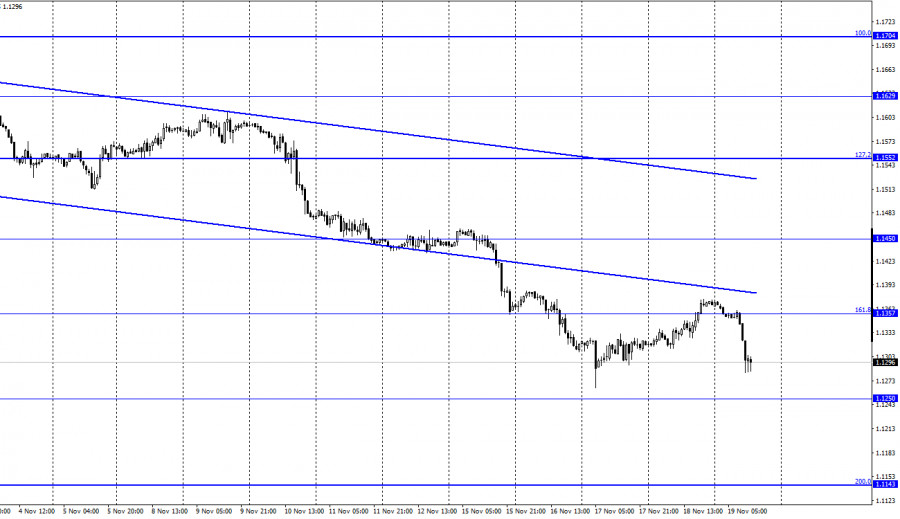

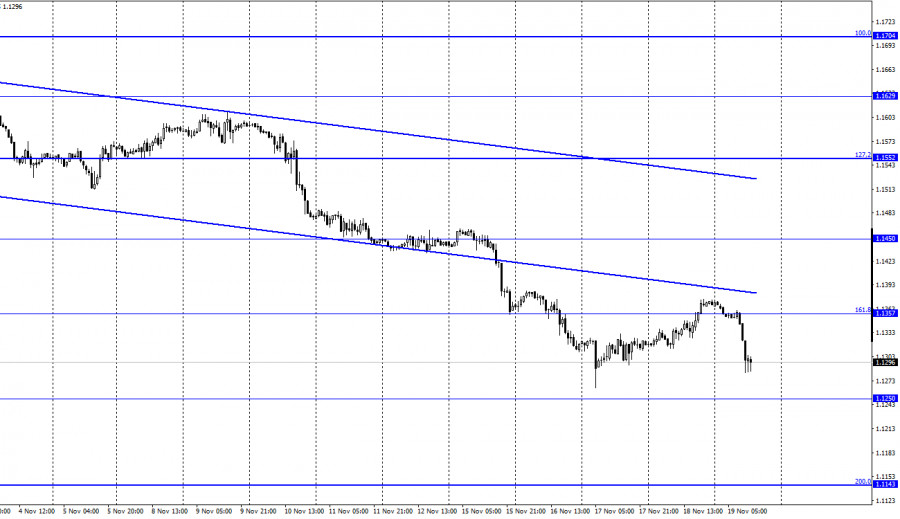

EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the US currency yesterday and resumed the process of falling in the direction of 1.1250. The rebound of quotes from this level will allow us to count on a reversal already in favor of the EU currency and some growth back to the corrective level of 161.8% (1.1357). Fixing the pair's rate below the level of 1.1250 will increase the chances of continuing to fall towards the next Fibo level of 200.0% (1.1143). You should immediately pay attention to the fact that the euro and the pound have fallen synchronously today, which makes you think about the information background much deeper. After all, today in the first half of the day nothing was interesting either in the European Union or in America. The euro could not fall just like that, and the dollar cannot grow just like that. However, the following situation is possible. A new lockdown will be introduced in Austria from next Monday, already the fourth in a row, as the number of cases of coronavirus in the country continues to grow. Since not all Austrians wanted to be vaccinated, at this time the percentage of the fully vaccinated population is 65. Chancellor Alexander Schallenberg said that from February 1, vaccination will be mandatory for everyone.

Thus, from the very beginning of the week, the dollar may rise due to the growing demand for protective assets. In addition, the acute situation with coronavirus is observed in the European Union, so additional pressure is being exerted on the euro currency. To top it all off, ECB President Christine Lagarde has been saying all week that rates will not be raised next year. Thus, there are three factors at once that do not just hinder the growth of the euro currency but support its fall. With such an informational background, the euro may continue to fall in the coming weeks. A lot will now depend on the new wave of the pandemic in the European Union. With the arrival of the cold season, the number of diseases increases, and new strains of the virus continues to be detected in the world.

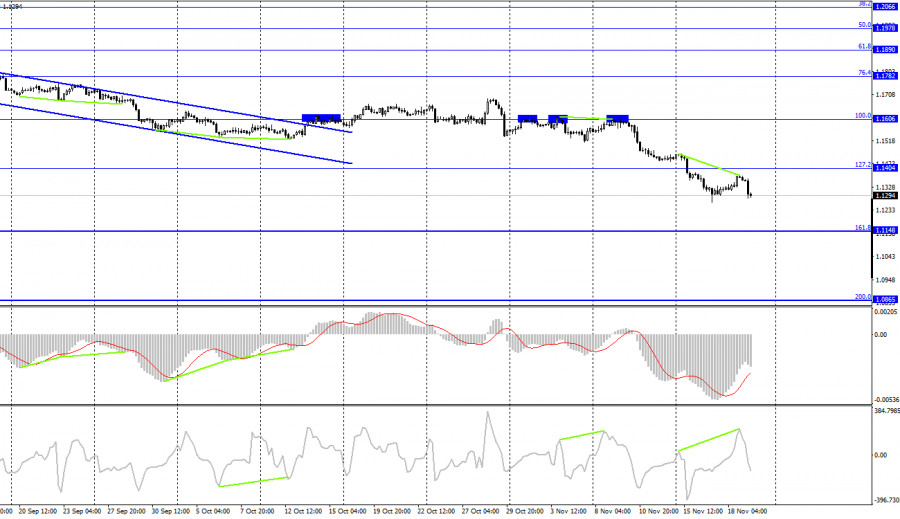

EUR/USD – 4H

On the 4-hour chart, the pair's quotes were secured under the corrective level of 127.2% (1.1404), which allows us to count on the continuation of the fall in the direction of the next corrective level of 161.8% (1.1148). The bearish divergence of the CCI indicator allowed today to resume the process of falling. No new emerging divergences are observed in any indicator today.

News calendar for the USA and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (08:30 UTC).

EU - ECB President Christine Lagarde will deliver a speech (18:00 UTC).

On November 19, the EU calendar contains two more speeches by Christine Lagarde, and the US calendar is empty. However, traders now do not even need a new Lagarde speech to clearly understand how to trade a pair. The information background will be weak today.

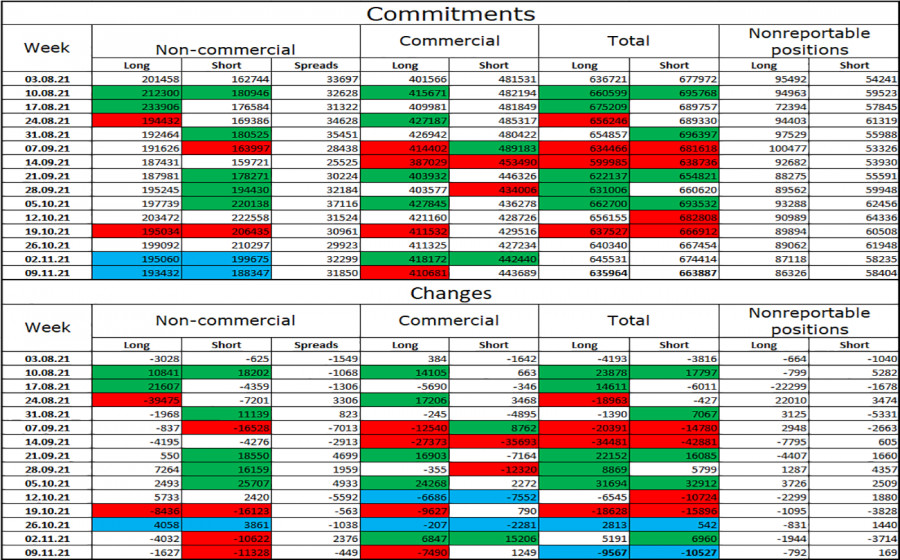

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became more "bullish". Speculators closed 1,627 long contracts on the euro currency and 11,328 short contracts. Thus, the total number of long contracts in the hands of speculators decreased to 193 thousand, and the total number of short contracts - to 188 thousand. These numbers practically coincide for the second week in a row, which gives reason to assume that there is no clear mood among speculators. However, in general, in recent months there has been a tendency to strengthen the "bearish" mood. Perhaps it's just that now the mood of traders is at a point where neither bulls nor bears have an advantage. However, the European currency continues to fall at the same time, therefore, the tendency to strengthen the "bearish" mood is correct.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair at the close under the level of 1.1357 on the hourly chart from 1.1250. Now, these deals can be kept open. Or open new ones in case of a rebound from the level of 1.1357. Purchases – when rebounding from the 1.1250 level on the hourly chart with a target of 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.