Analyzing Wednesday's trades

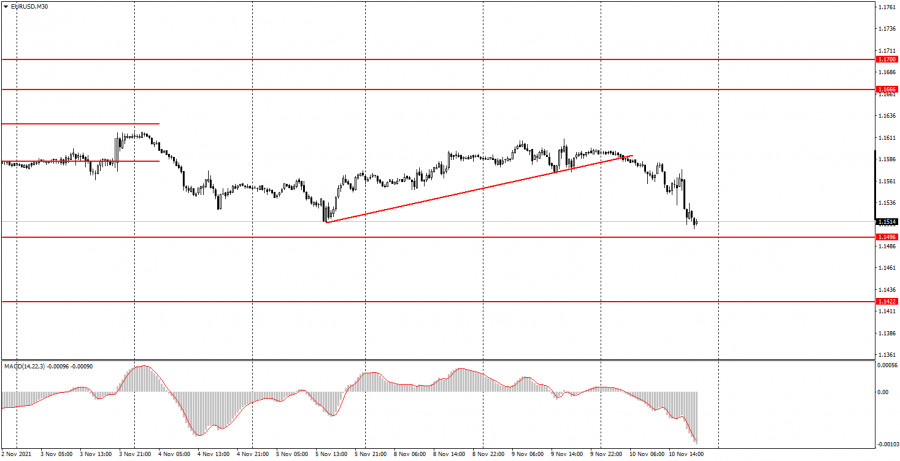

EUR/USD on M30 chart

EUR/USD faced a steep decline on Wednesday. The downward movement started at night, and there is a reason for this. A key report on US inflation was expected on Wednesday, being the only important event of the day. In addition, all market participants are now focused on inflation data as it is a crucial indicator for the American economy and financial markets. Thus, when it turned out that the consumer price index rose to 6.2% in October, while the reading was estimated to stand at 5.8%, the US currency began to rise. Actually, the dollar continued its growth that was initiated earlier at night. We assume that traders predicted such a high inflation rate and started buying up the greenback in advance. Thus, the euro/dollar pair has once again approached the level of 1.1496 and retested its yearly lows.

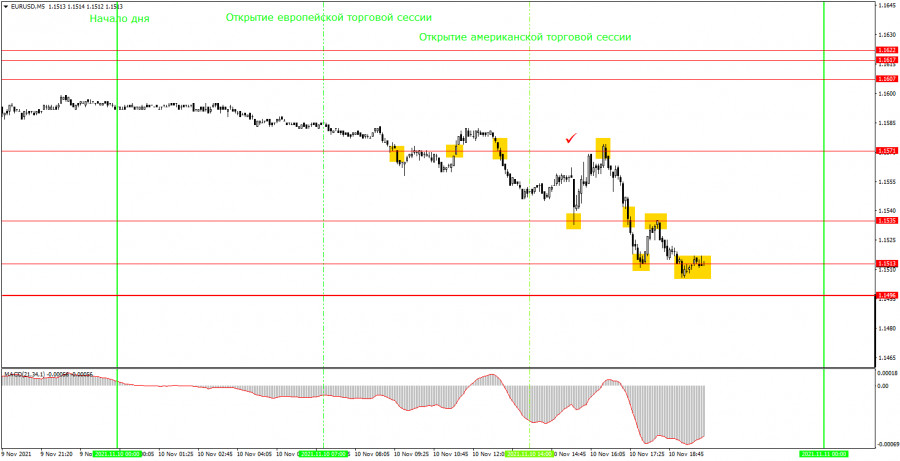

EUR/USD on M5 chart

On the 5 minute time frame, the pair's movement was pretty smooth, especially during the American trading session. However, it was still better to skip most of the signals as they turned out to be false or too risky. Let's discuss possible trading strategies you could have used today. In the course of the European trading session, three signals were formed around the level of 1.1571. First, the price consolidated below it (a sell signal), then above it (a buy signal) and then it went lower again (a sell signal). Since in the first two cases the price did not even pass 10 pips in the right direction, both signals were considered false. The signals brought a loss of 24 pips. The third signal formed in the European session should not have been used, just as all other signals around the level of 1.1571. Then, the first buy signal was formed near the level of 1.1535during the US trading hours. It was formed exactly at the time when the inflation report was published. Therefore, you should have ignored this signal as it was too risky. After that, the signals around the 1.1535 and 1.1513 levels were formed. The price bounced off these levels three times, which allowed novice traders to open three trades at once. Each of them brought traders a small profit since the distance between these levels was only 22 pips. So, beginners could have earned about 30 pips which helped offset morning losses. The last signal was formed too late and should not have been followed.

Trading tips for Thursday

On the 30-minute timeframe, the pair quickly consolidated below the trendline, so the uptrend reversed without even starting. At the moment, the quotes have dropped to the level of 1.1496 and may continue to fall. However, today's downtrend was caused mainly by strong statistics, while tomorrow the situation will be different. Therefore, the decline may not necessarily continue. On the 5-minute time frame, the key levels for November 11 are located at 1.1496, 1.1513, 1.1535, and 1.1571. As usual, Take Profit should be set at the distance of 30-40 pips, while Stop Loss should be placed to a breakeven point as soon as the price passes 15 pips in the right direction. On the M5 chart, the nearest level could serve as a target unless it is located too close or too far away. If it is, then you should act according to the situation or trade with a Take Profit. On Thursday, beginning traders will have nothing to focus on since neither the US nor the EU will publish any macroeconomic report. Also, no important fundamental events are expected tomorrow.

Basic rules of trading

1) The signal strength is determined by the time the signal took to form (a bounce or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on false signals (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only given that volatility is strong and there is a clear trend that should be confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trend lines).

Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.