The EUR/USD currency pair continued its steady rally on Friday. At this point, there are no more questions about what is happening in the currency market—it's as simple as it gets. Donald Trump keeps raising the stakes, attempting to force (there's no better word) every country trading with the U.S. to do so strictly on American terms. Naturally, not everyone is thrilled with this turn of events, and the much-talked-about line of eager trade delegations to the White House has yet to appear.

Speaking of Trump, he has never been shy with words—and this time is no different. According to the sitting U.S. President, all countries are ready to "lick (censored)" to get a trade deal with the U.S. It's worth noting that these are official statements by the President of the United States. In our view, this borders on surrealism and absurdity. Trump continues to insult, humiliate, and issue ultimatums while waging trade wars under the guise of being a peacemaker.

The results of his actions are nothing short of comical. Trump wants to bring back jobs and factories to the U.S., grow the economy, reduce the trade deficit, and cut national debt. Currently, the outcomes are the exact opposite. Investors and traders are fleeing American assets, and many notable figures are leaving the U.S. The economy is beginning to slow, and now even the most conservative analysts are forecasting a recession. Inflation is declining for now, but no one doubts it will accelerate significantly soon. Jobs aren't rushing back to the U.S., and factories aren't planning large-scale relocations. On the contrary, companies are seeking ways to avoid Trump's tariffs—but we haven't heard of any major firm moving production back to the U.S.

As for the national debt—thanks to Trump's policies, it's only likely to increase. Remember that government bonds are traditionally considered a stable and safe investment tool. U.S. Treasuries are now being sold off. As a result, bond yields are rising—and yield is effectively the cost of borrowing. In other words, the U.S. government is now forced to borrow at higher rates. We're talking about billions of dollars at increased interest rates.

So we—and many experts—are left wondering: was it worth it? Perhaps there are brilliant economists in the Trump administration capable of modeling not only cash flows but also the reactions of half the world's countries to this kind of policy. But for now, the results are deeply disappointing. Some experts even believe the bond market may end up restraining Trump. In short, the more the bond market declines, the more the U.S. will pay in interest. This trend has started to worry Trump, which is likely why we're beginning to hear talk of "tariff amnesties."

In closing, we'd like to remind readers that Trump could declare victory, claim that America got what it wanted, and cancel most tariffs at any moment.

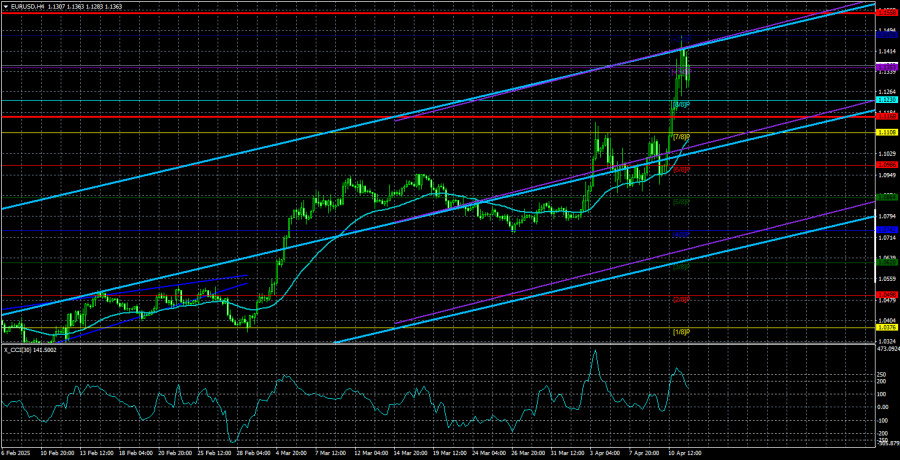

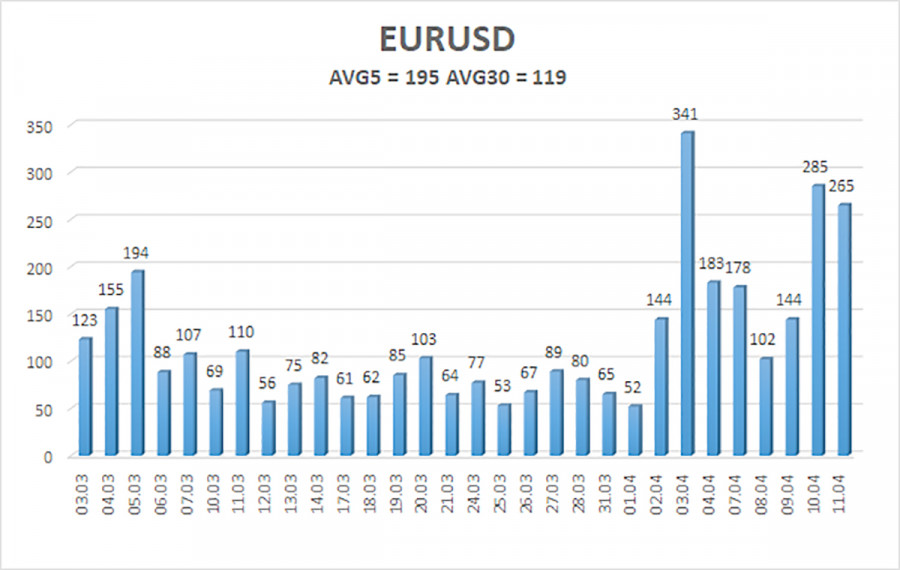

The average volatility of the EUR/USD pair over the last five trading days stands at 195 pips, which is considered "high." We expect the pair to move between the levels of 1.1168 and 1.1558 on Monday. The long-term regression channel is pointing upward, indicating a short-term bullish trend. The CCI indicator has entered overbought territory for the second time, signaling the potential for a correction. A bearish divergence may also form. However, since Trump hasn't backed down, the dollar may continue to decline.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest Resistance Levels:

R1 – 1.1353

R2 – 1.1475

Trading Recommendations:

The EUR/USD pair maintains a bullish trend. For several months, we've repeatedly stated that we expect only a medium-term decline in the euro, and that outlook has not changed. Aside from Donald Trump, there is still no fundamental reason for a medium-term decline in the dollar. Yet this single reason continues to drag the dollar into an abyss. Moreover, it is increasingly unclear what the long-term economic consequences of his policies will be. When Trump calms down, the U.S. economy may be in such poor shape that a dollar recovery becomes impossible.

If you're trading based on pure technicals or following "the Trump factor," long positions can be considered when the price is above the moving average, with targets at 1.1475 and 1.1558.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.