The US macroeconomic data published on Tuesday turned out to be positive in most parameters, which increased the demand for risk and contributed to the strengthening of the US dollar. In October, retail sales increased by 1.7% against the forecast of 1.4%. Industrial production also rose by 1.6%, with a forecast of 0.7%. In November, the index of housing prices increased.

On another note, US President Joe Biden signed into law a $1.2 trillion infrastructure plan, which was approved by the House of Representatives after a long debate, followed by a 1.75 trillion social spending plan. The markets received the signing favorably, which was reflected in the growing interest in risk and the growth of stock indices.

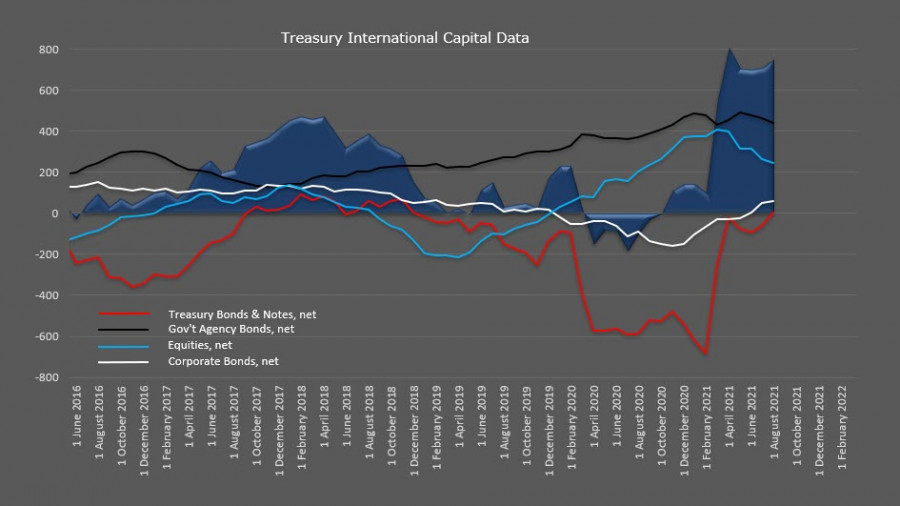

Biden's plan has a very clear goal – to prevent the stock market from collapsing after the start of the Fed's QE curtailment. The report on the movement of foreign capital published yesterday gives a clear assessment of what is happening. Investments of non-residents in the stock market grew in the pre-crisis era, and with the beginning of COVID-19 and QE from the Fed, there was a sharp infusion into the US debt market, primarily in US Treasury. Accordingly, the exit from QE may lead to the collapse of stock indices, since their growth is due to US residents, which is what the infrastructure support plan is intended for.

There are no reasons to expect a reversal in the US dollar yet. Everything is going to ensure that this currency will continue to grow in the medium term.

NZD/USD

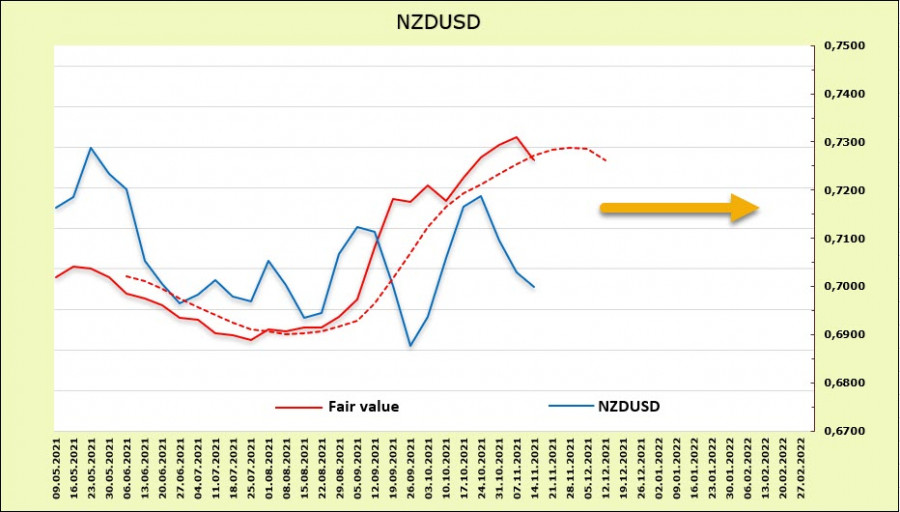

The New Zealand dollar failed to consolidate above the level of 0.72, as too high inflation in the US increases the chances that the Fed will become more aggressive and the difference in rates between the Fed and the RBNZ will lose pace. Nevertheless, the NZD remains near recent highs and has lost much less than, for example, European currencies, since it has a good chance of resuming growth.

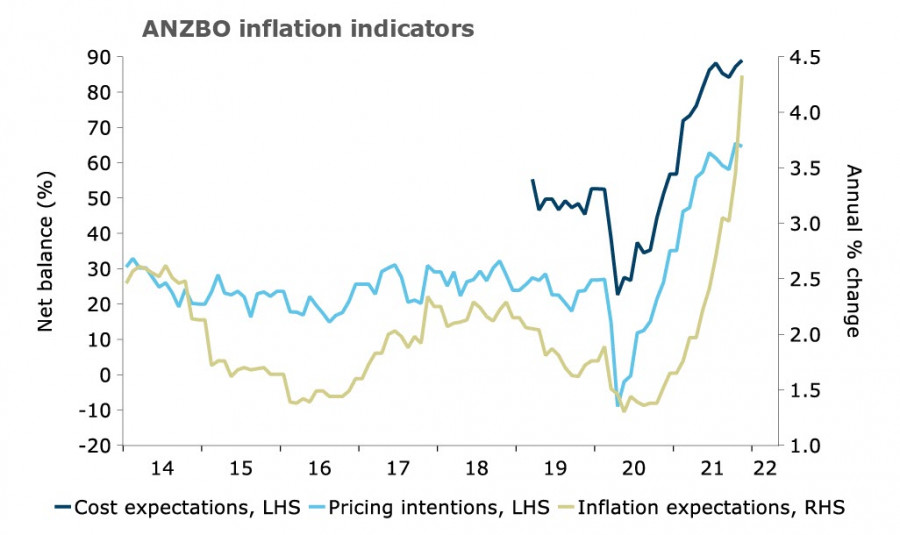

The assessment of inflation expectations comes to the fore. Inflation in the US has reached 6.2% and is already the highest in 30 years, while in New Zealand, inflation expectations are rising just as sharply, and maybe even faster.

Tonight, the RBNZ will publish updated inflation expectations for the 4th quarter. There is no doubt that they will grow, which gives almost 100% confidence that the RBNZ will raise the rate by 0.25% at the next meeting on November 24. However, there is a possibility that the RBNZ will revise the forecast more aggressively after inflation of 4.9% in Q3, and this will mean that the rate on November 24 will likely be raised immediately by 0.5%.

A quarter-point increase has already been taken into account by the markets and is reflected in the fact that the New Zealand dollar is held near the high. A half-point increase will allow NZD/USD to make a sharp upward leap and settle above 0.72 on the second attempt. Accordingly, a strong movement is possible tonight if the market evaluates the revised RBNZ inflation expectations as hawkish.

According to the CFTC, the net long position has changed slightly (-67 million) and is 918 million. The advantage for NZD is quite significant. The settlement price turned down, which is a reaction to the growth of UST yields, but still significantly higher than the spot.

It can be assumed that the long-term base of 0.6796 has already been formed. The nearest support is 0.6900/20. There will be a decline to it if today's inflation expectations do not inspire the bulls, but the continuation of growth looks more likely. The target is 0.72 10/30, then 0.7315.

AUD/USD

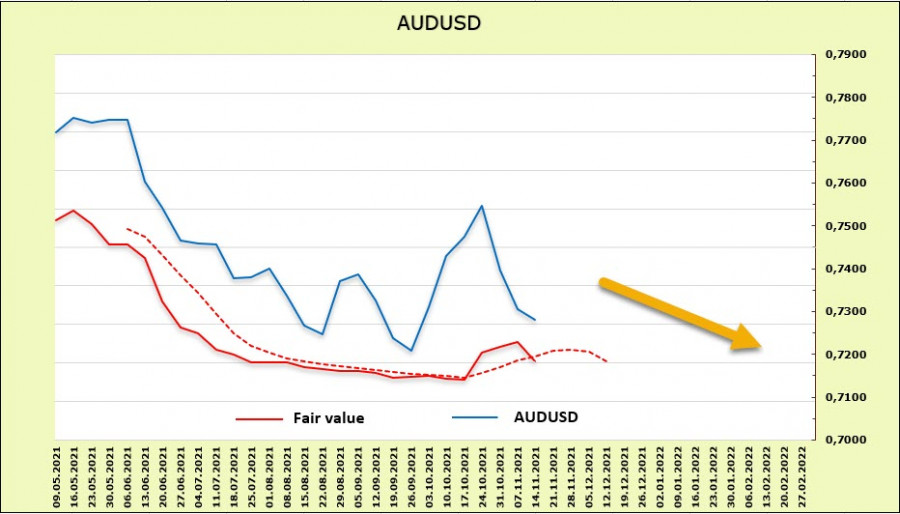

The minutes of the RBA meeting and the speech of the RBA Governor Lowe showed that the RBA continues to assess the growth of inflation as temporary. The rate of wage growth is also considered low and will clearly lag behind the rate of rate growth from both the Fed and the RBNZ. On average, markets predict the first increase in July 2022, and NAB bank, for example, pushes this step to the summer of 2023, assuming a rate increase to 1.75-2.0% by the end of 2024.

As follows from the CFTC report, the net short position decreased by 929 million, but the bearish advantage (-4.68 billion) is still significant. The estimated price is lower than the spot price and makes an attempt to turn down.

The Australian dollar fell to the lower border of the 0.7260 channel, so any attempt to further decline to the support of 0.7170 is likely. Meanwhile, an upward reversal is possible with renewed interest in risk and the absence of hawkish rhetoric from the Fed.