Bitcoin has been in a correction for the last week, not so much because of negative news, but because of the panic reaction of speculative traders. The coin will continue to be within the upward trend, but there is a possibility of aggravation of the current correction.

A further decline in the price does not cancel out the fundamental bullish mood of the market for the subsequent growth of BTC quotes, however, theoretically, the deepening of the correction may contribute to a significant postponement of a new stage of growth and even a full-fledged trend reversal.

As of 11:00 UTC, Bitcoin is trading in the $60k region and is showing more and more signals for further price declines. The market has formed a powerful support zone and has already bought out the price three times when reaching $58.6k. However, right now, the quotes are starting to decline again, which indicates another line retest.

The more often the price tests a certain zone, the more likely it is to break out on the next entry. And within the current local bearish movement, there is every reason to believe that BTC will continue to decline and enter the fluctuation range of $53k- $57.6k, which is a significant worsening of the correction, not without the help of bears.

The main fundamental factor behind this decline is the excessive volatility of Bitcoin at the current growth stage. According to the historical context, November has always been a highly volatile month for BTC, and given the rise in inflation and the increased correlation with the US dollar, the cryptocurrency received an additional incentive for sharp price surges.

In addition, the local euphoria in the market provoked an influx of short-term investors who want to play on the rise in prices. This category of investors acquired the coin at the $60k level, which makes it psychologically unstable in the opposite upward price movement. Local negativity due to tightening control over cryptocurrencies proved that the market is prone to inadequate reactions, which provoked a sell-off.

It is worth noting the interests of large capital, which are playing down not the first bullish rally. The main strategy of large capital is to "shake up" the retail audience, which, when the price drops, begins to get rid of coins, and further absorb them.

A similar pattern is observed with the current price drop when one of their largest BTC holders purchased 200 coins during a local sale. On the one hand, this is the manipulative behavior of the dominant category of investors, but, on the other hand, this is a significant improvement in the cryptocurrency market, thanks to which the further upward movement will be more systematic and calm.

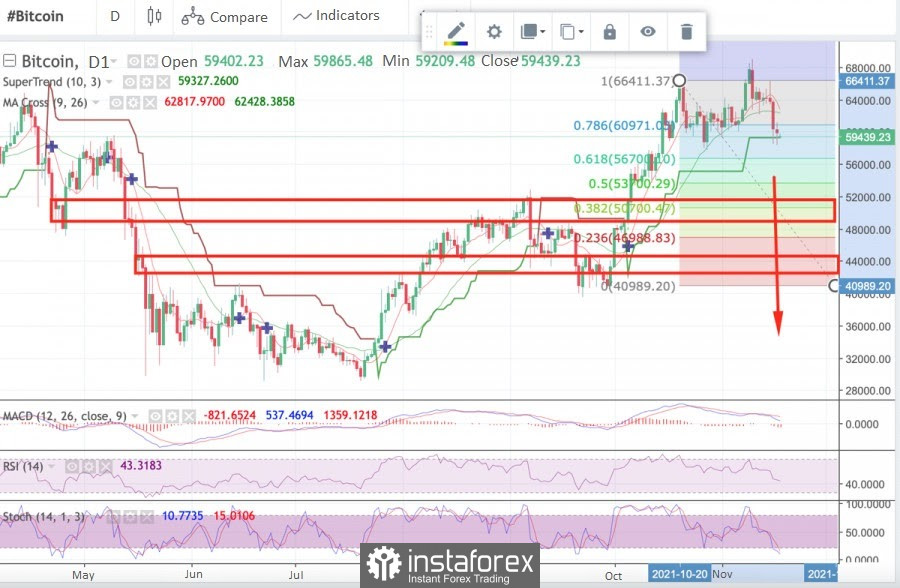

Bitcoin's technical picture also signals a breakdown of the support zone at $58.6k and a further decline to the $53k-$57.6k area. The MACD is approaching zero, which is a bearish sign and a lack of strength of the upward momentum. The Stochastic Oscillator left the bullish zone, breaking through the 40 mark, which indicates the prevalence of selling over buying. The relative strength index is declining less actively but is also approaching a decline over 40, which indicates a lack of strength in the long-term upward trend.

In the event of a breakdown of $58.6k, buyers will try to redeem the offered volumes, which will slow down the price drop, and for some time we can expect fluctuations in the $56.2k-$56.5k region. Subsequently, the price will break through the local support corridor and start moving along the main range of $53k-$56k.

A fall in the price into this area does not cancel the long-term upward impulse, but if the news background aggravates and the holders are not confident, a local reversal of the medium-term trend can be expected, which could accelerate the decline to $53k and significantly increase selling pressure.

In this case, the likelihood of a full-fledged bearish breakdown of $53k rises significantly and casts doubt on the long-term upward trend.

With a decline below $53k, we should expect a drop in the range of $47.8k-$50k, which coincides with the Fibo level of 0.382. At the breakdown of this mark, a full-fledged bull market is canceled, and the price goes into the stage of consolidation of a protracted correction.

Most likely, the Bitcoin price rebound will occur in the range of $53k-$57k, which fully corresponds to the bullish scenario, and collecting liquidity from this range will allow a much faster start of the recovery period and move on to a full-fledged bullish rally cycle.