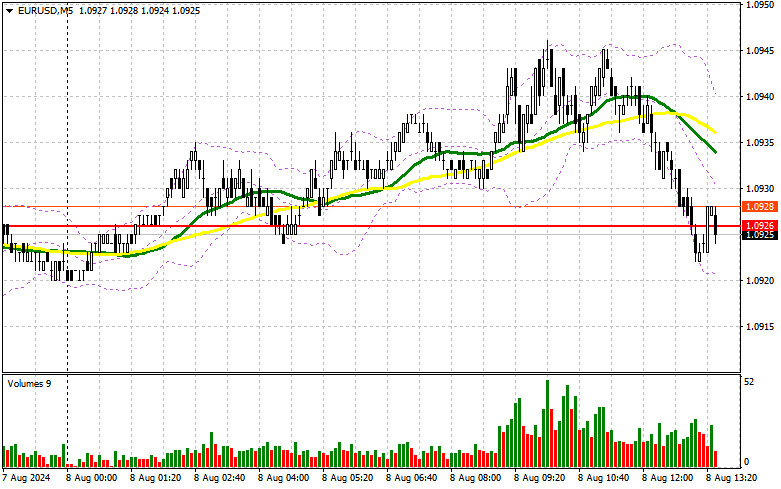

In my morning forecast, I highlighted the level of 1.0926 and planned to make market entry decisions from there. Let us examine the 5-minute chart to see what occurred. A decline to the 1.0926 level occurred, but there was no false breakout formation at that level. For this reason, I did not make any trades in the first half of the day. The technical picture was slightly revised for the second half of the day.

To Open Long Positions on EUR/USD:

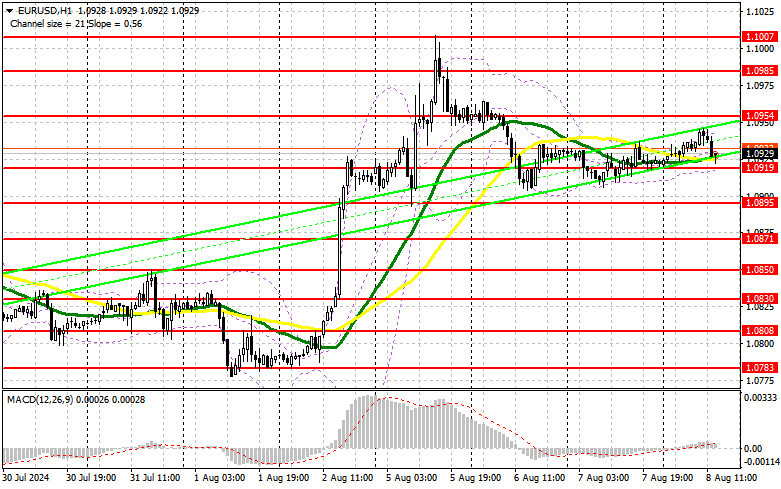

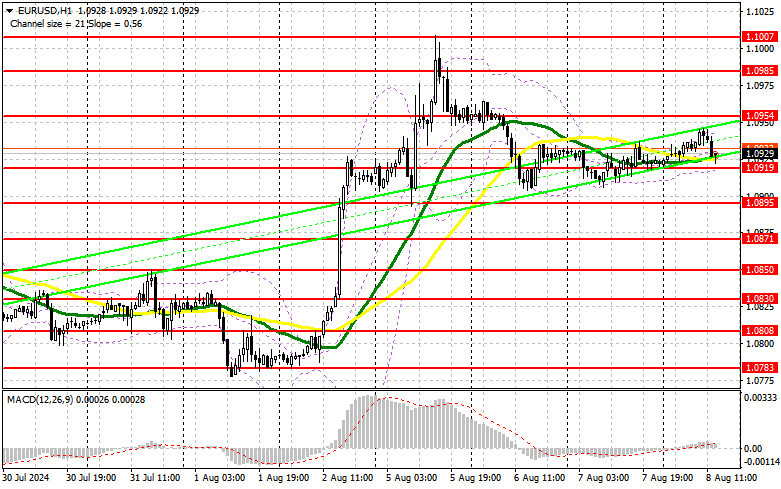

Given the absence of significant statistics from the Eurozone, it is unsurprising that traders did not react. The upcoming statistics from the U.S. are related to the labor market, but even there, we are unlikely to see strong and directed movements. The expected figures include the number of initial jobless claims in the U.S. and changes in wholesale inventories. The speech by FOMC member Thomas Barkin will be the most notable event. In the event of dovish statements regarding rates, the euro may have an opportunity to rise. However, for opening long positions, I would prefer to wait for a decline and the formation of a false breakout around the new support at 1.0919, formed based on yesterday's results. The target will be a rise and update of the new resistance at 1.0954, where I expect the first appearance of euro sellers. A breakout and subsequent retest of this range will strengthen the pair, providing a chance to rise to the area of 1.0985. The furthest target will be the 1.1007 high, where I will be taking profits. If EUR/USD declines and there is no activity around 1.0919 in the second half of the day, which is an important technical level, sellers will regain initiative and begin building a downward trend. In this case, I will enter only after the formation of a false breakout around 1.0895. I plan to open long positions immediately on a rebound from 1.0871, with a target of an upward correction of 30-35 points within the day.

To Open Short Positions on EUR/USD:

Sellers continued to maintain the initiative, but they acted rather sluggish in the first half of the day. Considering the absence of important U.S. statistics, we can expect sellers to return to the market. Defending 1.0954 along with a false breakout, similar to what I discussed above, will be a suitable scenario for opening short positions with a target of a decline to the support at 1.0919, formed based on yesterday's results. A breakout and consolidation below this range, along with a bottom-up retest, will provide another selling point, moving towards the area of 1.0895, where I expect to see more active buying interest. The furthest target will be the 1.0871 level, where I will be taking profits. Testing this level will undermine the euro buyers' plans to build an upward trend. If EUR/USD moves up in the second half of the day and there are no bears at 1.0954, buyers will have a chance to regain initiative. In that case, I will postpone selling until the test of the next resistance at 1.0985. I will also act there but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.1007, with a target of a downward correction of 30-35 points.

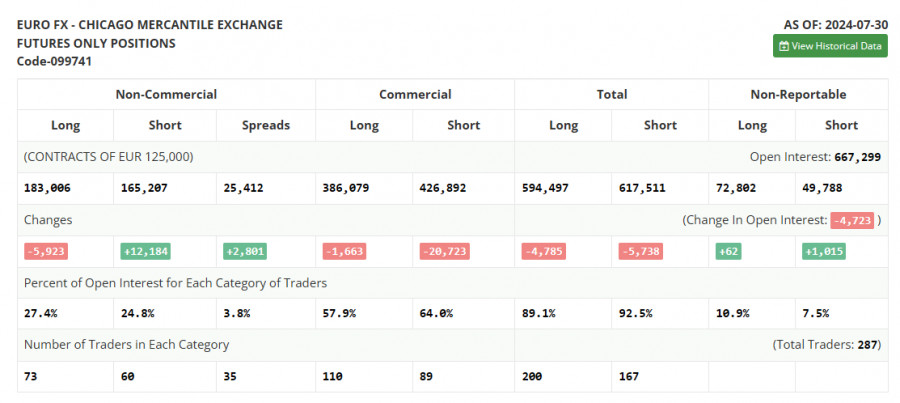

The COT report (Commitment of Traders) for July 30 showed a reduction in long positions and a sharp increase in short positions. The ECB's decision to leave rates unchanged with a direct hint of a reduction in September coincided with the rather soft position of the Federal Reserve, which also made it clear that it would not leave rates unchanged in early autumn of this year. Given the recent data on the American economy, most likely, the regulator needed to act much earlier, which led to the panic that is now being observed in the stock market, as well as the risk of a recession next year, which is bad for the strength of the U.S. dollar. The COT report indicates that long non-profit positions decreased by 5,923, to the level of 183,006, while short non-profit positions increased by 12,184, to the level of 165,207. As a result, the spread between long and short positions increased by 2,801.

Signals of Indicators:

Moving Averages:

Trading is conducted around the 30 and 50-day moving averages, indicating the sideways nature of the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.0919 will act as support.

Description of Indicators:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.