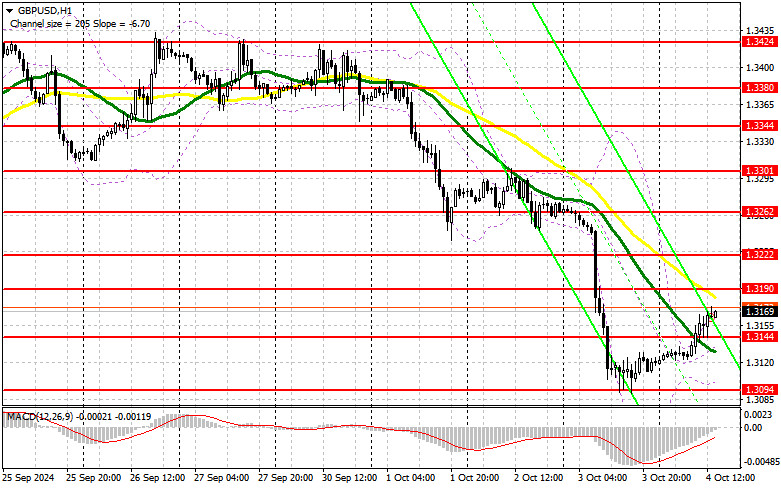

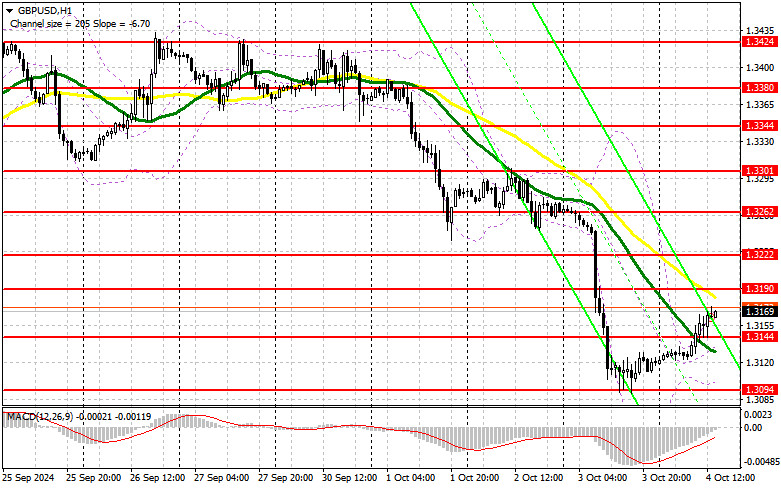

In my morning forecast, I highlighted the level of 1.3144 and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. A breakout and retest of 1.3111 provided a buy entry point for the pound, resulting in an increase of over 30 points for the pair. The technical picture was not revised for the second half of the day.

To Open Long Positions on GBP/USD:

The fairly good data on activity in the UK construction sector led to a rise in the pound during the first half of the day. Future movements will depend on U.S. statistics. A decrease in the unemployment rate and an increase in non-farm employment in the U.S. in September could trigger a sell-off of the pound and strengthen the U.S. dollar, which can be leveraged. A false breakout around 1.3144 after the U.S. data release will present an opportunity for the pair to rise to approximately 1.3190. A breakout and retest from above this range will increase the likelihood of developing an upward trend by the end of the week, leading to the liquidation of sellers' stop orders and an ideal entry point for long positions with a potential move toward 1.3222. The furthest target will be the area of 1.3262, where I plan to take profit. In the scenario of a decline in GBP/USD and a lack of bullish activity at 1.3144 in the second half of the day, which is more likely, pressure on the pair will intensify. This will also result in a decline and retest of support at 1.3094. Only a false breakout there will provide a suitable condition for opening long positions. I plan to buy GBP/USD on a rebound from the minimum of 1.3060 with a target for an intraday correction of 30-35 points.

To Open Short Positions on GBP/USD:

Sellers will show their presence if the pair rises only near the resistance of 1.3190 and provided that the labor market data aligns with economists' forecasts. A false breakout there will be an appropriate opportunity to open short positions with a target for a decline to support at 1.3144. A breakout and retest from below this range will deal a blow to buyers' positions, leading to the liquidation of stop orders and opening the way to 1.3094. The furthest target will be the area of 1.3060, where I will take profit. A retest of this level will strengthen the bearish market. If GBP/USD rises in the second half of the day and there is no activity at 1.3190, buyers will attempt to recover part of the decline. The bears will have no choice but to retreat to the resistance area at 1.3222. I will sell there only on a false breakout. If there is no downward movement there, I will look for short positions on a rebound in the area of 1.3262, but only with the expectation of a correction of the pair downwards by 30-35 points within the day.

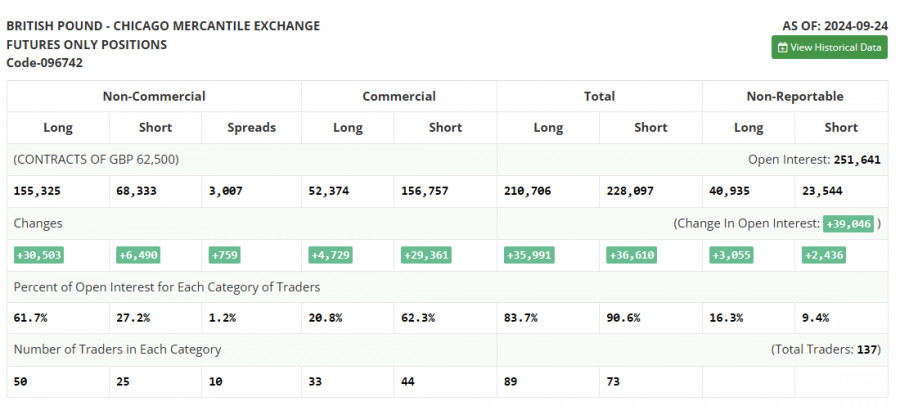

In the COT report (Commitment of Traders) for September 24, there was an increase in both short and long positions. It is evident that after the Bank of England's decision to keep monetary policy unchanged and the Federal Reserve's decision to lower interest rates, more and more buyers are entering the pound market every day. The chances that the U.S. Central Bank will continue a dovish policy only fuel interest in purchasing risk assets, driving away from the U.S. dollar. Statements from Bank of England representatives asserting that the economy is strong and doing well also contribute to attracting new traders betting on the medium-term strengthening of the pound. The latest COT report indicates that long non-commercial positions increased by 30,503 to 155,325, while short non-commercial positions rose by 6,490 to 68,333. As a result, the gap between long and short positions increased by 759.

Indicator Signals:

Moving Averages

Trading is taking place around the 30 and 50-day moving averages, indicating a sideways market.

Note: The periods and prices of the moving averages are analyzed by the author on the hourly H1 chart and differ from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger BandsIn the event of a decline, the lower boundary of the indicator, near 1.3094, will serve as support.

Indicator Descriptions:

- Moving Average (Period 50): Defines the current trend by smoothing volatility and noise. Marked in yellow on the chart.

- Moving Average (Period 30): Defines the current trend by smoothing volatility and noise. Marked in green on the chart.

- MACD Indicator: Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total open long position of non-commercial traders.

- Short non-commercial positions: Represent the total open short position of non-commercial traders.

- Total non-commercial net position: Represents the difference between the short and long positions of non-commercial traders.