The EUR/USD pair finally began a slight downward retracement on Thursday. This retracement was so weak that it's difficult to classify it as a "retracement." It's important to note that there are several types of counter-trend movements in the forex market. The most common are retracements and corrections. A correction implies a movement against the trend of at least 38.2% according to Fibonacci levels, while a retracement is less than that. The downward movement of the EUR/USD pair on Thursday does not qualify as a "retracement." And indeed, such a movement does not open any prospects for the dollar.

We want our readers to understand our point of view correctly. Even on Thursday, a new downward trend could have started, which might last several months or even years. Nothing is impossible. The euro has shown so many illogical movements throughout 2024 that another one would not even surprise us. Over the past two weeks, the euro has been rising as if on yeast, without requiring any macroeconomic or fundamental grounds. The market has been continuously buying euros and selling dollars. Therefore, it's hard to argue that the euro is overbought and the dollar is oversold. However, these currencies were already in that state in June or March.

Since the beginning of the year, the market has been reacting to the Federal Reserve's monetary policy easing, and other factors haven't been of much interest. Initially, the market responded to the easing in March, then in June, and now in September. It's logical that any US report is viewed through the lens of market expectations. Reports that typically provoke a 20-30 pip reaction now trigger 50-60 pips. Reports that the market wouldn't have paid attention to before now cause the dollar to collapse. We've often said that the American economy is not in a dire state or on the brink of recession. However, the market trades as if GDP growth is negative and the unemployment rate is approaching double digits. In the Eurozone, the unemployment rate is one and a half times higher, and GDP growth has been minimal for the past two years.

On Wednesday, the market once again found a very convenient excuse. A report that nobody had heard of before triggered a new fall in the US dollar. The NonFarm Payrolls report, in annual terms, essentially represents the sum of the monthly reports. In other words, the market has been reacting to the monthly NonFarm Payrolls reports for 12 months in a row, and in 2024, these reports have almost always been weaker than forecasts. This means the market reacted by selling the dollar. When the annual report showed a lower value than expected, the market processed all this information again. And, naturally, the dollar fell again. And why not?

Federal Reserve Chair Jerome Powell's speech today has already been factored into the market about five times this week—such has been the extent of the dollar's depreciation. It's worth noting that this involves one of the most stable currency pairs, where a movement of 200-300 pips is considered significant.

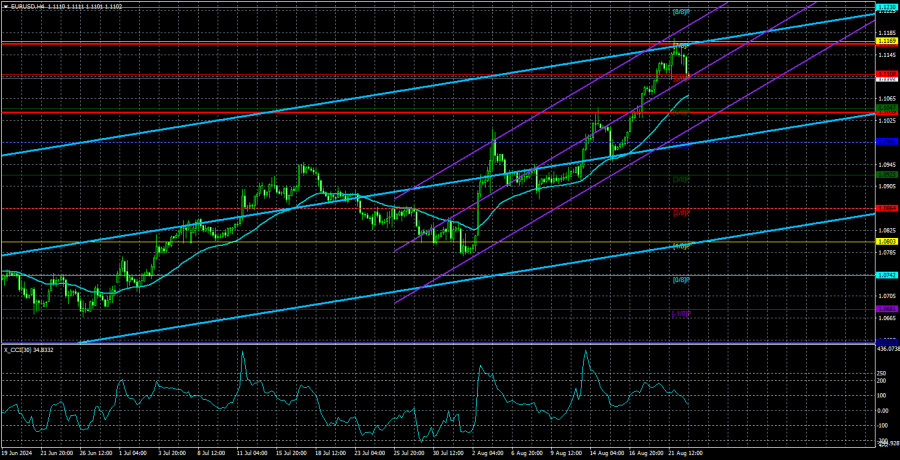

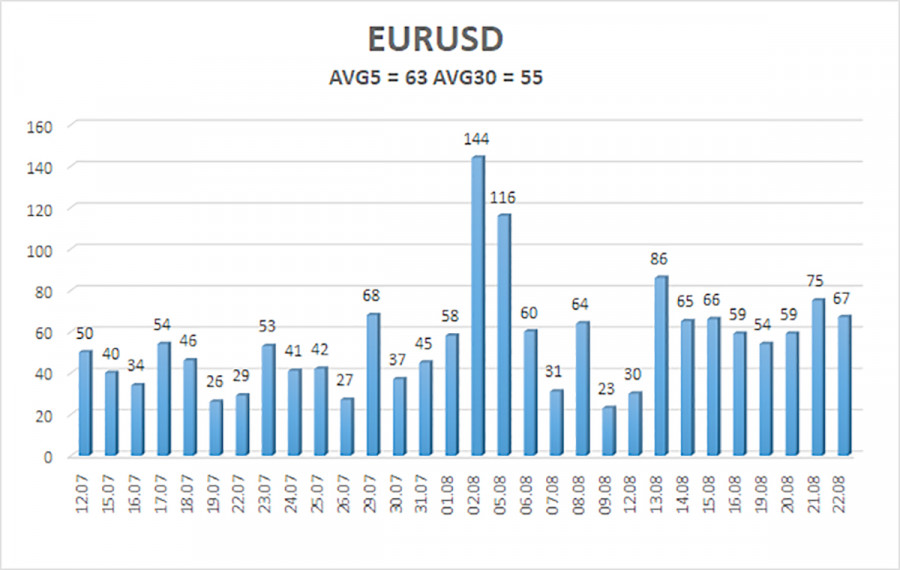

The average volatility of EUR/USD over the past five trading days as of August 23 is 63 pips, which is considered average. We expect the pair to move between the levels of 1.1039 and 1.1165 on Friday. The upper channel of the linear regression is directed upwards, but the global downtrend persists. The CCI indicator entered the overbought area for the third time, which warns not only of a possible trend reversal to the downside but also of how the current rise is entirely illogical.

Nearest Support Levels:

- S1 – 1.1108

- S2 – 1.1047

- S3 – 1.0986

Nearest Resistance Levels:

- R1 – 1.1169

- R2 – 1.1230

- R3 – 1.1292

Trading Recommendations:

The EUR/USD pair maintains a global downward trend, but in the 4-hour time frame, a strong and relentless upward movement continues, driven by the market's relentless desire to buy euros and sell dollars continuously. In previous reviews, we mentioned that we only expect declines from the euro in the medium term, but the current rise now seems almost like a mockery. However, it would be foolish to deny that the price is in an upward movement, and there are no signs of its end yet. The market continues to use every opportunity for purchases, but the technical picture warns of a high probability of the local upward trend ending. Short positions may be considered after the pair settles below the moving average, with targets at 1.1047 and 1.0986.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.