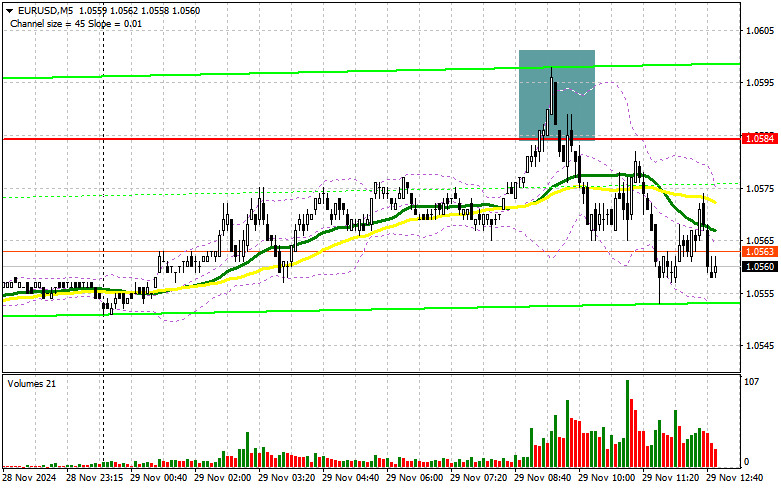

In my morning forecast, I highlighted the 1.0584 level as a key decision point. Let's review the 5-minute chart to analyze what happened. An upward movement and failed breakout around 1.0584 provided a strong selling opportunity, resulting in a 30-point decline. The technical outlook for the second half of the day remains unchanged.

For Long Positions on EUR/USD:European statistics had little market impact, as Eurozone inflation data and German labor market figures matched economists' forecasts. The absence of U.S. economic data today will likely reduce market volatility and trading volume. Additionally, with a shortened U.S. session due to the Thanksgiving holiday, significant price movements are unlikely. Downward pressure on the euro is expected to return, particularly following the failed breakout at 1.0584.

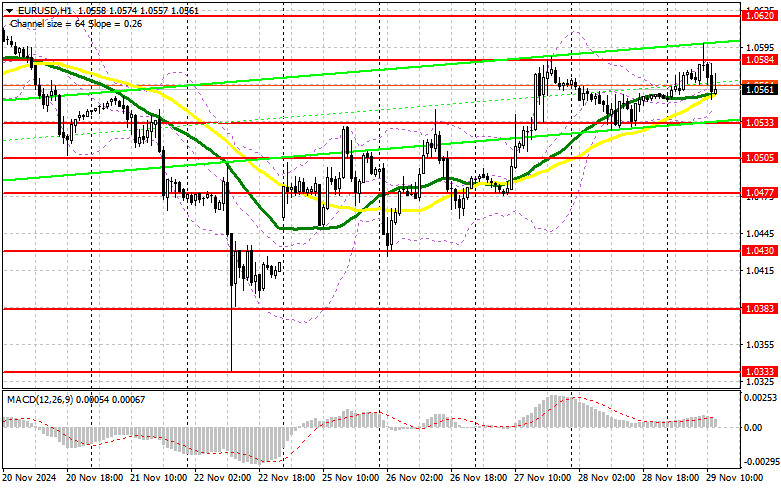

If the pair declines, I will look for opportunities near the 1.0533 support level, established during yesterday's session. A false breakout at this level may present an opportunity to open long positions, targeting a return to 1.0584, which remains unbroken. A breakout and subsequent retest of this range would confirm a buying signal, with targets set at 1.0620. The ultimate target is the 1.0653 high, where I plan to take profits.

If EUR/USD falls and there is no activity around 1.0533 in the second half of the day, downward pressure on the euro will likely intensify toward the end of the week. In this scenario, I will wait for a false breakout around the 1.0505 support level before considering long positions. Alternatively, I will open long positions on a direct rebound from 1.0477, aiming for an intraday upward correction of 30-35 points.

For Short Positions on EUR/USD:If the pair rises, defending the 1.0584 resistance level remains the primary objective for sellers. A failed breakout at this level, as analyzed earlier, would provide an opportunity to open short positions, targeting the 1.0533 support level. This level aligns with the moving averages, which currently favor bullish positions. A breakout and consolidation below this range, followed by a retest from below, would confirm another selling opportunity, with further targets at 1.0505 and 1.0477, effectively ending the upward correction. The ultimate target is 1.0430, where I plan to take profits.

If EUR/USD rises in the second half of the day and bears show no activity around 1.0584—which is unlikely at the month's end—I will delay selling until the pair tests the next resistance level at 1.0620. At this level, I will consider selling, but only after a failed breakout. I also plan to open short positions on a direct rebound from 1.0653, targeting a downward correction of 30-35 points.

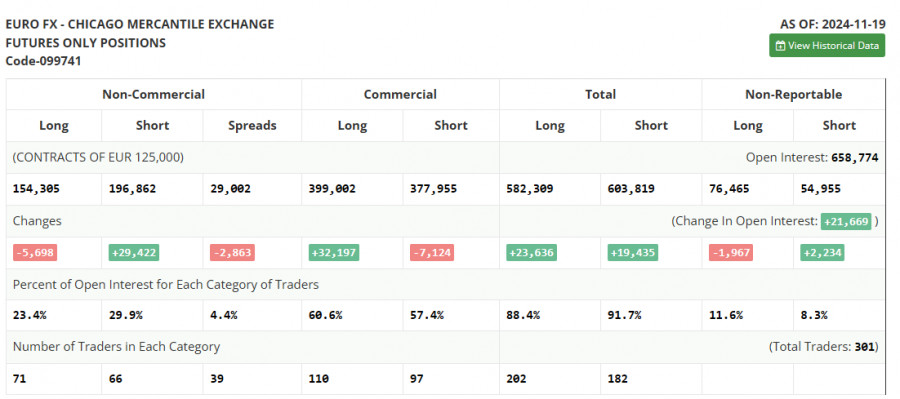

The Commitments of Traders (COT) report for November 19 revealed a notable increase in short positions and a reduction in long ones. Given the European Central Bank's likelihood of further rate cuts and persistent geopolitical risks, the euro remains under selling pressure against the U.S. dollar. According to the report, long non-commercial positions fell by 5,698 to 154,305, while short positions increased by 29,422 to 196,862. The net position gap narrowed by 2,422 contracts, reflecting a bearish sentiment.

Indicator Signals:Moving Averages:Trading above the 30- and 50-day moving averages maintains the pair's potential for a correction.(Note: These moving averages are based on the H1 chart and differ from those on the D1 chart.)

Bollinger Bands:In case of a decline, the lower boundary of the indicator around 1.0535 will act as support.

Indicator Descriptions:

- Moving Average: Smooths volatility and noise to indicate the current trend.

- Period 50: Yellow on the chart.

- Period 30: Green on the chart.

- MACD (Moving Average Convergence/Divergence):

- Fast EMA period: 12.

- Slow EMA period: 26.

- SMA period: 9.

- Bollinger Bands:

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes.

- Long Non-Commercial Positions: Total long open positions held by non-commercial traders.

- Short Non-Commercial Positions: Total short open positions held by non-commercial traders.

- Net Non-Commercial Position: Difference between long and short positions of non-commercial traders.