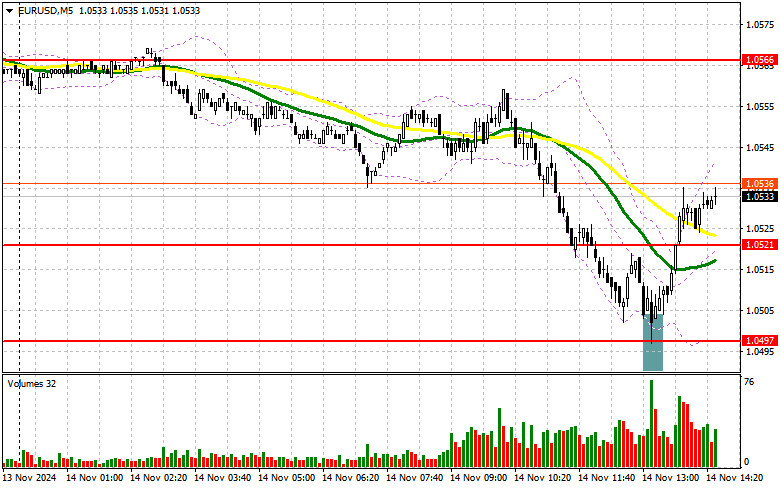

In my morning forecast, I focused on the 1.0497 level and planned my trading decisions around it. Let's analyze the 5-minute chart to review the market activity. A decline followed by a failed breakout at this level provided an entry opportunity for long positions, resulting in a rise of over 40 points. The technical outlook for the second half of the day has now been updated.

To Open Long Positions on EUR/USD:

The expected weak Eurozone data triggered another sell-off of the euro, as anticipated in my morning forecast. This afternoon, data on initial jobless claims and the Producer Price Index (PPI) for October will be released. An increase in these indicators, along with hawkish comments from Fed official Thomas Barkin, could lead to another wave of euro selling.

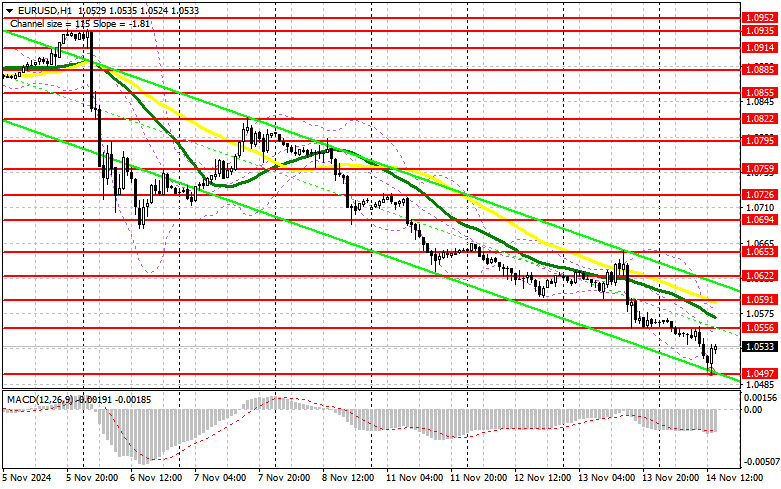

If the bearish trend persists, I plan to act near the new monthly low of 1.0497. A failed breakout at this level could signal an opportunity to increase long positions, aiming for a correction toward 1.0556. A breakout and subsequent test of this range would confirm a valid entry point for long positions, with targets at 1.0591 and 1.0622, where I plan to take profits.

If EUR/USD continues its decline and there is no market activity near 1.0497 in the afternoon, the bearish trend is likely to extend further. In this case, I will consider buying only after a failed breakout near the next support level at 1.0474. Immediate long positions on a rebound are planned from 1.0451, targeting a 30–35 point intraday correction.

To Open Short Positions on EUR/USD:

If the pair rises, sellers will focus on defending the resistance level at 1.0556. A failed breakout at this level following the release of US inflation data would create an opportunity for short positions, targeting the support at 1.0497 established earlier in the day. A breakout and consolidation below this range, followed by a retest from below, would confirm further declines to the monthly low of 1.0474, strengthening the bearish trend. The final target for short positions would be the 1.0451 area, where I plan to take profits.

If EUR/USD moves upward after the data release and market participants disregard the Fed's comments, buyers might attempt to initiate a correction. In this scenario, I will postpone selling until the next resistance at 1.0591, where the moving averages support the sellers. I also plan to sell at this level, but only after a failed consolidation. Immediate short positions on a rebound are planned from 1.0622, targeting a 30–35 point downward correction.

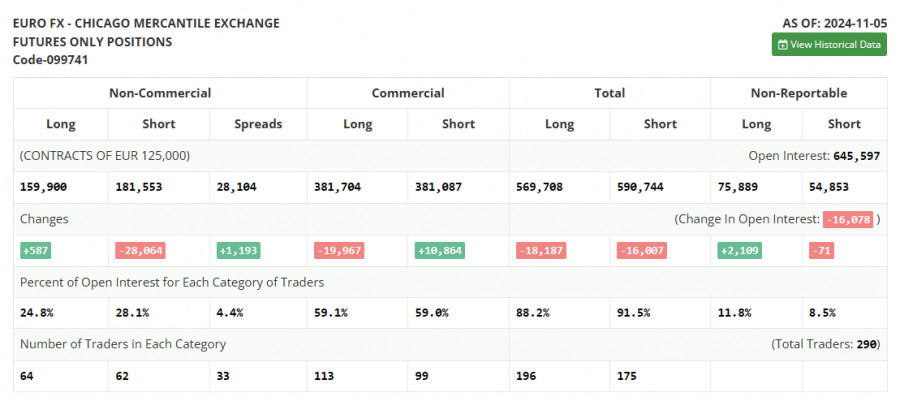

The Commitments of Traders (COT) report for November 5 showed a slight increase in long positions and a sharp reduction in short positions. However, these figures do not reflect Donald Trump's victory in the US presidential election or the Federal Reserve's interest rate cuts. Given recent developments, the pressure on risk assets is likely to persist, with the US dollar expected to remain in high demand. According to the COT report:

- Long non-commercial positions rose by 587 to 159,900.

- Short non-commercial positions fell by 28,064 to 181,553.

This resulted in a net increase in the gap between long and short positions by 1,193.

Indicator Signals:

- Moving Averages: Trading remains below the 30-day and 50-day moving averages, signaling a continued decline in the pair.

- Bollinger Bands: In case of a decline, the lower boundary of the indicator near 1.0497 will act as support.

Description of Indicators:

- Moving Average (MA): A trend-following indicator that smooths out price volatility and market noise. (Periods: 50, marked in yellow; 30, marked in green.)

- MACD (Moving Average Convergence/Divergence): A momentum indicator that measures the convergence/divergence of moving averages. (Fast EMA: 12; Slow EMA: 26; Signal Line: 9.)

- Bollinger Bands: A volatility indicator that highlights potential support and resistance levels. (Period: 20.)

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using futures markets for speculative purposes.

- Long non-commercial positions: The total long open positions of non-commercial traders.

- Short non-commercial positions: The total short open positions of non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.