The GBP/USD currency pair spent most of Monday moving sideways rather than trading in any clear direction. Traders may have expected more interesting movements given that at least four reports could influence market sentiment and actions. However, the UK PMI reports were moderately pessimistic but not pessimistic enough for the pound to extend last week's decline. Manufacturing activity fell further into contraction territory, while services activity rebounded slightly. Thus, one report was positive, and the other was negative. The pound strengthened somewhat, but further movement will depend on more significant events.

This report will determine what decision the Bank of England will make on Thursday. If inflation rises again (as forecasted), it will almost certainly guarantee that the BoE will keep the interest rate unchanged. But will such a decision support the pound? We believe it will not because the market is already anticipating this outcome. The voting results on the rate decision among the Monetary Policy Committee (MPC) members will be more significant. This will reflect the current sentiment within the committee, and the market will respond accordingly. Thus, inflation could strongly influence the pound's exchange rate.

The situation here is straightforward, but the market's reaction could hinge on any word from Jerome Powell. At this point, the market understands that the Federal Reserve will not rush to lower rates because there is no need to do so. Therefore, if the Fed cuts the rate in December, there is a high probability of a pause at the next meeting. The dollar will get a reason to strengthen. If the Fed keeps rates unchanged this week, the dollar will again find reasons to strengthen. However, as mentioned, much will depend on Jerome Powell's rhetoric. The more optimistic he is about the economy, labor market, unemployment, and inflation, the better for the US dollar. The more he repeats that there is no need for aggressive easing, the better for the dollar.

The CCI indicator entered the oversold area last week, warning of a new corrective wave. However, on a downtrend, any bullish signal is merely a signal for correction. Another corrective wave could occur, but what would that change? Will the UK economy suddenly improve, and will the BoE abandon further easing? Or will America start to have a recessionary crisis? Will the pound's overvaluation disappear? We believe none of this will change the medium- and long-term outlook. Moreover, in the daily timeframe, the price has rebounded from the Kijun-sen line, which is a strong sell signal. The upcoming meetings of the Fed and BoE could temporarily interrupt the pair's downward movement, but for now, the decline still looks preferable.

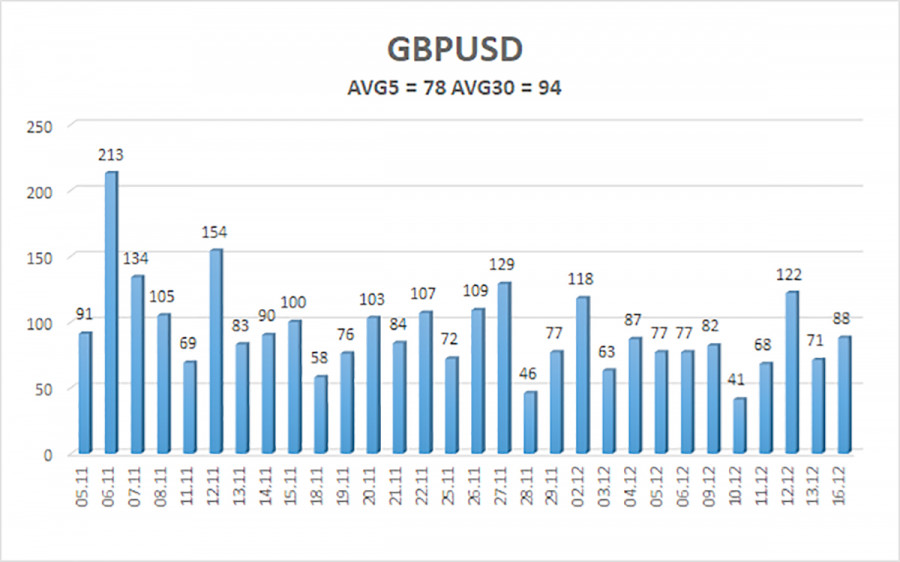

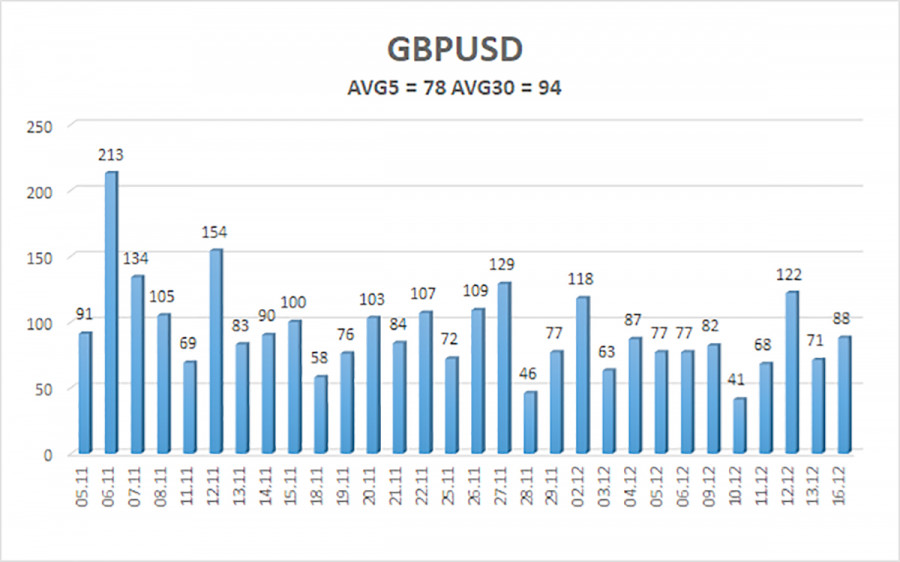

The average volatility of the GBP/USD pair over the last five trading days is 78 pips, considered "average" for the pound/dollar pair. On Tuesday, December 17, we expect movement within the range limited by the levels 1.2614 and 1.2770. The higher linear regression channel is directed downward, signaling a downtrend. The CCI indicator has again entered the oversold area, but this remains a signal for correction rather than a reversal. On a downtrend, any oversold condition typically indicates a temporary correction.

Nearest Support Levels

Nearest Resistance Levels

- R1 – 1.2695

- R2 – 1.2817

- R3 – 1.2939

Trading Recommendations:

The GBP/USD pair maintains its downward trend but continues to correct. We still do not recommend long positions as we believe that all growth factors for the British currency have already been priced into the market multiple times.

For traders relying on pure technical analysis, long positions are possible if the price rises above the moving average, with targets at 1.2770 and 1.2817. Short positions remain more relevant now, with targets at 1.2573 and 1.2540.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.