On Wednesday, the EUR/USD pair traded rather calmly despite the "super-important and super-resonant" U.S. inflation report. Over the weekend, we dubbed this report the "event of the week," but the reaction from some traders was quite surprising. In short, the dollar rose despite inflation dropping to 2.5% y/y.

Let's recall that all recent reports on U.S. inflation have led to one outcome—the dollar's decline. It reached the point of absurdity: the U.S. currency would fall even with minor deviations from forecasts or even with no deviations at all. Simply put, when inflation in the U.S. falls, so does the dollar. However, yesterday marked another significant moment that may signal the end of the dollar's two-year decline.

The market responded by buying the U.S. currency, even though inflation in the U.S. slowed to 2.5%. We've repeatedly mentioned that discussions about the Federal Reserve easing its monetary policy should begin once inflation nears the target level. This happened at the end of August, but here's the paradox—the market has been pricing in the Fed's easing for two years now, and there's a high probability that it's already fully priced in. Even if we don't talk about 2022 or 2023, the market has anticipated the Fed's maximum rate cuts this year. Naturally, it has been pricing these cuts in advance, as it tends to do. With inflation approaching the target and the Fed having all the reasons not just to lower rates once but to begin a full cycle of monetary policy easing, the market can no longer price in this factor—it's already been priced in.

Thus, we wouldn't be surprised if the dollar's decline ends here. It's worth mentioning once again that on the weekly time frame, all of the British currency's growth since September 25, 2022, has been a correction against a stronger phase of decline within the framework of a 16-year (!) downward trend. Therefore, if we take a long-term perspective, there are still no reasons to expect a prolonged and strong rise in the British currency. It's important to understand that the pound rose to the 1.32 mark purely due to the full pricing-in of the Fed's policy easing. The pound simply has no more bullish drivers left. There weren't any before either—the pound was rising simply because the dollar was falling.

Thus, we can draw a clear conclusion: expecting further growth of the British currency is illogical. We didn't anticipate the last phase of growth that brought the pair to the 1.32 level, but predicting the exact reversal of a medium-term trend is never precise to within a few days or a specific price level. So far, as before, the pound isn't in a hurry to move down, but it did fall yesterday on news that used to cause it to rise confidently. The price settling below the moving average line confirms good prospects for the dollar's recovery.

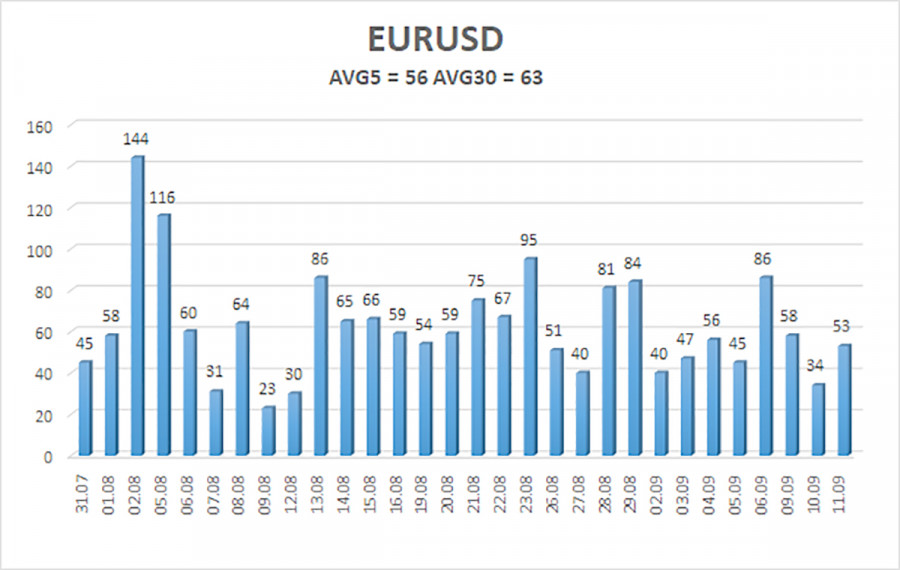

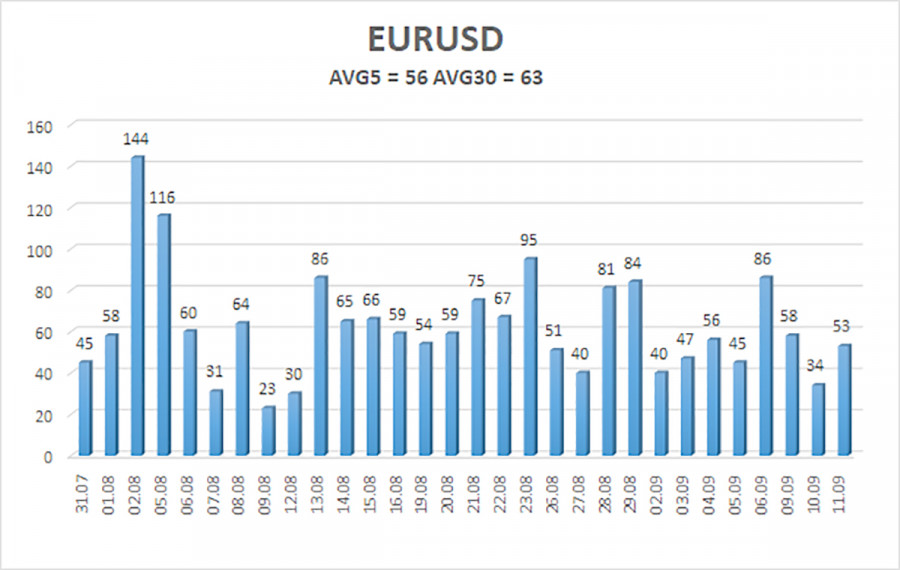

The average volatility of EUR/USD over the past five trading days as of September 12 is 56 pips, which is considered average. We expect the pair to move between the levels of 1.0959 and 1.1071 on Thursday. The upper linear regression channel points upward, but the global downward trend remains intact. The CCI indicator entered the overbought area three times, signaling a potential shift to a downtrend and indicating how the recent rise is illogical. However, for now, we only see a relatively mild correction.

Nearest Support Levels:

- S1 – 1.0986

- S2 – 1.0925

- S3 – 1.0864

Nearest Resistance Levels:

- R1 – 1.1047

- R2 – 1.1108

- R3 – 1.1169

Trading Recommendations:

The EUR/USD pair continues to move moderately to the south. In previous reviews, we mentioned that we only expect declines from the euro in the medium term, as any new rise would appear to be a mockery. There is a possibility that the market has already priced in all future rate cuts by the Fed. If so, the dollar no longer has any reason to fall. Short positions can be maintained if the price stays below the moving average, with targets at 1.0986 and 1.0925. Last week's macroeconomic data put significant pressure on the dollar, but we are not seeing a similar market reaction this week.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it indicates a strong trend.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction.