The EUR/USD currency pair attempted to continue its upward movement on Tuesday but ultimately performed poorly. On Monday, both the euro and the pound experienced significant growth after the German inflation report came in 0.2% higher than anticipated. The market seemed to react to this report in advance, indicating that major players may have received insider information. As a result, the euro rose in value, with expectations of a more cautious approach to monetary easing from the European Central Bank (ECB). However, Tuesday's performance revealed that these concerns were misplaced. Eurozone inflation accelerated to 2.4% year-on-year in December, in line with expectations, while core inflation remained unchanged at 2.7%. Consequently, traders had little new information to respond to, suggesting that the market had prematurely priced in the German inflation report. Ultimately, what matters most is the overall inflation of the eurozone, as it directly influences ECB monetary policy rather than the inflation of a single EU country.

In hindsight, the euro's rise on Monday shouldn't have happened. It's normal for every currency pair to experience periodic corrections, so such movements are not unusual. It's possible that the rise in the euro and the pound was not influenced by German inflation; indeed, the pound also increased on Monday despite having no connection to German inflation. This suggests that the movement might have been a typical corrective pullback, after which the downtrend could continue. The longer the euro declines, the greater the likelihood of a strong correction. However, a correction does not necessarily have to begin simply because the euro has been falling for three months or has lost nearly 1,000 pips. On the 4-hour chart, it is evident that the pair has not yet reached the latest local high.

This week still has several important events and releases that could present opportunities for the U.S. dollar to weaken further. However, there is also potential for the dollar to recover from its decline on Monday. Currently, there is no strong reason to anticipate a complete correction. Although the currency pair experienced a significant upward retracement, it only moved up by 120 pips. New bullish divergences and CCI oversold entries have emerged, but these indicators do not guarantee a reversal of the trend; they simply suggest a potential upward retracement within an existing downtrend. That retracement has already taken place. If U.S. reports this week remain strong, the dollar could swiftly regain its lost ground—and possibly do so decisively.

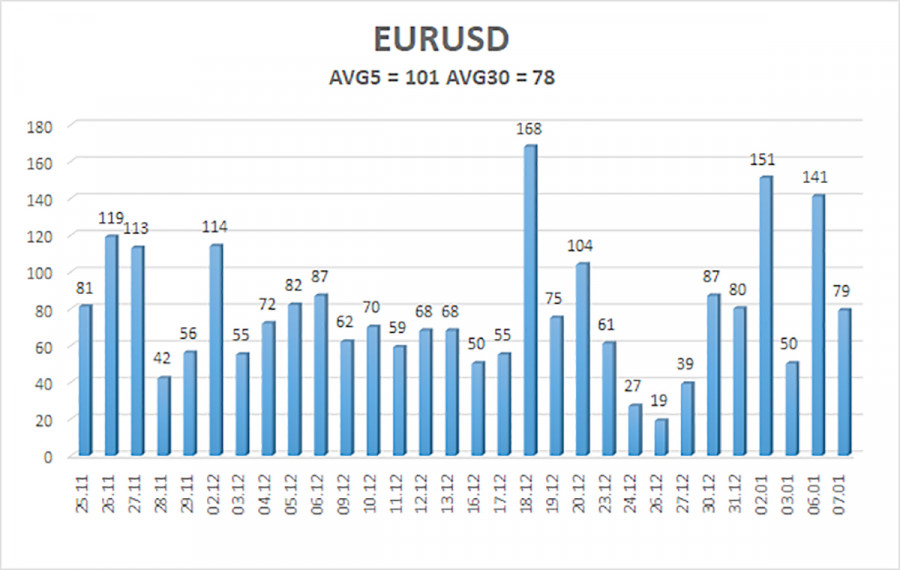

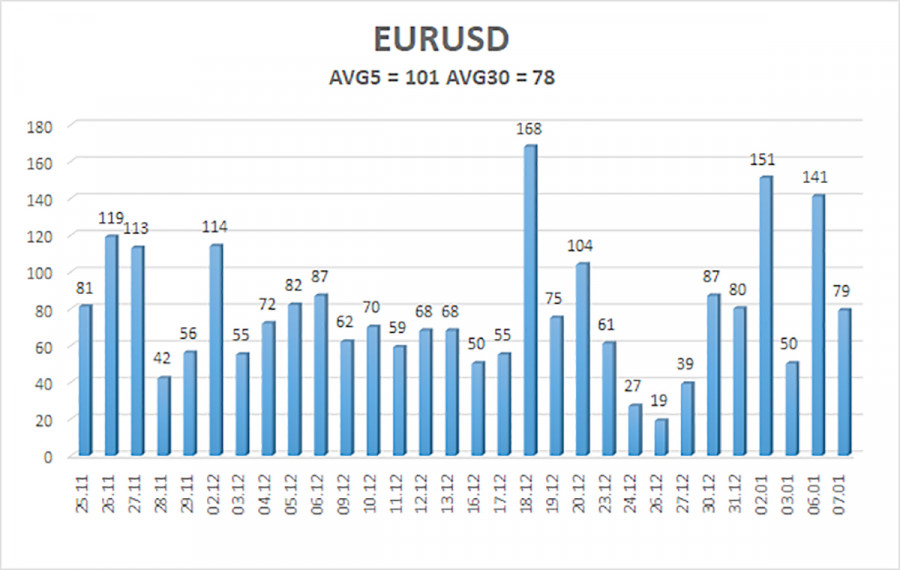

As of January 8, the average volatility of the EUR/USD currency pair over the last five trading days stands at 101 pips, which is considered "high." On Wednesday, we expect the pair to move within the range of 1.0268 to 1.0470. The higher linear regression channel remains downward, indicating that the global downtrend is intact. The CCI indicator has again entered the oversold zone and formed a new bullish divergence, but this signal points only to a possible correction at best.

Closest Support Levels:

- S1 – 1.0376

- S2 – 1.0254

- S3 – 1.0132

Closest Resistance Levels:

- R1 – 1.0498

- R2 – 1.0620

- R3 – 1.0742

Trading Recommendations:

The EUR/USD currency pair continues to show a downward trend. Over the past several months, we have consistently highlighted our expectation for further declines in the euro from a medium-term viewpoint. We strongly support this bearish outlook and believe it is not yet over. There is a high likelihood that the market has already factored in all future Federal Reserve rate cuts. As a result, there are no fundamental reasons for the U.S. dollar to decline in the medium term, aside from purely technical or corrective factors.

Short positions are still relevant, with targets set at 1.0268 and 1.0254, particularly if the price falls below the moving average (MA). For traders focused on strictly technical setups, long positions could be considered if the price rises above the moving average, with a target of 1.0484. However, any upward movement at this time should be viewed as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.