusions.

The wave pattern of the GBP/USD pair still suggests a decline. At the moment, I still consider selling the pair with targets below the level of 1.2039, as I believe that wave 3 or c will sooner or later begin. However, until wave 2 or b is completed with 100% certainty, an increase in the pair can be expected up to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. The construction of wave 3 or c may have already begun, but the retreat of quotes from the reached peaks is still too small to be confident in such a conclusion. Breaking the level of 1.2715 adds confidence to the downward scenario.

On a larger wave scale, the picture resembles that of the EUR/USD pair, but there are still some differences. The downward correctional segment of the trend continues its construction, and its second wave has taken on an extensive form – at 61.8% of the first wave. An unsuccessful attempt to break through this level may lead to the beginning of the construction of wave 3 or c.

The main principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play with, they often bring changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% certainty in the direction of movement and there never can be. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.